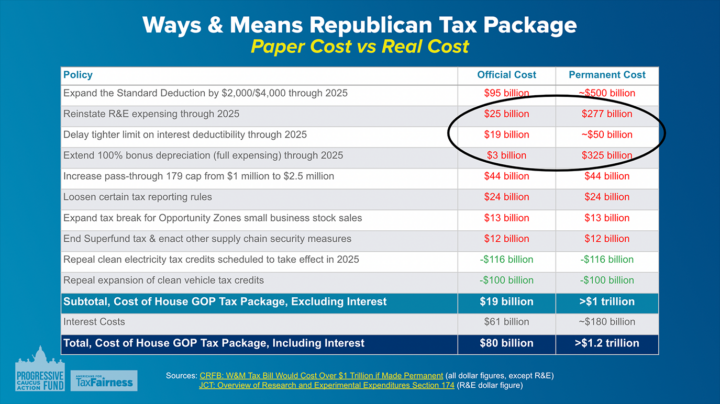

After passing historic corporate tax reform in the Inflation Reduction Act in 2022, Congress now risks erasing those tax-fairness gains with expensive new corporate tax breaks. A package of bills reported out by the House Ways & Means Committee on a party line vote in May would extend—at a long-term cost of over $1 trillion—three expired provisions of 2017’s Trump-GOP tax law benefitting big corporations, along with other tax cuts heavily tilted toward the wealthy. Americans for Tax Fairness strongly opposes these corporate tax breaks. Our coalition believes that corporations should be contributing more of their fair share of taxes, not less.

In December, 60 national groups wrote to Congress in opposition to these changes.

—OPPOSE OVERLY GENEROUS NET INTEREST DEDUCTION (section 163j)

To discourage corporations from excessive borrowing and to partially offset other corporate tax cuts included in the law, the 2017 Trump-GOP tax law restricted the amount of interest that corporations could deduct from their federal taxes. This limitation was originally calculated as 30% of a corporation’s EBITDA (earnings before interest, taxes, depreciation and amortization), but as of 2022, that 30% cap has been applied to a smaller measurement of income, EBIT (earnings before interest and taxes). Measuring income after subtracting depreciation and amortization leads to a smaller earnings figure, and therefore a smaller amount of deductible interest.

Corporations with over $1 billion in revenue would get half the tax savings from restoring the more generous interest deduction calculation; those with over $100 million in revenue would receive 85% of the benefit. Predatory private equity firms are among the biggest winners because their business model relies on loading up acquired companies with new debt, often turning those loans into dividends (which they pocket as majority shareholders), and then reaping the tax benefits of the interest payments—even as they drive those companies into bankruptcy at the cost of lost jobs and pensions. Examples abound, such as Toys “R” Us, Payless ShoeSource, J.Crew and NineWest, and most recently the maker of Pyrex and Instant Pot, which private equity firm Cornell Capital drove to bankruptcy just two years after forcing the company to dole out a $245 million debt-financed dividend. In short, making the net interest deduction more generous means that American taxpayers subsidize private equity when it hollows out employers and retailers.

A permanent restoration of the more generous interest deduction would cost $50 billion in lost revenue over ten years (CRFB).

RESOURCES:

- Institute for Taxation and Economic Policy, Dec 2022: “Reversing the Stricter Limit on Interest Deductions: Another Huge Tax Break for Private Equity”

- Americans for Tax Fairness, June 2023: “GOP Tax Package a Giveaway to Private Equity’s Corporate Raiders”

—OPPOSE 100% BONUS DEPRECIATION

Federal tax law has long permitted “accelerated depreciation,” which allows businesses to deduct the costs of equipment more quickly than it wears out. But the 2017 Trump-GOP tax law created an aggressive new version of this tax break, allowing businesses to write off the entire cost of long-term property and assets in the year they were purchased. This tax provision began phasing out at the end of 2022 and will fully expire at the end of 2026, but the House GOP package would extend 100% bonus depreciation through 2025—with the long-term goal of making it permanent.

