by Frank Clemente, Executive Director of Americans for Tax Fairness

On behalf of Americans for Tax Fairness and its coalition of more than 400 endorsing organizations, I write to submit testimony for the record for the committee hearing on Tuesday, February 11— “The Disappearing Corporate Income Tax.”

We commend the committee for having this hearing. It is critical to analyze the two-year record of the Tax Cuts and Jobs Act (TCJA) not only for its impact on corporations, but also on pass-through businesses and the economy at large. This testimony highlights the following:

- On several key measures, corporate taxes are close to disappearing:

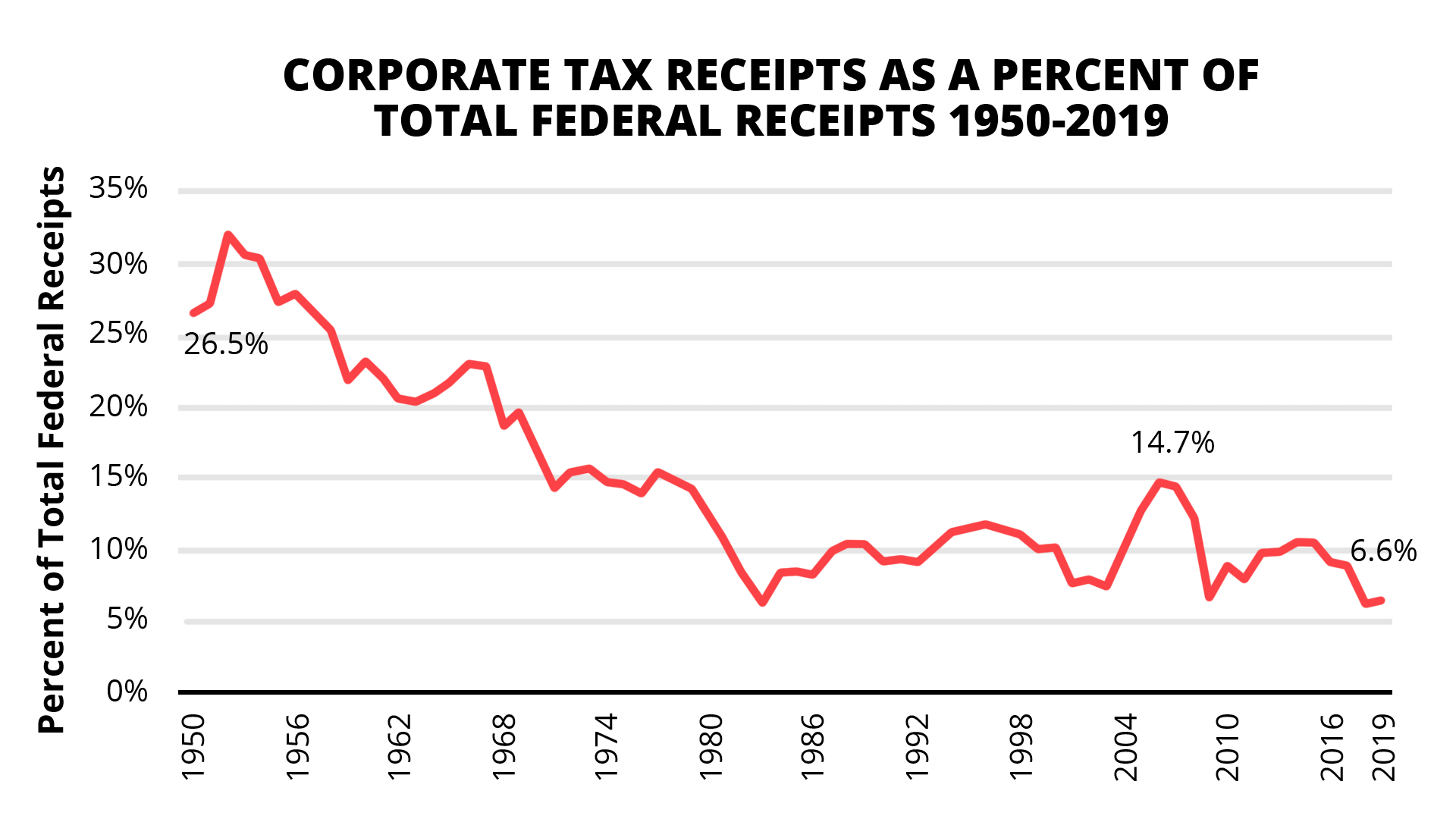

- Corporate tax revenue as a share of all federal revenue has plummeted since 1950: It was 26.5% in 1950 but just 6.6% in 2019. As recently as 2006 corporate taxes comprised 14.7% of all federal revenue. Between 2017 and 2019, the period in which the TCJA took effect, corporate revenues declined from 9.0% to 6.6%—a 27% drop.

