‘If Democrats…Cave to This Special Interest Demand They Will Be Betraying Working Families’

Private equity billionaires would be among the big winners from a corporate lobbying push in Congress to reap a windfall from a retroactive tax break in the omnibus bill now being crafted. Lobbyists and their many allies in Congress are trying to repeal new restrictions that took effect this year that limit how much corporations can deduct in interest payments on their debt. If the lobbyists get their way the revenue loss could be about $20 billion in one year and up to $200 billion over 10 years. Some significant portion of that cash will likely wind up in the pockets of private equity (PE) billionaires.

Private equity’s main business is the leveraged buyout—taking over companies using lots of debt. They saddle the acquired companies with huge debt and big interest payments, which are then deducted to slash income tax payments. A corporation is limited in the amount of interest it can deduct to 30% of its income, which is calculated narrowly beginning this year. Corporate lobbyists are trying to expand the definition of income so that they can get a much bigger tax deduction. Private equity would disproportionately benefit from this tax break.

That’s why private equity’s lobby, the American Investment Council, has been lobbying hard for passage of the Permanently Preserving America’s Investment in Manufacturing Act (S.1077/H.R.5371). It would make a more lucrative method of determining tax-deductible interest permanent.

This predatory industry does not deserve any more favorable tax treatment. PE tycoons already pay only a 20% income tax rate on their major source of income, capital gains, instead of the top ordinary tax rate of 37% paid by employees with equivalent wage income. They bring their rate down by exploiting the notorious “carried interest” loophole, which treats ordinary compensation as capital gains. As a result, many PE billionaires already pay income tax rates about the same as those paid by upper-middle-class employees.

Private equity is notoriously known as the “billionaire factory” (the words of a prominent scholar) because of its ability to extract fees from the pension funds and other entities whose money it uses. As of November 2022, the PE industry had created 37 billionaires who will benefit handsomely if they succeed in securing this tax break. Their collective net worth is $180 billion—up $50 billion, or nearly half, since the beginning of the pandemic in March 2020. (See ATF table based on Forbes data and this Forbes reporting on private-equity billionaires.)

“Private equity companies have been driving up rents and crushing entire industries, and now their hordes of lobbyists are pushing for massive tax breaks to line their pockets even more,” said Senator Elizabeth Warren (D-MA). “While Republicans are trying to help these billionaires pay even less in taxes, Democrats are fighting against corporate tax giveaways and to deliver relief for working families.”

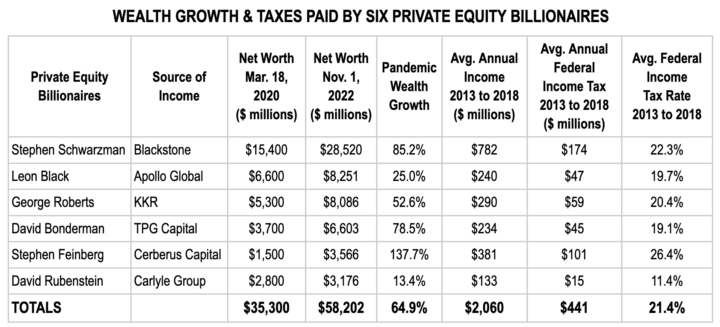

Six PE billionaires whose tax return information has been made public by ProPublica paid an average effective federal income tax rate of 21.4% between 2013 and 2018. (See table) Meanwhile, their wealth grew by almost two-thirds since March 2020, up nearly $23 billion to a collective $58 billion, according to Americans for Tax Fairness (ATF) using Forbes data.

Sources: Forbes billionaire data analyzed by Americans for Tax Fairness; ProPublica, America’s Highest Earners and Their Taxes Revealed, April 14, 2022. All data is available here.

One of the billionaires set to benefit from the more generous tax break is Stephen Schwarzman, head of private equity giant Blackstone Group. Schwarzman, who is worth about $28 billion (his net worth having jumped 85% during the pandemic), uses his riches to warp our democracy, and was a notable supporter of former President Trump. As of September 30, he had contributed over $33 million during this year’s midterm campaign to the two main GOP congressional super PACs helping elect Republicans to Congress. These groups are effectively controlled by Senate Minority Leader Mitch McConnell (R-KY), who has considerable leverage in the Senate to push for this tax break, and House Minority Leader Kevin McCarthy (R-CA).

The 2017 Trump-GOP tax law is where the current interest-deduction rules were born. To partially pay for a 40% cut in the corporate income-tax rate, Republicans mandated that three corporate tax breaks become less generous over time. The more restrictive interest-deduction rule went into effect this year: it shrank how much interest corporations could deduct by changing how the figure was calculated. By lobbying to reverse this reform—along with two other revenue-raisers—corporations are going back on the deal they struck with Republicans five years ago, which will make the 2017 tax law an even costlier boondoggle.