Bonus depreciation has already lost an estimated $120 billion in the last five years, with 66% of the tax benefit going to corporations with over $250 million in annual revenue. Among the biggest winners over a recent four-year stretch were Big Tech firms: Verizon got a $5.1 billion tax cut; Google, $4.7 billion; Facebook, $3.8 billion; and Intel, $3.3 billion.

Since the Trump law took effect in 2018, just 25 of the corporations that have benefited most—including household names like Google, Facebook, Intel, UPS, Target, PepsiCo, and the railroads Union Pacific and Norfolk Southern—have cost American taxpayers nearly $67 billion, driving these companies’ effective federal corporate tax rate down to 12.2% (far below the statutory rate of 21%).

A permanent extension of bonus depreciation would cost $325 billion over ten years (CBO).

RESOURCES:

- Institute for Taxation and Economic Policy, 2023: Corporations Reap Billions in Tax Breaks Under ‘Bonus Depreciation’

—OPPOSE OVERLY GENEROUS RESEARCH & EXPERIMENTATION EXPENSING (section 174)

Historically, businesses have been allowed to immediately deduct from taxable income their full research and experimentation, or R&E, costs (also known by the abbreviation “R&D” for “research and development”). But the 2017 Trump-GOP tax law reduced this benefit after 2021 to partially offset the revenue losses from the other tax cuts that they gave to highly profitable businesses in that bill, including a 14-point cut in the corporate income tax rate (from 35% down to 21%).

As of 2022, firms must deduct in pieces, or “amortize”, these expenses over multiple years (five years for domestic research and fifteen years for foreign research). House Republicans are trying to undo this policy—one of the few provisions of their 2017 law that actually raised taxes on big businesses—by retroactively giving firms the ability to immediately deduct their research costs in a single year, through 2025.

The R&E expensing deduction is different from the permanent Research Tax Credit, which also provides billions of dollars in taxpayers subsidies for these same firms.

A permanent restoration of the R&E expensing deduction would cost $277 billion over ten years (JCT).

RESOURCES:

- Institute for Taxation and Economic Policy & Americans for Tax Fairness, 2022: letter to Congress opposing the R&E extension without revenue offsets

- Americans for Tax Fairness, 2022: analysis showing that many of the major corporations lobbying Congress for this tax break have paid little or no federal income taxes over the past three years

- Americans for Tax Fairness, 2023: fact sheet differentiating between the R&E Expensing Deduction and the Research Tax Credit, which provides billions of dollars in research tax subsidies to firms every year

ADDITIONAL RESOURCES:

Americans for Tax Fairness & Progressive Caucus Action Fund Webinar, 2023: Recording of presentations, slide deck

Institute for Taxation and Economic Policy, 2023: Trio of GOP Tax Bills Would Expand Corporate Tax Breaks While Doing Little for Americans Who Most Need Help

- Because foreign investors own much of the stock in U.S. corporations, they would ultimately receive $23.8 billion of the corporate tax cuts next year.

- The only group of Americans receiving more than foreign investors next year would be the richest 1 percent, who would receive $28.4 billion.

- The poorest fifth of Americans would receive an average tax cut of just $40 next year while the richest one percent would receive an average $16,550 tax cut next year.

Committee for a Responsible Federal Budget, 2023: W&M Tax Bill Would Cost Over $1 Trillion if Made Permanent

- We estimate that the plan would cost over $1.1 trillion ($950 billion without interest) through 2033 if these temporary tax cuts and extensions were made permanent.

Center for American Progress, 2023: House Bill Would Slash Business Taxes and Undermine Efforts To Stem Profit Shifting

- The Republican majority on the House Ways and Means Committee has advanced a measure that would further enlarge the primary cause of the nation’s increasing debt ratio: tax cuts. Republican members of the Ways and Means Committee are fighting hard to have their proverbial cake—the corporate rate cut—and eat it too.

Center on Budget and Policy Priorities: Flawed House GOP Tax Package Chooses Wealthy Shareholders Over Children and Families and the Fight Against Climate Change