- Corporate tax revenue as a share of GDP has declined dramatically since 1947, even as profits exploded. In 1947, corporate tax revenue was 3.6% of GDP and corporate profits were 5.2%. By 2018, corporate revenue had plummeted to just 1.0% of GDP and corporate profits reached 9.0%. Between 2017 and 2018, the period in which the TCJA took effect, corporate revenues as a share of GDP dropped by a third—from 1.5% to 1% (they rebounded slightly to 1.1% in 2019). Corporate profits as a share of GDP rose over that same two-year span from 8.6% to 9.0%.

- The failure of the corporate cuts after two years to live up to the many promises made for them prior to enactment. Those promises, and the actual outcomes, include:

- Quick raises averaging $4,000 to $9,000 were guaranteed for working families from the TCJA’s corporate tax cuts. Instead, median household income barely budged in the first year of the new law, rising a little over $500.

- At the TCJA’s signing ceremony, President Trump called it a bill “for jobs.” But instead of accelerating with the law’s enactment, job creation has slackened, with fewer jobs created in the two years under the law than in the last two years of the Obama administration.

- President Trump promised as much as a doubling of economic growth, yet GDP has risen at roughly the same rate as during the last two years of the Obama administration.

- Business investment was, in the words of President Trump’s top economic adviser, supposed to “really take off” with the TCJA’s enactment; instead it collapsed the last three quarters of 2019.

- The hundreds of billions of dollars in revenue lost by the legislation’s corporate tax cuts and creation of the pass-through business income deduction.

- The ability of at least 91 highly profitable Fortune 500 corporations to avoid all federal income taxes in 2018, and hundreds more to pay taxes at half the statutory rate.

- The failure of the law’s new international tax provisions – coupled with the implementation of these laws through the regulatory process – to curb offshore tax dodging by U.S. corporations.

- The major layoffs and outsourcing plans announced by many iconic American corporations in the wake of their tax cuts, which were supposed to create jobs.

- The distribution of the corporate and business tax cuts, which overwhelmingly rewarded the richest Americans and foreign investors to the exclusion of ordinary working Americans.

Following are further details on many of these issues.

DISAPPEARING CORPORATE TAX REVENUE EXACERBATED BY THE TCJA

The TCJA has rapidly accelerated the long and steep decline of corporate tax revenue as a contribution to the public good, even as corporate profits have robustly increased. Of course, this was to be expected as the TCJA slashed the corporate income tax rate by 40%—dropping it from 35% to 21% on domestic profits and to about half that on a large share of foreign profits. As a result, on several key measures corporate taxes are close to disappearing.

For instance, corporate tax revenue as a share of all federal revenue has plummeted since 1950: It was 26.5% in 1950 but just 6.6% in 2019. As recently as 2006 corporate taxes comprised 14.7% of all federal revenue. Between 2017 and 2019, the period in which the TCJA took effect, corporate revenues declined from 9.0% to 6.6%—a 27% drop.

Source: Office of Management and Budget, Table 2.2 (pp. 37-38), Percentage Composition of Receipts By Source, 1934-2025. https://www.whitehouse.gov/wp-content/uploads/2020/02/hist_fy21.pdf

Corporate tax revenue as a share of GDP has declined dramatically since 1947, even as profits exploded. In 1947, corporate tax revenue was 3.6% of GDP and corporate profits were 5.2%. By 2018, corporate revenue had plummeted to just 1.0% of GDP and corporate profits reached 9.0%. Between 2017 and 2018, the period in which the TCJA took effect, corporate revenues as a share of GDP dropped by a third—from 1.5% to 1% (they rebounded slightly to 1.1% in 2019). Corporate profits as a share of GDP rose over that same two-year span from 8.6% to 9.0%.

