- The November midterm election results in the U.S. House of Representatives were a clear rejection of President Trump’s tax and economic policies that favor the wealthy and corporations over working families.

- Prior to the November vote, pollsters for the Republican National Committee found that the GOP had “lost the messaging battle on the [tax] issue.” By 2 to 1, voters said the law benefits “large corporations and rich Americans” over “middle class families.” They also found that “[T]he challenge for GOP candidates is that most voters believe that the GOP wants to cut back on (Medicare and Social Security) in order to provide tax breaks for corporations and the wealthy.”

- Republican candidates for Congress ran hard on tax issues – either accusing their Democratic opponents of favoring tax increases or, less frequently, supporting the Trump-GOP tax law – but they lost their majority in the House to many candidates who ran against the tax cuts and their potential threats to services like Medicare, Medicaid and Social Security.

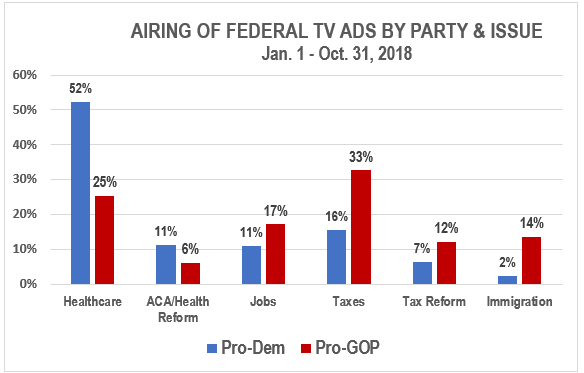

- One-third of all GOP TV ads in 2018 were about tax issues in general—the most of any issue (healthcare was second at 25%). Just 12% of GOP ads were about the Trump-GOP tax law.

- 52% of Democratic ads were about health care; general tax issues were second at 16% and 7% on the Trump-GOP tax law.

- The outcome of key races where taxes and the tax cut law were factors demonstrate that the 2018 election has put to rest the belief that promising voters tax cuts works as a winning campaign message. It should close the book on the typical and tired GOP strategy that tax cuts favoring the wealthy and well-connected will trickle down to working families and the middle class.

- The threat the tax cuts pose to funding key services like Social Security, Medicare and Medicaid was a far more potent and effective message than the promise of lower taxes or threats of a tax increase.

THE AD WAR ON TAXES

Tax issues were the second most heavily TV-advertised issue in federal races in 2018 – and the top issue in ads purchased by GOP candidates, according to data from the Wesleyan Media Project and analyzed by ATF. Tax issues were 23% of all TV ads and 33% of all GOP TV ads from Jan. 1 through Oct. 31, 2018. [See chart below] Healthcare was the subject of 40% of all TV ads.

But the Trump-GOP tax cut law itself was largely removed as an issue from campaign ads and messaging by Republican candidates. It was the subject of only 9% of all TV ads and 12% of all GOP TV ads, demonstrating that tax cuts have lost their potency as an issue.

Health care was mentioned in 52% of Democratic TV ads, highlighting GOP plans to cut Medicare and Medicaid, repeal the Affordable Care Act, eliminate coverage for preexisting conditions and spike health costs through the so-called “age tax,” which makes insurance premiums more expensive for the elderly—issues that are tied to the vote on the tax cut law.

Source: Data from Wesleyan Media Project analyzed by Americans for Tax Fairness and available at: https://bit.ly/2JN7umI. Note: there is overlap in the data between “healthcare” and “ACA/Health Reform” and “tax” and “tax reform” issues so these categories are not cumulative.

THE POLLING ENVIRONMENT FOR TAX CUTS

- In mid-October, just 40% of voters approved of the tax law based on an average of all polls maintained by Real Clear Politics.

- An October Gallup poll found that 64% of Americans said they had received no increase in their paychecks from the tax cuts as President Trump had promised.

- The 2018 election exit poll found that just 28% of Americans said the Republican tax cuts benefitted them, while 45% said they had no effect.

- An NPR/PBS News Hour/Marist poll in October found that 45% of adults said the issue of tax cuts made them more likely to vote for Democrats, while only 39% said it would make them likely to vote for Republicans.

- A Morning Consult poll in September showed that around 50% of voters didn’t trust President Trump or Republicans in Congress to implement a tax policy that benefited them.

THE TAX ISSUE AND KEY MIDTERM RACES

Duplicating the March special election of Conor Lamb in Pennsylvania’s 17th District—blasting tax cuts for the wealthy and raising concerns about cuts to Social Security and Medicare— Democratic candidates and the party produced positive results in several key midterm races:

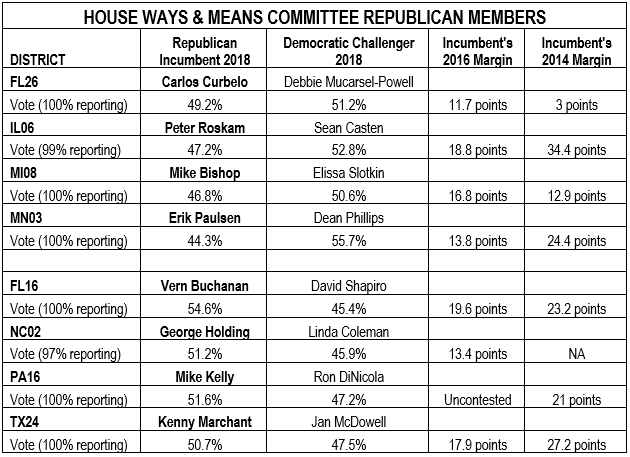

- Four members of the tax-writing House Ways and Means Committee, including some of the key architects of the Trump-GOP tax cut law, were defeated by Democratic challengers. Reps. Peter Roskam (IL06), Carlos Curbelo (FL26), Mike Bishop (MI08) and Erik Paulsen (MN03), long-time incumbents, lost their seats at least in part because of their strong support for the Trump-GOP tax cut law. [See Table]

