Major candidates in Democratic presidential field offer fiscal plans many times the size of Clinton’s in 2016

Five leading candidates for the Democratic presidential nomination who have announced detailed revenue and investment plans all proposed much more robust plans than Hillary Clinton offered in 2016, showing how far the debate has shifted in the progressive direction in four years. Like Clinton, they would all raise taxes almost exclusively on the wealthy and corporations to improve public services working families rely on like healthcare, education, and infrastructure.

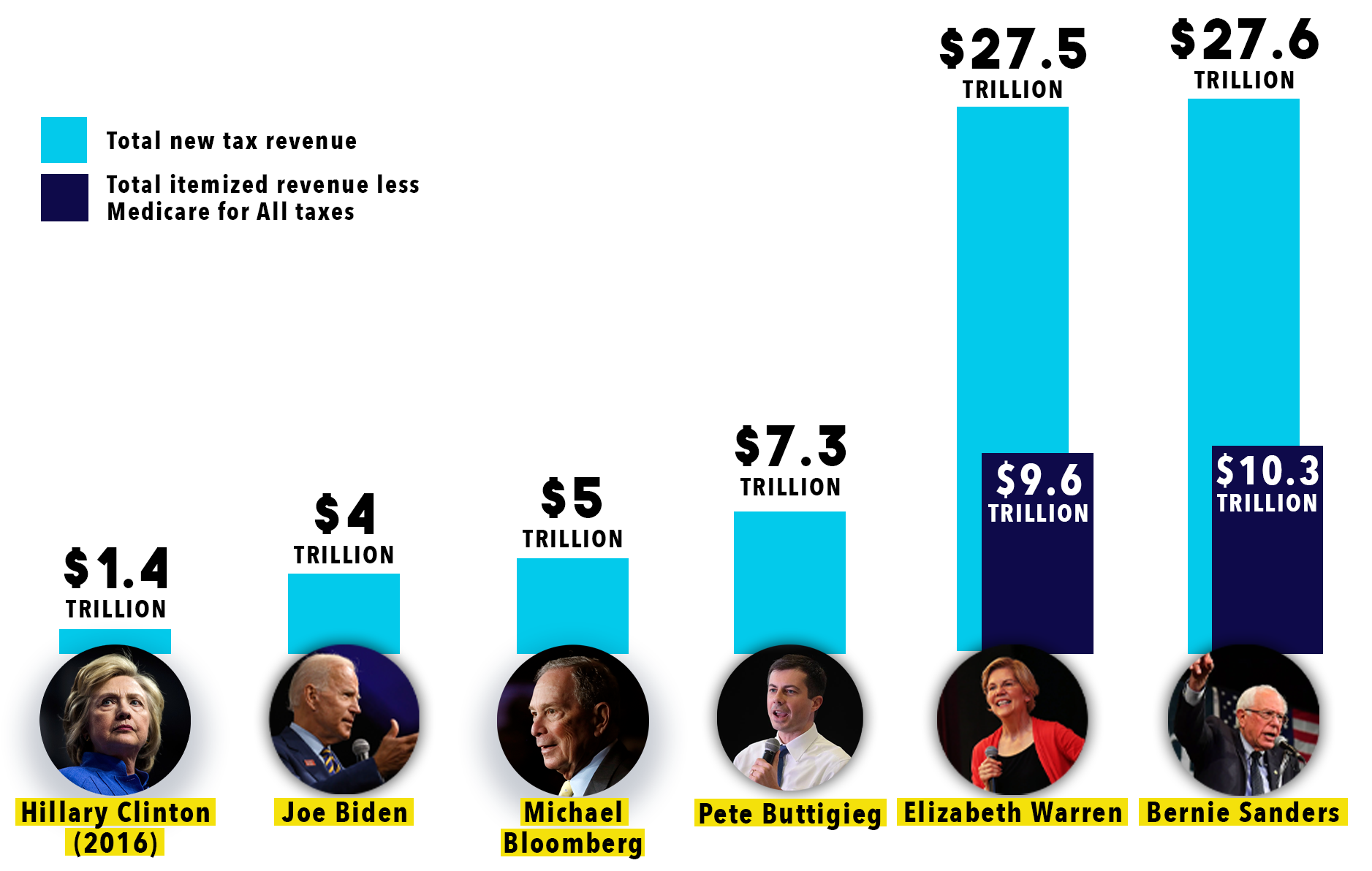

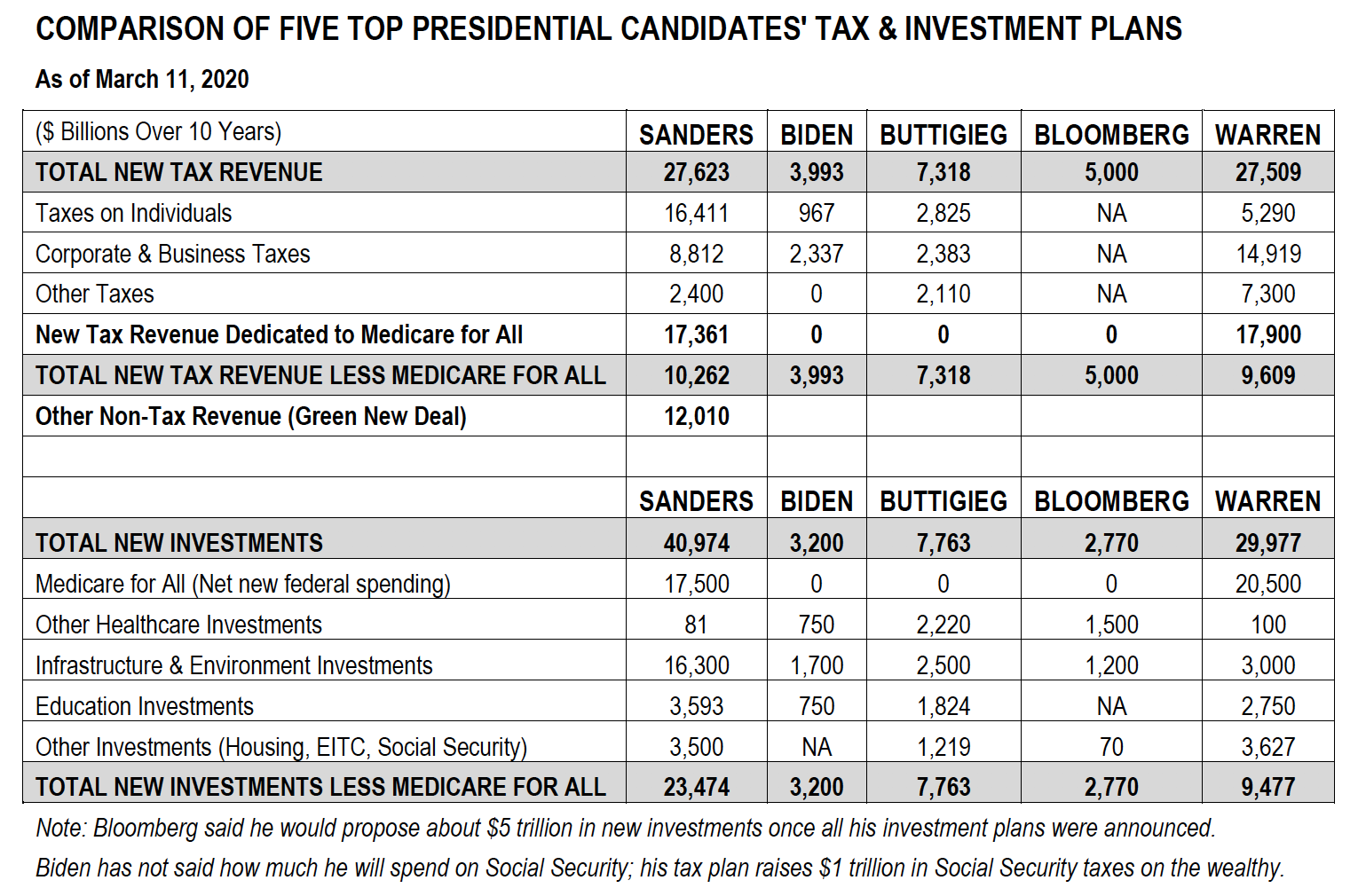

A summary of the proposed increases in tax revenue proposed by Joe Biden, Michael Bloomberg, Pete Buttigieg, Bernie Sanders and Elizabeth Warren is in the figure and table below. Highlights include:

- • Their tax plans would raise from the rich and corporations over 10 years: $4 trillion for Biden, $5 trillion for Bloomberg, $7.3 trillion for Buttigieg and more than $27 trillion for Warren and Sanders. Hillary Clinton proposed $1.4 trillion over 10 years in 2016.

- • Not counting Medicare for All, Sanders and Warren are each proposing to raise about $10 trillion in new taxes to pay for their investments.

- • Investment plans range from $3.2 trillion over 10 years for Biden and $7.8 trillion for Buttigieg to $30 trillion for Warren and $41 trillion for Sanders (which, for both, do not count current federal, state and local government spending on health care that would be dedicated to Medicare for All). Clinton proposed $1.7 trillion in new public investments.

Among the specific tax proposals that are common to the candidates’ plans:

- • Ending the tax discount enjoyed by certain investment income predominately received by rich people, so that wealth is taxed like work.

- • Raising the top tax rates charged on the nation’s highest incomes.

- • Raising the corporate tax rate from the current 21% to at least 28% (Biden and Bloomberg) or to 35% (Buttigieg, Sanders and Warren). The corporate tax rate was slashed 40% by the 2017 Trump-GOP tax law.

- • Establishing a financial transaction tax (except Biden) that would assess a very small sales tax on the trading of financial securities, typically 10 cents on a $100 trade.

The detailed revenue and investment plans of the five candidates are available here.

Details & sources for tax and investment plans are available at this spreadsheet.