Sources: Corporate Tax Revenue: Office of Management and Budget, Historical Tables, Table 2.3: Receipts by Source, as Percentages of GDP, 1934-2019; https://www.whitehouse.gov/omb/historical-tables/ Corporate Profits: Federal Reserve Bank of St. Louis, Annual Corporate Profits After Tax with Inventory Valuation Adjustment (IVA) and Capital Consumption Adjustment (CCAdj)/Gross Domestic Product*100, 1947-2018 https://fred.stlouisfed.org/graph/?g=nMZG#0

In July 2018, President Trump predicted “when this [tax cut] kicks in we’ll start paying off [federal] debt like water.”[i] His Treasury Secretary, Steve Mnuchin, reiterated this claim a month later, proclaiming “as I’ve said at 3% economic growth this tax plan will not only pay for itself but in fact create additional revenue for the government.” However, two years after the passage of the TCJA, it is more than clear that the TCJA does anything but pay for itself.

The Congressional Budget Office (CBO) has predicted ever since the TCJA became law that it would increase the deficit by $1.9 trillion (including interest) over 10 years, and that prediction has started to come true.[ii] The annual deficit has increased from $665 billion in fiscal year 2017—Trump’s first year in office—to $984 billion in the most recently completed fiscal year, 2019.[iii]

The cut in corporate tax rates is a principal contributor to the TCJA’s bleeding of federal revenue. In late 2017, the Joint Committee on Taxation (JCT) estimated that the law’s cut in the corporate tax rate would lose $1.35 trillion over ten years.[iv] That prediction is also coming to realization. In its last budget outlook prior to passage of the TCJA in 2017, the CBO estimated the government would collect $344 billion in corporate income taxes in fiscal year 2019, what would become the first full fiscal year under the new law.[v] But the government only collected $230 billion in corporate income taxes in FY 2019, $114 billion less than CBO’s estimate before the TCJA was enacted.[vi]

Moreover, the corporate tax cut is not the only revenue-losing business tax cut in the TCJA. The law instituted a new 20% deduction for so-called “pass-through” businesses, where income is taxed at the individual level. JCT scored this provision losing $387 billion over 7 years (the provision is set to expire in 2025).[vii] While sold as a “small business tax cut,” the reality is much different—60% of this tax break will go to the richest 1% by 2024.[viii] That’s because half of all pass-through income goes to the wealthiest 1% of business owners.[ix]

THE MANY FAILED PROMISES FOR CORPORATE TAX CUTS

Household Income

In 2017, President Trump trumpeted that “[m]y Council of Economic Advisors estimates that [corporate tax cuts and offshore rules changes] would likely give the typical American household a $4,000 pay raise.”[x] The CEA chairman, Kevin Hassett, more than doubled down on that promise, boasting that the raises could average as much as $9,000 per family.[xi] And he expected that in the wake of the new tax law wage growth would be “immediate.”[xii]

Instead, according to the U.S. Census Bureau, median household income rose by only $514, or about 0.8%, in the first year after the law’s enactment (the most recent data available).[xiii] Wage growth acceleration has slowed in the two years under the TCJA compared to the last two years of the Obama administration.[xiv]

A 2019 report by the Congressional Research Service determined the CEA pay-hike projections were based on the fantastical economic assumption that the tax cuts would boost the economy 3.8 to 8.5 times more than the tax law’s cost.[xv]

Highly publicized employee bonuses that immediately followed the TCJA’s enactment turned out to be a transitory and, for the vast majority of American workers, symbolic phenomenon.[xvi] A study by Americans for Tax Fairness referenced in the CRS report found that only 4% of workers (about 7 million) had received a bonus or other pay hike tied to the tax law.[xvii] In January 2018, President Trump said just “over 3 million workers have gotten tax cut bonuses.”[xviii] The total amount of that compensation (ATF estimated it at $7 billion in one-time bonuses including stock grants), was dwarfed by the size of the corporate tax cuts and by the amount spent on corporate stock buybacks, which overwhelmingly benefit top executives and other wealthy shareholders.

