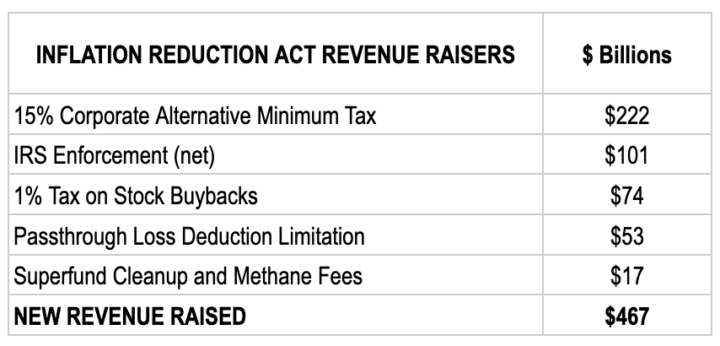

Tax reforms in the Inflation Reduction Act (IRA) will raise nearly $470 billion over ten years by making corporations and the wealthy pay a fairer share of taxes. About $400 billion of the revenue will be used for historic clean energy investments to combat climate change and reduce household energy costs, and for deficit reduction.

Below is a summary of the tax reforms in the IRA, followed by more detailed descriptions. Unless otherwise noted, all dollar figures are over 10 years and from the Joint Committee on Taxation or the Congressional Budget Office.

Source: Americans for Tax Fairness IRA Revenue Raisers Analysis; data extracted from CBO and JCT reports

Source: Americans for Tax Fairness IRA Revenue Raisers Analysis; data extracted from CBO and JCT reports

15% MINIMUM TAX ON BILLION-DOLLAR CORPORATIONS

Revenue raised: $222 billion

How it will work: Corporations with at least $1 billion in annual profits over the previous three years would have to start calculating their income in two ways and pay taxes on whichever amount is higher. The current way is based on “taxable income” reported to the IRS, which is taxed at 21% less deductions and credits. It is generally lower than the “book income” they report to investors. The new 15% Corporate Alternative Minimum Tax (CAMT) rate will be applied to those “book” earnings, with partial credit given for deductions and credits. It will affect roughly 90 U.S. corporations.

Talking Points

- The 15% minimum corporate tax rate will ensure billion-dollar corporations no longer pay a lower tax rate than average Americans, including nurses, firefighters, and teachers. Year after year these corporations report large profits to shareholders but pay a lower tax rate than the 13.3% average federal income tax rate paid by all taxpayers.

- The 15% minimum tax rate is needed because 55 big corporations paid $0 in federal taxes in 2020. Some of America’s biggest corporations – Amazon, FedEx, Netflix and Nike – go years paying little or nothing in taxes despite making billions in profits.

- Despite phony Republican claims that the middle-class will pay more in taxes, no one making less than $400,000 will pay one penny in additional taxes under the Inflation Reduction Act, as confirmed by the Washington Post fact checker and other sources here and here.

- This 15% minimum tax would ensure that some prescription drug, high tech and apparel corporations, which avoid taxes by manufacturing their drugs, phones and shoes abroad and by stashing their profits in tax havens, will start paying closer to their fair share.

- For decades, Republicans have made false claims that tax cuts for corporations will trickle-down to workers and the rest of us. They promised that employers would give workers big wage increases after the Trump-GOP tax cuts became law. Corporations got their huge tax cut and after-tax profits soared, but workers did not get their share. Now Republicans are saying this legislation will raise taxes on the middle-class. That’s a lie.

$80 BILLION IN FUNDING TO THE IRS TO CATCH WEALTHY TAX CHEATS

Revenue raised: $181 billion for a net of $101 billion

The Treasury Department estimates it could raise up to $400 billion net

How it will work: The IRS will receive $80 billion in additional funding over the next 10 years, which will generate at least $180 billion in new revenue. This roughly 50% increase in the IRS budget (currently about $14 billion a year) will allow it to replace tens of thousands of employees expected to retire or depart over that period, as well as hire new employees with specialized knowledge of the complex schemes used by the rich and corporations to evade taxes. The extra funding will also allow the agency to substantially improve customer services (such as expediting tax refunds and answering customer phone calls), update antiquated technology and generally focus more resources on high-end tax evaders.

Talking Points

- The inflation Reduction Act will strengthen tax enforcement to crack down on tax cheating by the wealthy and corporations. The richest 1% avoid paying $160 billion a year that they owe in taxes because the IRS lacks the staff to catch them.

