Huge corporations waste hundreds of billions of dollars each year further enriching their top executives and wealthy shareholders with stock buybacks, rather than improving worker pay and benefits or investing in their businesses and communities. President Biden and Congressional Democrats took the first step in curbing this behavior while also raising revenue to support working families by enacting a 1% stock buyback tax in the Inflation Reduction Act in 2022, which is projected to raise $74 billion over 10 years.

But instead of slowing down, share repurchases have continued to accelerate. That’s why the President proposed in his State of the Union message raising the tax rate to 4%. Senators Sherrod Brown (D-OH) and Ron Wyden (D-OR) have introduced S.413, the Stock Buyback Accountability Act of 2023 to do just that. If enacted, this improved stock buyback tax is expected to generate $238 billion in new revenue over the next decade.

What Are Stock Buybacks?

Corporations often use extra cash to buy back shares of their own stock, rather than invest in facilities or workers. Corporate executives often prefer buybacks to dividends. Paying out dividends typically reduces their company’s stock price as they are holding onto less cash, which in turn lowers the value of their stock options. Buybacks typically help lift stock prices “because shareholders value a dollar on their own balance sheets more than a dollar inside the companies buying back stock.” Until a regulatory rule change 40 years ago, companies that bought their own shares could be accused of stock manipulation.

How Big A Problem Are Stock Buybacks?

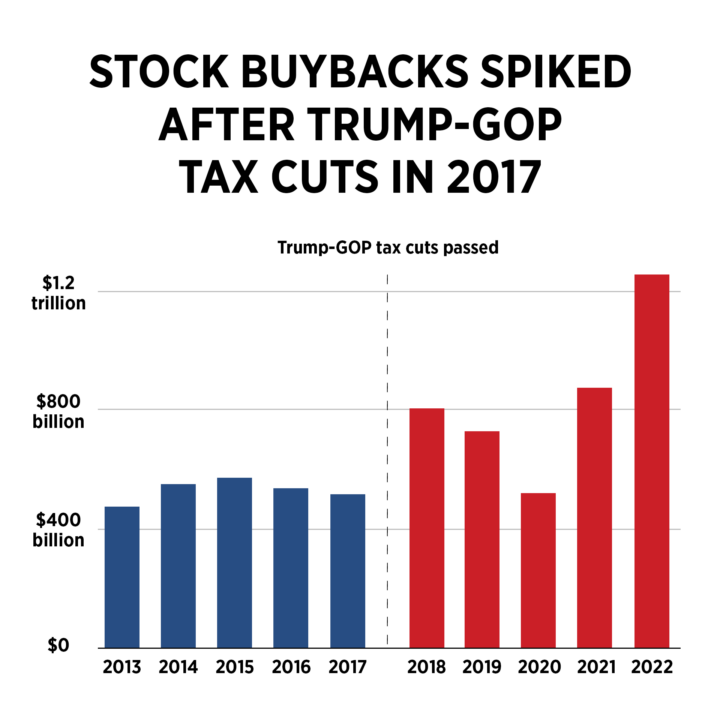

They’re a big problem, and growing. In 2022, corporations announced plans to buy back $1.2 trillion worth of their stock—a one-year record. That trend accelerated further in January 2023, when firms unveiled plans for $132 billion in repurchases—a record for the first month of a year. Buybacks have particularly exploded since 2018, when the Trump-GOP tax law came into effect and gave big corporations a huge tax cut. Backers of the law claimed firms would use their tax-saving windfall to invest in worker compensation and business capital, but instead they went on a buyback binge that continues.

In the five years since the Trump tax cuts went into effect, corporations have spent $4.2 trillion on buybacks. Except for the pandemic year of 2020, firms have spent much more on share repurchases in each of the five years after the law than in the five years before it. The $1.2 trillion announced in 2022 was more than double the $519 billion announced in 2017, the last year before the law’s big corporate tax breaks began [see chart].