Job Creation

The welcome fall in unemployment over the past two years is a continuation of a decade-long trend, with nothing to indicate the TCJA has played a role in the decline. Another key job statistic has actually worsened in the two years since the law’s enactment—monthly job creation averaged 185,000 in the two years under the TCJA, which is lower than the 210,000 average per month during the last two years of the Obama administration, per the Bureau of Labor Statistics.[xix] Remarkably, 2019 had the fewest jobs created per month (an average of 175,000) since 2011 (173,000 average).[xx]

GDP and Business Investment

According to President Trump, the TCJA was going to be “rocket fuel” for the economy, boosting growth by as much as double the recent pace.[xxi] But despite these boastful predictions, GDP growth since the tax cuts has been very much in line with the economic performance of the Obama years. Trump suggested growth could hit 6%, but in fact hasn’t even been 3%: the quarterly GDP rose by an average of 2.9% in 2018 and just 2.3% in 2019.[xxii]

After a mild rise in the first quarter after the TCJA was signed, business investment slowed, and then collapsed, falling into negative territory—contracting—for the last three quarters of 2019, according to the Bureau of Economic Analysis.[xxiii] Just like wage growth and job creation, capital investment has taken a backseat in corporate boardrooms to stock buybacks, which in the first year of the law set a record of over $800 billion.[xxiv]

Distributional Effects of the Tax Cuts

While the TCJA has not lived up to the promises its backers used to sell the massive cut to corporate and business taxes, it has exacerbated inequality. The richest 1% of taxpayers will get an average tax cut of $50,000 in 2020 from the Trump-GOP tax cuts, according to the Institute on Taxation and Economic Policy (ITEP).[xxv] That’s over 75 times more than the tax cut for the bottom 80% of taxpayers, which will average $645.

Moreover, the law has benefited not just wealthy Americans, but wealthy foreigners too. ITEP estimates that in 2020 foreign investors will save $38 billion in tax from the TCJA, almost as much as the bottom 60% of combined.[xxvi] That’s because they own stock in American firms that got the corporate tax cuts.

The law also serves to widen racial divisions.[xxvii] The Trump-GOP tax cuts disproportionally benefit white Americans at the expense of other racial groups. In 2020, whites will make up 67% of tax filers but will garner 79% of the tax cuts. On the other hand, African Americans will comprise 10% of all filers yet only receive 5% of the benefits. Latinx will be 12% of filers but get only 7% of the tax savings.

CORPORATIONS HAVE ENJOYED WINDFALLS, INCLUDING 91 FIRMS PAYING NOTHING

An ITEP report determined that 91 corporations in the Fortune 500—all profitable enterprises—paid no federal income taxes in 2018 or even received a tax rebate.[xxviii] (In total, the report found 379 Fortune 500 companies that were profitable in 2018 and provided enough information to calculate effective federal income tax rates.) This was a sharp increase from ITEP’s last pre-TCJA report on Fortune 500 corporate tax avoidance, which found that 29 profitable companies paid no U.S. income taxes in 2015, the latest year studied.[xxix] Even among those big corporations that did pay taxes in 2018, it was on average at a rate of 11.3%, or little more than half the new low statutory rate of 21%.

One of the companies paying zero income taxes last year was Amazon, which made $11 billion in U.S. profits and got a rebate of $129 million. Its founder and CEO, Jeff Bezos, is the richest man in the world, worth $127 billion in February 2020.[xxx] Other members of the tax-free group: Netflix, which made $856 million and got a $22 million rebate; General Motors, which had $4.3 billion in U.S. profits yet got $104 million back from the government; FedEx, which got a $107 million refund despite $2.3 billion in profits; and drug maker Eli Lilly, which enjoyed a nearly $600 million profit yet pocketed a $54 million refund.

Though they didn’t get refunds, scores of other big corporations paid minuscule tax rates. Over 50 firms paid less than 5%, and more than half of the 379 companies in the study paid less than half the statutory rate.

It’s sobering to consider that a single employee of any of these companies with any tax liability at all paid more in federal income taxes in 2018 than all 91 tax-free firms combined. While corporations are not required by SEC regulations to divulge their tax savings from the TCJA, some estimates are available. For instance, Bloomberg recently calculated that the law in its first two years had handed the nation’s six biggest banks a total tax savings of $32 billion.[xxxi] Oxfam determined that four of the nation’s biggest drug companies (notably, not including Eli Lilly, whose tax benefits are cited above) collectively avoided $7 billion in taxes in the first year of the TCJA.[xxxii]

COMPLEX NEW RULES HAVE NOT STOPPED OFFSHORE CORPORATE TAX DODGING

Multiple provisions of the tax law with catchy-sounding acronyms (such as BEAT and GILTI) were supposed to reduce corporate offshore tax dodging, though not by much. According to a CBO analysis after passage of the TCJA, corporations shift about $300 billion in profits out of the U.S. each year.[xxxiii] The TCJA will only reduce that profit-shifting by $65 billion, meaning corporations will avoid paying taxes on $235 billion in profits each year. This is revenue that should be funding critical public investments in healthcare, education, infrastructure, and other priorities.

