Proposed ‘Billionaires Income Tax’ Would Tap Pandemic Profits & Other Investment Gains of Richest 750 Americans to Fund Biden’s Build Back Better Agenda

Billionaires in nearly every corner of America got richer during COVID and their pandemic profits—along with other investment income currently not taxed—would be subject to a Billionaires Income Tax now being considered in Congress, a new report finds. Americans for Tax Fairness today released a state-by-state analysis of Forbes billionaire data showing who would likely have to pay the tax and how the billionaires found in almost every state rank in the “billionaires bonanza” they enjoyed while the rest of the nation suffered through the 19 months of the pandemic.

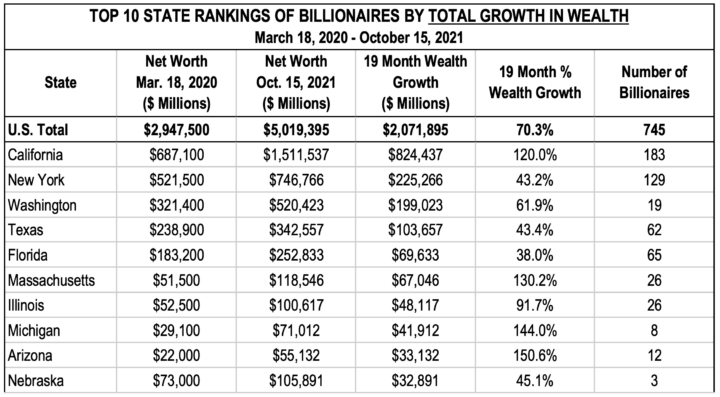

Total U.S. billionaire wealth increased $2.1 trillion, or 70% during the pandemic—from March 18, 2020, to Oct. 15, 2021. By comparison that is more than Congress is considering spending on the entire Build Back Better investment plan over 10 years.

California’s 183 billionaires captured 40% of that growth, or $824 billion—more than a doubling of their collective wealth to a total of $1.5 trillion. New York’s 129 billionaires were next with a $225 billion, or 43%, increase in total wealth—11% of the national total. [See Table 1 below for top 10 state rankings]

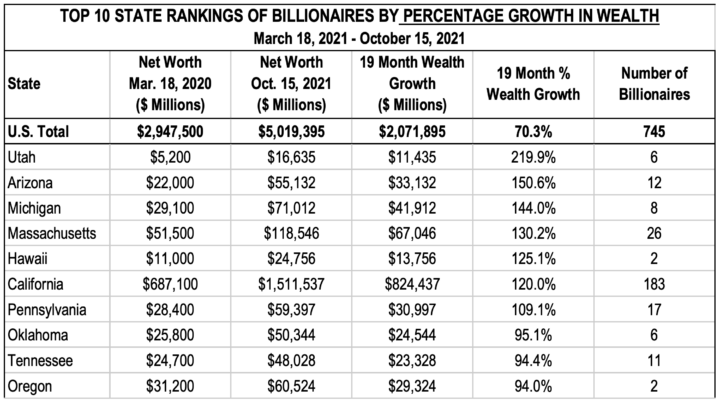

Utah’s billionaires enjoyed the biggest percentage increase, their total fortunes more than tripling (up 220%), from $5.2 billion at the pandemic’s start to $16.6 billion this month. Arizona was the next closest state with billionaire wealth surging $33 billion or 151%. [See Table 2 below for top 10 state rankings]

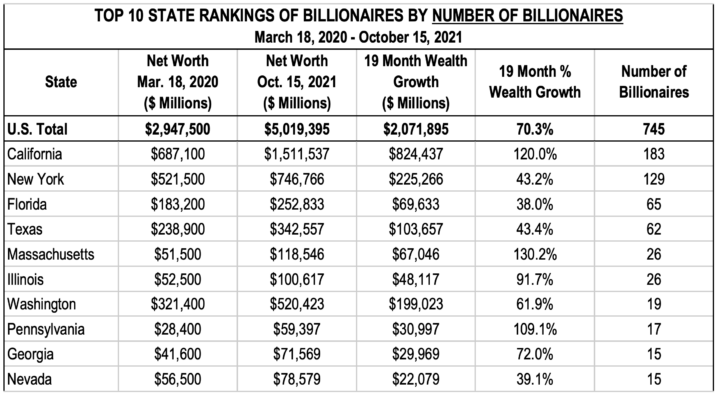

California has 183 billionaires out of 745, or a quarter of the U.S. total. New York is home to 129 billionaires or 17%. Florida and Texas are nearly tied with 65 and 62 billionaires respectively. [See Table 3 below for top 10 state rankings]

The full data set is available here with tabs for each of the rankings above.