Who Benefits from Stock Buybacks?

Stock buybacks further enrich top corporate executives, foreign and other wealthy shareholders. Foreign investors—who own about 30% of all publicly-traded corporate stock—benefit particularly from buybacks. That’s because they are taxed on the corporate dividends they receive at up to a 30% rate, but pay zero tax if they sell their shares in the buyback or later.

Wealthy US shareholders also benefit, because they also are taxed on dividends, but are not taxed on their stock gains until they sell. Often they keep their shares with a low cost basis until death and never pay tax on their gains. About 90% of the corporate stock that is held by Americans is owned by the richest 10% (over half is owned by the top 1%). The bottom 50% of households own less than 1% of corporate stock, either directly or through mutual funds.

Who’s Hurt by Stock Buybacks?

Stock buybacks waste money that could be used to hire more workers, boost wages and benefits, and invest in the corporate business and surrounding communities. Studies have shown that stock buybacks are associated with wage stagnation and layoffs, investment slowdowns, and reduced innovation.

Corporations that buy back a lot of their own stock often show their disregard for anyone but their shareholders in other ways as well. Two Big Oil companies are using profits gouged from drivers at the pump in recent years to reward their rich shareholders with tens of billions of dollars in stock buybacks. In early 2023, Chevron announced a $75 billion share repurchase program, one of the biggest in history, after record profits of $35.5 billion in 2022. It comes as no surprise Chevon has the cash to make such a sweeping repurchase after paying just a 1.8% corporate tax rate on profits of $9.5 billion in 2021.

Last year ExxonMobil made a record $56 billion in profits from sky-high gas prices in the midst of a global energy crisis; it then spent $15 billion of those profits, or more than one-quarter, on share repurchases. This comes on the heels of ExxonMobil paying just a 2.8% tax rate on its 2021 income.

Many of the corporations that buy back the highest amount of their own stock are also union busters. In other words, instead of negotiating higher wages and benefits with a unionized workforce they crush organizing efforts and use the money they save to repurchase their own shares, further enriching their wealthy executives and stockholders.

Starbucks has bought back more than $30 billion in stock over the past decade or so and been a particularly notorious union buster. Starbucks’ average effective tax rate was slashed from 28% to 18% after the passage of the Trump Tax Cuts. Home Depot has repurchased almost $74 billion worth of its shares over that same period while using underhanded tactics to stymie unionization at its stores. Apple has bought back over $400 billion in stock over the last five years―over $95 billion in a recent 12-month period. From 2018 to 2021 Apple spent twelve times more on stock buybacks $307 billion) than it paid in federal income taxes ($25 billion). Now, the National Labor Relations Board is accusing Apple of violating the National Labor Relations Act, interfering with workers’ rights to organize for fair wages and benefits.

What Can We Do About Stock Buybacks?

President Biden and fellow Democrats last year placed a 1% tax on stock buybacks, as part of the Inflation Reduction Act, the first curb on the practice since it became a practical option for corporations in 1982. This levy will raise $74 billion in revenue over 10 years, money that is being used to fund investments to move the United States to a clean-energy economy, lowering energy costs for families and addressing the climate change crisis.

But judging by the record buybacks announced in the first month the tax was in effect this year, a 1% tax rate is not enough of a deterrent. That’s why President Biden, Senator Wyden (chairman of the tax-writing Senate Finance Committee) and Senator Brown proposed raising the rate to 4%. The Stock Buyback Accountability Act of 2023 was introduced in the U.S. Senate in February 2023. The Treasury Department estimates that a three percentage point increase to the current 1% stock buyback tax would raise an additional $238 billion over the next ten years, more than enough revenue to cover President Biden’s plan to make preschool free for American children.

Even as it slows down buybacks and frees up corporate cash for higher wages, business improvements and other better uses, this higher tax will raise more revenue to help working families afford healthcare, childcare, education, housing and for other useful purposes. A revenue estimate is forthcoming.