A recent report by economist Kimberly Clausing found the TCJA’s international tax provisions to have had “conflicting and ambiguous effects on [corporate offshore] profit shifting.”[xxxiv]

One example: the GILTI (global intangible low-taxed income) tax is meant to curb profit shifting, but has the perverse effect of encouraging U.S. corporations to shift actual production and jobs overseas. That’s because a 10% return on physical foreign investments is exempt from the GILTI, so the more factories, stores and offices U.S. corporations build overseas, the more of their international profits are GILTI-tax free.[xxxv]

While Clausing writes that it’s hard to form precise conclusions about the long-term impact of the law, she does observe that “as of the third quarter of 2019, there is no evidence of a reduction in profit shifting or a change in the location of U.S. MNC [multinational corporation] profits.”

In addition to faults in their legislative drafting, the BEAT, GILTI, FDII and other international provisions may well fail in their mission of curbing offshore corporate tax dodging because of post-enactment lobbying. As reported by the New York Times late last year, the Treasury Department was responsive to the pressure asserted by a coordinated corporate lobbying campaign to weaken the international tax provisions in the administrative rule-making process.[xxxvi] The Times article cites a Joint Committee on Taxation calculation indicating exemptions for international banks could reduce revenues by $50 billion compared to what was predicted when the law was enacted. Senate Democrats, led by Finance Committee Ranking Member Ron Wyden, have launched an investigation into Treasury’s giveaway.[xxxvii]

In its most recent Budget and Economic Outlook, the CBO confirmed the negative projected impact of the new international tax rules, especially as interpreted through regulatory changes.[xxxviii] In a very real sense, these favorable regulatory rulings represent a “Tax Cuts 2.0” for corporations.[xxxix]

CASE STUDIES OF POST-TCJA CORPORATE ABUSES

As noted above, General Motors paid no federal income taxes in 2018 despite billions in profits, instead receiving a rebate of over $100 million. What’s more, it likely got a one-time tax break of hundreds of millions of dollars more on its $6.5 billion of accumulated offshore profits.[xl] Despite all these tax savings meant to spur domestic investment, in June 2018 GM announced it would build its Chevrolet Blazer in Mexico rather than the United States.[xli] Then in November, it said it would idle five North American plants laying off almost 15,000 workers.[xlii]

Wells Fargo paying $3.2 billion less in 2018[xliii]has failed to use its corporate tax cuts to benefit its workers or customers.

That tax savings is 12 times the cost of raising the bank’s minimum wage to $15, which was announced to great fanfare in the wake of the new tax law (and which a company spokesman at first stated were unrelated to the tax cuts).[xliv] Those raises are even more dwarfed by the $40.6 billion in stock buybacks the bank announced after passage of the TCJA—repurchases that almost exclusively benefit top executives and other wealthy shareholders.[xlv]

Though the TCJA’s corporate tax cuts were supposed to create jobs, Wells Fargo announced in 2018 that up to 26,500 positions could be eliminated over the next few years. Government and journalistic investigators determined a lot of those lost American jobs were to be filled by cheap offshore labor.[xlvi]

The bank didn’t announce any plans to use its tax-cut savings to compensate customers for a pattern of abuse that led to unprecedented government sanctions.[xlvii]

AT&T is another example of a major corporation that used its massive tax cut to benefit top executives and shareholders, rather than workers. ITEP found that AT&T had profits of $20.9 billion in 2018 and paid $3.3 billion in taxes, for an effective tax rate of 15.6%. ITEP calculates that AT&T got a federal tax subsidy of $1.1 billion by not paying at the full 21% tax rate.[xlviii]

One of the TCJA’s biggest boosters, AT&T CEO Randall Stephenson, claimed that the law would increase capital expenditures by at least $1 billion so it could create 7,000 jobs. [xlix] The company benefitted from the new law immediately, reporting a $20 billion boost in profits from the TCJA in 2017 thanks to a reduction in anticipated tax payments.[l]