“Congress should not be giving tax breaks that encourage more job-killing leveraged buyouts by private equity billionaires,” said Frank Clemente, Americans for Tax Fairness executive director. “If Democrats in particular cave to this special interest demand they will be betraying working families. It would be ironic and unconscionable if they repeal one of the few corporate tax increases from the Trump-GOP tax cuts, which partially paid for that law’s outrageous 40% corporate income tax cut.

“Billionaires are already paying too little tax and the debt run up by private-equity corporate raiders is already too high. Tax reforms should instead be headed in the opposite direction: demanding billionaires pay closer to their fair share of taxes; and making debt-financed buyouts more rather than less expensive, and therefore less frequent.”

Private Equity’s Business Model Does Not Deserve More Tax Subsidies

Private equity is the term for huge pools of cash raised from pension funds, endowments, and wealthy people for the purpose of buying up companies, often in an attempt to boost their market value then sell them off for a short-term profit. Many PE investors show little interest in the long-term health of the companies they buy or in the welfare of the companies’ workers and communities.

PE firms typically use “leverage,” or borrowing, to finance their purchases. They use the assets of the target companies as collateral, just like a prospective homeowner uses the value of the purchased home as collateral for a mortgage. But unlike most mortgages and mortgage payments, the size of the debt and interest payments forced onto the acquired company often bear no relationship to its ability to pay. Every other cost of the company—including employment, wages and long-term investment—must often be slashed just to pay the interest.

“Crushing debt burdens drive the abuses of private equity firms in so many ways,” said Aliya Sabharwal, private equity campaign manager at Americans for Financial Reform, which has led efforts to reform private equity. “The last thing Congress should do is rework the tax code to make using debt more attractive for an extremely predatory industry.”

A recent study found that corporations acquired through such “leveraged buyouts” are 10 times as likely to go bankrupt as similar firms not deeply indebted. Another study from 2019 determined that 1.3 million jobs in or dependent on the retail sector were lost in the previous decade to PE-owned companies. After Bain Capital and KKR acquired Toys R Us, debt was at one point sucking up 97% of its operating profits. Many companies understandably collapse under the mountain of debt, including Toys R Us, which eventually went into bankruptcy, closing all its U.S. stores and laying off 30,000 workers without severance.

Over the past decade, PE has begun to threaten the physical as well as economic health of ordinary Americans by pouring nearly a trillion dollars worth of investments into the healthcare industry. According to Kaiser Health News, PE has come to dominate some fields of medicine, raising costs to patients and lowering the quality of care in search of ever higher profits.

Before their acquired companies go bankrupt, PE investors and managers reap huge rewards. In fact, the companies are often forced deeper into debt by taking on loans just for the purpose of paying the PE investors a fat dividend. Private equity managers also often extract excessive fees from their purchased companies.

Multiple agencies of the Biden administration are probing private-equity abuses, including the same firm controlling board seats on competing companies and other potential antitrust violations. The Securities and Exchange Commission is also writing new investor protections around fee transparency of private funds. And Sen. Elizabeth Warren (D-MA) is spearheading legislation that would curb the worst PE practices by making investors responsible for the economic mayhem they create.

Net Interest Deduction Tax Break: Deducting a Bigger Share of Interest Costs by Raising a Limit on How It’s Calculated

The interest that businesses pay on loans is an expense they can deduct from their earnings before figuring their income taxes. The Trump-GOP tax law of 2017 limited the amount businesses can deduct to 30% of the businesses’ income, although the law calculated income more generously in early versus later years by permitting more interest deductions in those early years.

Starting this year, the tax law calculated income more stringently—thus limiting the interest deduction further. From 2018 to 2021, the deduction for business interest expense was limited to 30% of a corporation’s earnings before interest, tax, depreciation and amortization (EBITDA). Beginning in 2022 the deduction was limited to 30% of earnings before interest and tax (EBIT). Having to subtract depreciation and amortization costs before determining the deduction limit leads to a smaller earnings figure and therefore a smaller amount of deductible interest. The interest limitations were a way to make the Trump-GOP 40% corporate tax-rate cut look less costly.

Republicans and some Democrats want to go back on this deal by allowing businesses to calculate income in the original way using EBITDA, making their interest deductions larger and therefore their tax bills smaller. They even want to make the change retroactive, so that corporations already prepared to figure their interest deduction the new way in 2022 would be allowed to return to the old way.

Private equity would benefit greatly from abandoning the EBIT calculation that began in 2022 and returning to EBITDA. That’s because private equity loads the companies it acquires with lots of debt, which creates lots of tax-deductible interest. Plus, private equity companies also deduct disproportionate amounts of depreciation and amortization. That is because any acquired goodwill and other intangible assets may be written off over 15 years, even if these assets do not lose value. While a big write-off for items such as brand awareness, customer loyalty and other passive attributes saves PE investors in one section of the tax return, it would under the new rules cost them in another because it would reduce how much interest they can deduct.