“From Maine to Arizona, Washington State to Florida, America’s billionaires have enjoyed a bonanza of growing riches during the past 19 months of shutdowns, job losses, overcrowded ERs and lost hope,” said Frank Clemente, executive director of Americans for Tax Fairness. “This boom in billionaire wealth occurred against a backdrop of millions of other Americans losing their health, jobs and lives. The Billionaires Income Tax is a perfectly timed reform that would tax those outsized gains to invest in the healing of our states and people.”

Most of the billionaires’ investment income in the form of increased wealth may never be taxed under current law. But the Billionaires Income Tax, proposed by Sen. Ron Wyden (D-Ore.), chairman of the Senate Finance Committee, would finally tax this primary source of income for the super-rich and use it to fund President Biden’s Build Back Better investment plan. It is estimated to raise up to $250 billion. The tax is supported by President Biden and by 105 national groups.

The Billionaires Income Tax would only apply to taxpayers with $1 billion in assets during three consecutive years or income of over $100 million three years running. Only about 750 billionaires would likely pay the tax. It would be assessed annually on the increase in value of tradable assets, such as stocks, mutual funds and derivatives, where the value of the asset is known at the beginning and end of the year, and the owner gets a financial statement. For non-tradable assets—such as ownership in a business, real estate holdings or a fine art collection—the tax would be deferred until the asset is sold. Interest would be charged for those years the asset increased in value, but no tax was paid.

The tax rate would be the top rate on long-term capital gains, which is currently 20% plus a 3.8% net investment income tax. The first year a taxpayer would owe tax on tradable assets they could elect to pay the tax over five years. Special rules will be in place for taxpayers who experience a loss of income or wealth.

Public support for the Billionaires Income Tax is very strong. When proposed as a way to pay for President Biden’s original $3.5 trillion investment package it raises support 20 to 40 points among voters in battleground districts and states.

The Billionaires Income Tax is not a wealth tax. It simply taxes the investment income represented by the increase in billionaire asset values, income that can now go completely untaxed forever. If a billionaire is worth $5 billion at the start of the year and $5 billion at the end of the year, he would owe no tax.

BILLIONAIRES UNDERTAXED

On average, billionaires pay an effective federal income tax rate of about 8% when the increased value of their stock is counted, according to the White House. This is a lower rate than is paid by many middle-income taxpayers like teachers, nurses and firefighters. Billionaires pay such low tax rates because:

- Most of their income comes from the increased value of their investments such as stocks, a business or real estate, rather than a paycheck like most people, and they don’t have to pay taxes on that increased wealth unless they sell the assets. But the ultra-rich don’t need to sell assets. Instead, because of the size of their fortunes, they can borrow money at low rates from banks and live lavishly tax-free.

- When they sell their assets they pay a top capital gains tax rate of 20% (plus a 3.8% net investment income tax, NIIT) far below the current 37% (40.8%) top rate they would pay on an equivalent salary. This is why many ultra-rich pay a lower tax rate than people in the middle class.

According to ProPublica’s analysis of IRS data:

- Billionaires have paid no federal income taxes in some recent years, including Jeff Bezos, Elon Musk, Michael Bloomberg and George Soros.

- The country’s 25 top billionaires paid a tax rate of just 3.4% on a $400 billion increase in their collective fortune between 2014-18. ProPublica bases that tax rate on how much each billionaire paid in federal income taxes during that period compared with how much their wealth grew.

Public support for the Billionaires Income Tax is very strong. When proposed as a way to pay for President Biden’s $3.5 trillion investment package it increased support 20 to 40 points among voters in battleground districts and states.

March 18, 2020 is used as the unofficial beginning of the coronavirus crisis because by then most federal and state economic restrictions responding to the virus were in place. March 18 was also the date that Forbes picked to measure billionaire wealth for the 2020 edition of its annual billionaires’ report, which provided a baseline that ATF and HCAN compare periodically with real-time data from the Forbes website. PolitiFact has favorably reviewed this methodology.

Americans for Tax Fairness analysis of Forbes billionaires data

Americans for Tax Fairness analysis of Forbes billionaires data

Americans for Tax Fairness analysis of Forbes billionaires data