Yet since the law was passed, the company has eliminated over 30,000 jobs.[li] And while AT&T operates a global web of at least 38 third-party call centers to handle customer service, sales and tech support, they have not moved any of this work back to America.[lii] What AT&T has done instead is reward its top management and shareholders. Under pressure from a Wall Street vulture investor, the company recently committed to spending up to 70% of its free cash flow – a massive $30 billion – to buying back its own stock.[liii] CEO Stephenson, who made $29 million in 2018, ironically signed a pledge, as a member of the Business Roundtable, to stop putting the interests of large shareholders above all else and instead institute a vision of “inclusive prosperity.”[liv]

Given this poor track record of corporations productively using their TCJA tax savings, we urge the committee to go beyond academic witnesses and hear from the CEOs of these and other large corporations that have greatly profited from the TCJA and yet failed to share those benefits with workers, customers or communities. Among the questions it seems the committee could usefully pursue are:

- Why have corporate tax receipts—already historically low even before enactment of the TCJA—fallen even farther than expected in the wake of the law’s big corporate tax cut?

- What loopholes did the TCJA fail to close (or possibly expand) that resulted in 91 Fortune 500 corporations paying zero federal income taxes during the first year of the law and hundreds of other corporations?

- Why have workers generally not participated in the windfall of the corporate tax cuts through higher wages and better benefits?

- Have corporations, such as prescription drug corporations, passed any of their tax savings onto consumers in the form of lower prices?

- Why has the predicted big jump in corporate capital expenditures not occurred?

- What role has the huge increase in corporate stock buybacks played in increasing inequality and diverting money from investments in workers, plants and equipment?

- Why are multinationals not relocating production back to America as promised, and in many cases still outsourcing jobs and operations?

Your committee is the fulcrum of U.S. tax policy. Further exercising your investigatory powers to better reveal the true impact of the TCJA on Corporate America, the American economy and working families will help Congress craft much needed repairs to this deeply flawed law.

[i] New York Magazine, “Trump Predicts 9 Percent Growth, Budget Surplus by End of Presidency” (July 27, 2018).

[ii] Congressional Budget Office (CBO), “Additional Information About the Effects of Public Law 115-97 on Revenues” (Oct. 28, 2019). https://www.cbo.gov/system/files/2019-10/55743-CBO-effects-of-public-law-115-97-on-revenues.pdf

[iii] Americans for Tax Fairness (ATF), “Chartbook: Trump-GOP Tax Cuts Failing Workers and the Economy” (February 3, 2020), figure 13, p. 13. https://americansfortaxfairness.org/wp-content/uploads/Chartbook-Trump-GOP-Tax-Cuts-Fail-Workers-The-Economy-FINAL-2-3-20.pdf

[iv] Joint Committee on Taxation (JCT), “Estimated Budget Effects Of The Conference Agreement For H.R.1, The “Tax Cuts And Jobs Act”” (Dec. 18, 2017). https://www.jct.gov/publications.html?func=startdown&id=5053

[v] CBO, “An Update to the Budget and Economic Outlook: 2017 to 2027” (June 2017), table 1, p. 13. https://www.cbo.gov/system/files/115th-congress-2017-2018/reports/52801-june2017outlook.pdf

[vi] U.S. Department of the Treasury, “Final Monthly Treasury Statement” (Fiscal Year 2019), figure 2, p. 4. https://fiscal.treasury.gov/files/reports-statements/mts/mts0919.pdf

[vii] ATF, “Tax Cuts and Jobs Act Expiring Tax Cuts” (April 4, 2019). https://americansfortaxfairness.org/wp-content/uploads/ATF-JCT-Table-of-TCJA-Expiring-Tax-Cuts-4-5-19.pdf

[viii] ATF, “Chartbook,” figure 11, p. 11.

[ix] Center on Budget and Policy Priorities (CBPP) “Senate Pass Through Tax Cut Favors Biggest Businesses and Wealthiest Owners” (Nov. 14, 2017). https://www.cbpp.org/blog/senates-pass-through-tax-cut-favors-biggest-businesses-and-wealthiest-owners

[x] CBS News, “Trump Claims Families Will See $4,000 Pay Raise from His Tax Plan” (Oct. 11, 2017). https://www.cbsnews.com/news/trump-claims-families-will-see-4000-pay-raise-from-his-tax-plan/

[xi] Council of Economic Advisers (CEA), “Corporate Tax Reform and Wages: Theory and Evidence” (Oct. 2017). https://www.whitehouse.gov/sites/whitehouse.gov/files/documents/Tax%20Reform%20and%20Wages.pdf

[xii] Washington Post, “The Average American Family Will Get $4,000 From Tax Cuts, Trump Team Claims” (Oct. 16, 2017). https://www.washingtonpost.com/news/wonk/wp/2017/10/16/the-average-american-family-will-get-4000-from-tax-cuts-trump-team-claims/

[xiii] ATF, “Chartbook” figure 8, p. 8.