- Four other committee members barely hung onto their seats after winning by double-digit margins in 2016—Reps. Vern Buchanan (FL16), George Holding (NC02), Mike Kelly (PA16), and Kenny Marchant (TX24)—

- Numerous other races around the country found the tax message—either promising tax cuts or accusing their opponents of wanting to raise taxes—ineffective with voters. These include Reps. Mike Coffman (CO-06), Tom MacArthur (NJ-03), Steve Knight (CA-25) and Claudia Tenney (NY-22), all defeated. Others likely to fall in too-close-to-call races are Reps. Mimi Walters (CA-45) and Mia Love (UT-04).

Sources: New York Times election results for 2018, 2016 and 2014

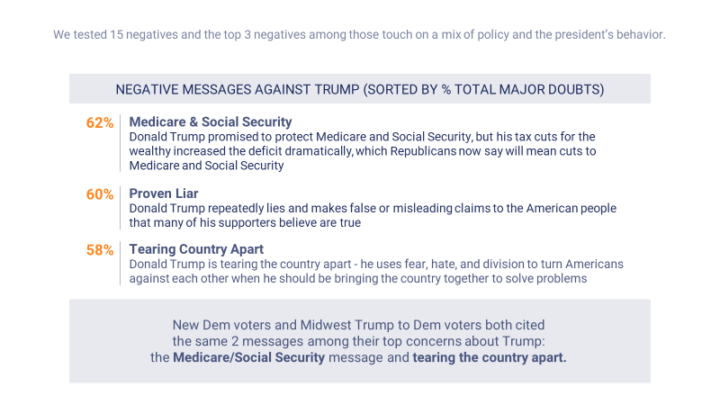

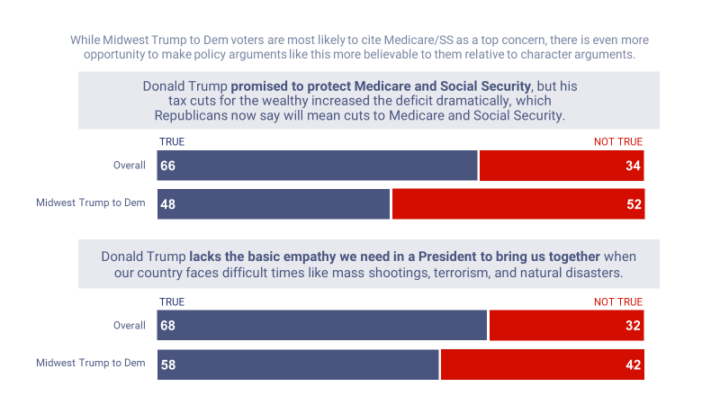

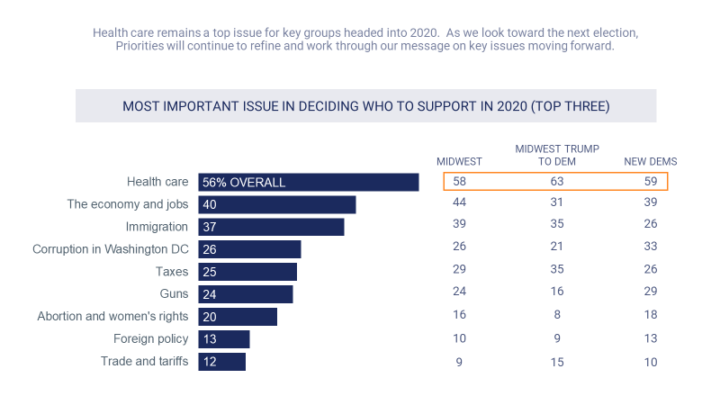

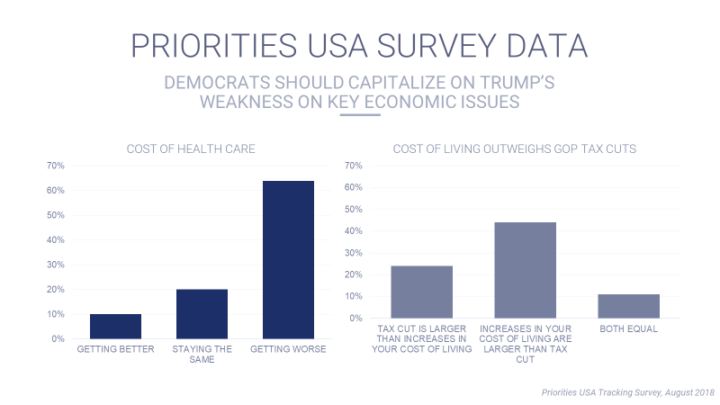

EXIT POLLING FROM PRIORITIES USA

“Post Election Research—What We’ve Done So Far” conducted by Global Strategy Group and Garin Hart Yang Research Group. 1,016 nationwide online interviews and 1,200 online interviews across Wisconsin, Michigan, Ohio, and Pennsylvania between November 9-11, 2018.