- By restoring IRS staffing levels to where they were before deep Republican budget cuts this law will make the IRS work better for taxpayers. That means shorter waits to get tax refunds and questions answered and catching more wealthy and corporate tax cheats.

- Because of Republican budget cuts over the last decade, the IRS lacks the resources to catch many rich tax cheats: funding and staffing are each down by at least 20%; audits of corporations are down by over half and audits of millionaires are down by almost three-quarters.

- This legislation will provide the funds needed for the IRS to fully staff customer service centers to help taxpayers wanting to get their tax refund on time or their phone calls answered.

- The IRS will not increase the audit rates of small businesses or people making less than $400,000 a year. It will only crack down on tax cheating by the wealthy and corporations.

- Treasury Secretary Janet Yellen has stated: “I direct that any additional resources— including any new personnel or auditors that are hired—shall not be used to increase the share of small business or households below the $400,000 threshold that are audited relative to historical levels. This means that, contrary to the misinformation from opponents of this legislation, small businesses or households earning $400,000 per year or less will not see an increase in the chances that they are audited.”

1% TAX ON CORPORATE STOCK BUYBACKS THAT BENEFIT THE WEALTHY

Revenue raised: $74 billion

How it will work: Publicly traded corporations often use corporate funds to buy back their own shares. They will now pay a 1% excise tax on such repurchases. Though a 1% tax is modest, once the tax is in place it can be raised in the future to generate more revenue and to curb HARMFUL corporate behavior.

Talking Points

- The Inflation Reduction Act requires corporations to pay a 1% tax on stock buybacks. When corporations have a lot of cash, they often buy back their own stock, which artificially inflates its value and benefits CEOs and other wealthy shareholders.

- Buybacks help wealthy CEOs and investors dodge taxes. The rise in stock price created by a buyback is not taxed unless the stock is sold. However, if a corporation rewards its shareholders with cash payments called dividends, those are taxed in the year they are received. With the stock buybacks tax, corporations are expected to pay out more in dividends, which are taxed at a 20% rate for wealthier investors.

- A stock buybacks tax will increase U.S. tax receipts from foreign investors, who do not pay U.S. capital gains tax when they sell stock but are taxed on dividends they receive. If the corporation paid $10 million in dividends, the foreign investors generally would pay a 30% tax on the payout (or 15%, under some treaties).

- Studies have shown that stock buybacks are associated with wage stagnation and layoffs, investment slowdowns, and reduced innovation. A 1% tax on stock buybacks will discourage the practice and instead encourage more socially useful ways to spend corporate cash.

- Stock buybacks are out of control and should be curbed: Corporations have been on a buyback frenzy in recent years, intensifying since the 2017 Trump-GOP tax cuts. Rather than investing in their workers and communities, big corporations used the windfall from the Republican tax cuts to buy back record-breaking amounts of their own shares.

- Corporate stock buybacks set an all-time high in 2018, the first year the tax law was in effect. Another buyback record was set in 2021, even as tens of millions of ordinary Americans were losing jobs and businesses, falling ill and dying from the COVID pandemic.

EXTENSION OF A LIMIT ON DEDUCTIONS FOR LOSSES BY WEALTHY BUSINESSES

Revenue raised: $53 billion

How it will work: Under the 2017 Trump-GOP tax cuts, pass-through business entities were limited on how much business losses they could deduct against other income. The limit was set at $500,000 for joint filers and $250,000 for single filers. This provision is scheduled to expire at the end of 2026, but the IRA extended the loss limitation for an additional two years.

Talking Points:

- Real estate tycoons like Donald Trump have a history of using paper business losses to wipe out taxable salaries and investment gains when filing their personal returns, cutting what they owe. An earlier law curbed this tax dodging for the next few years. The Inflation Reduction Act extends the curb several years more.

- The type of business owners who benefit from the tax dodge the IRA is helping to curb are overwhelmingly rich. Over 60% of the benefit of this loophole goes to the highest- income 1%.

TAX REFORMS ON FOSSIL FUELS

- The IRA reinstates a tax on petroleum products to support the Superfund that cleans up toxic wastes sites. ($12 billion)

- It also establishes a fee on methane emissions that represents the first direct federal fee on greenhouse gasses responsible for climate change. ($5 billion)