[xiv] Ibid, figure 9, p. 9

[xv] Congressional Research Service (CRS), “The Economic Effects of the 2017 Tax Revision: Preliminary Observations” (May 22, 2019. https://www.everycrsreport.com/files/20190522_R45736_8a1214e903ee2b719e00731791d60f26d75d35f4.pdf

[xvi] The American Prospect, “Raises and Bonuses: The PR Fraud” (June 25, 2018). https://prospect.org/power/raises-bonuses-pr-fraud/

[xvii] ATF, “How Corporations Are Spending Their Trump Tax Cuts” (accessed Feb. 24, 2020). https://web.archive.org/web/20231011141557/https://americansfortaxfairness.org/key-facts-american-corporations-really-trump-tax-cuts/

[xviii] The White House, “President Donald J. Trump’s State of the Union Address” (Jan. 30, 2018). https://www.whitehouse.gov/briefings-statements/president-donald-j-trumps-state-union-address/

[xix] Slate, “Trump’s Jobs Record Is Weaker Than Everyone Thought” (Feb. 7, 2020). https://slate.com/business/2020/02/trumps-jobs-bls-obama-economy.html

[xx] Indeed.com “Monthly Job Growth Revised Downward” (Feb. 7, 2020). https://twitter.com/JedKolko/status/1225776969544916992

[xxi] The Wall Street Journal (WSJ), “Trump Says Tax Cuts Will Supercharge Economic Growth” (Sept. 29, 2017). https://www.wsj.com/articles/trump-says-tax-cuts-will-supercharge-economic-growth-1506703428

[xxii] ATF, “Chartbook,” figure 12, p. 12.

[xxiii] ATF, “Chartbook,” figure 16, p. 16.

[xxiv] CNBC, “Share Buybacks Soar To Record $806 Billion — Bigger Than A Facebook Or Exxon Mobil” (Mar. 25, 2019). https://www.cnbc.com/2019/03/25/share-buybacks-soar-to-a-record-topping-800-billion-bigger-than-a-facebook-or-exxon-mobil.html

[xxv] ATF, “Chartbook,” figure 1, p. 2.

[xxvi] Institute on Taxation and Economic Policy (ITEP), “TCJA by the Numbers, 2020” (Aug. 28, 2019). https://itep.org/tcja-2020/

[xxvii] ATF, Chartbook,” figure 3, p. 3.

[xxviii] ITEP, “Corporate Tax Avoidance in the First Year of the Trump Tax Law” (Dec. 16, 2019). https://itep.org/corporate-tax-avoidance-in-the-first-year-of-the-trump-tax-law/

[xxix] ITEP, “The 35 Percent Corporate Tax Myth” (March 2017). https://itep.org/wp-content/uploads/35percentfullreport.pdf

[xxx] Forbes, “Jeff Bezos Billionaires List,” Accessed Feb. 24, 2020. https://www.forbes.com/profile/jeff-bezos/?list=billionaires#8cbfabc1b238

[xxxi] Bloomberg, “Trump Tax Cut Hands $32 Billion Windfall to America’s Top Banks” (Jan. 16, 2020). https://www.bloomberg.com/news/articles/2020-01-16/trump-tax-cut-hands-32-billion-windfall-to-america-s-top-banks

[xxxii] Oxfam, “Drug Companies Reaped Billions from New US Tax Law” (April 9, 2019). https://www.oxfamamerica.org/press/drug-companies-reaped-billions-new-us-tax-law/

[xxxiii] CBO, “The Budget and Economic Outlook: 2018 to 2028” (April 2019), p. 127. https://www.cbo.gov/system/files/2019-04/53651-outlook-2.pdf

[xxxiv] Center for American Progress (CAP), “Options for International Tax Policy After the TCJA” (Jan. 30, 2020), p. 8. https://cdn.americanprogress.org/content/uploads/2020/01/29121458/InternationalTaxAfterTCJA-brief1.pdf

[xxxv] FACT Coalition, “Experts Agree: The Tax Cuts and Jobs Act Encourages Companies to Shift Activity Offshore.” https://thefactcoalition.org/wp-content/uploads/2018/12/Experts-Agree-TCJA-Will-Incentivize-Offshoring-Final.pdf

[xxxvi] New York Times, “How Big Companies Won New Tax Breaks From the Trump Administration” (Dec. 30, 2019). https://www.nytimes.com/2019/12/30/business/trump-tax-cuts-beat-gilti.html and New York Times, “Why the Impact of the Trump Taxes Remains Partly Hidden” (Dec. 30, 2019). https://www.nytimes.com/2019/12/30/business/corporate-tax-cuts-impact.html

[xxxvii] U.S. Senate Committee on Finance, “Democrats Launch Investigation of Treasury Department Giveaway to Multinational Corporations” (Jan. 16, 2020). https://www.finance.senate.gov/ranking-members-news/democrats-launch-investigation-of-treasury-department-giveaway-to-multinational-corporations

[xxxviii] CBO, “Budget and Economic Outlook: 2020 to 2030” (Jan. 28, 2020), p. 73. https://www.cbo.gov/publication/56020

[xxxix] ITEP, “Trump Already Did Tax Cuts 2.0… For Corporations” (Feb. 4, 2020). https://itep.org/trump-already-did-tax-cuts-2-0-for-corporations/

[xl] ITEP, “Offshore Shell Games 2017” (Oct. 2017). https://itep.org/wp-content/uploads/offshoreshellgames2017.pdf

[xli] Reuters, “GM to build Chevrolet Blazer in Mexico” (June 21, 2019). https://www.reuters.com/article/us-gm-mexico/gm-to-build-chevrolet-blazer-in-mexico-idUSKBN1JI069

[xlii] NBC News, “GM To Slash Over 14,000 Jobs From North American Workforce” (Nov. 26, 2018). https://www.nbcnews.com/news/us-news/gm-slash-over-14-000-jobs-north-american-workforce-n940091?cid=sm_npd_nn_fb_ma

[xliii] ITEP, “Corporate Tax Avoidance,” fig. 4 on p. 10 and p. 37.

[xliv] ATF, “Corporate Tax Tracker: Wells Fargo.” https://web.archive.org/web/20230929210725/https://americansfortaxfairness.org/trumptaxdatatracker/

[xlv] Ibid.

[xlvi] Reuters, “Wells Fargo Moves Jobs Abroad After U.S. Layoffs, Government Says” (Dec. 20, 2018) and Charlotte Observer, “Wells Fargo Shifts Many Jobs Overseas Following Layoffs In The US, Documents Show” (Dec. 20, 2018). https://www.charlotteobserver.com/news/business/banking/article222369295.html

[xlvii] CNN, “The Fed Drops The Hammer On Wells Fargo” (Feb. 3, 2018). https://money.cnn.com/2018/02/02/news/companies/wells-fargo-federal-reserve/index.html

[xlviii] ITEP “Corporate Tax Avoidance,” fig. 4 on p. 10 and p. 37.

[xlix] Yahoo Finance, “AT&T CEO Says They’ll Invest ‘At Least’ $1 Billion And Create 7,000 Jobs If Tax Reform Passes” (Nov. 29, 2017). https://finance.yahoo.com/news/atandt-ceo-says-theyll-invest-least-1-billion-create-7000-jobs-tax-reform-passes-200245187.html

[l] Communication Workers of America (CWA), “AT&T and the Tax Cut and Jobs Act.” https://cwa-union.org/att-tax-cuts

[li] CWA, “AT&T’s New Financial Plan Caters to Wall Street and Leaves Customers and Employees Behind” (Oct. 28, 2019). https://cwa-union.org/news/releases/atts-new-financial-plan-caters-wall-street-and-leaves-customers-and-employees-behind

[lii] CWA, “Offshoring Customer Service” (May 2018). https://cwa-union.org/sites/default/files/20180501-att-offshoring-customer-service.pdf

[liii] CWA, “AT&T Reports More Job Cuts, Massive Stock Buyback Plan” Oct. 31, 2019). https://cwa-union.org/news/att-reports-more-job-cuts-massive-stock-buyback-plan

[liv] Business Roundtable, “Our Commitment” (accessed Feb. 25, 2020). https://opportunity.businessroundtable.org/ourcommitment/