Table of Contents

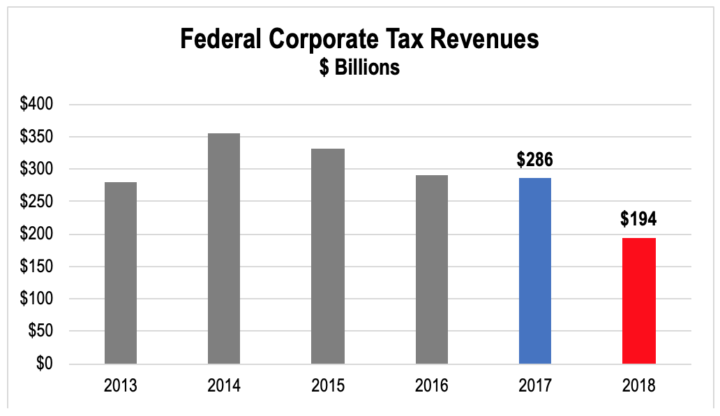

Figure 1: Corporate Tax Revenues Collapse from TCJA.. 3

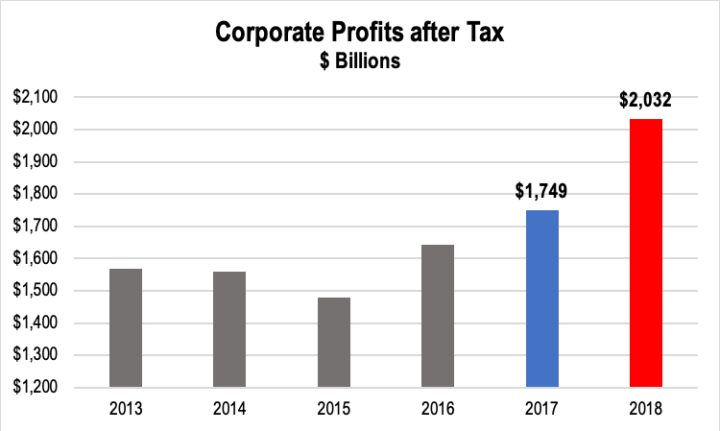

Figure 2: Corporate Profits Up, Corporate Tax Revenues Down. 3

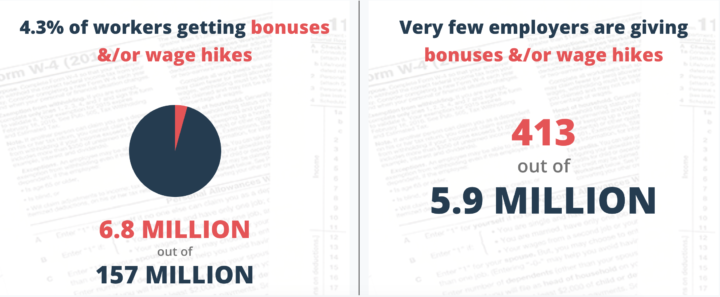

Figure 3: Few Employers Have Announced Raises or One-Time Bonuses. 4

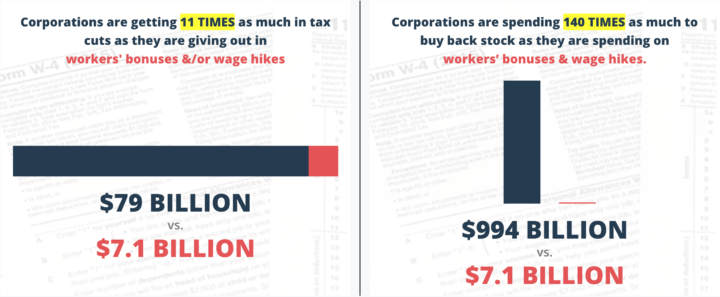

Figure 4: Corporate Tax Cuts Going Mostly to Wealthy Shareholders & CEOs. 4

EXAMPLES OF HOW CORPORATIONS ARE SPENDING THEIR TAX CUTS. 5

Altria Group (Rank #154 On Fortune 500 List In 2019): Share Buybacks Dwarf Bonuses. 5

Amazon (#8): Delivering Zero U.S. Taxes On Billions In Profits. 5

Anthem (#29): Big Tax Cut, Relatively Little For Workers. 5

Apple (#4): Big Payout To Investors, “New Investments” Not Linked To Tax Plan. 5

AT&T (#9): Spotty Service To Employees. 6

Bank Of America (#24): Bulk Of Big Tax Cut Goes To Shareholders, Not Workers. 7

Boeing (#27): Paying Little Even Before Tax Cuts, No Payouts To Workers. 7

Broadcom: Layoffs, No Pay Hikes & Billions For Investors. 7

Centurylink (#163): Christmas Bonuses Cancelled. 8

Cisco Systems (#62): What Doesn’t Go To Investors Will Go To Deals. 8

Comcast (#33): Tax Cuts & Share Buybacks Dwarf Bonuses. 8

Disney (#55): Want Your Bonus? Accept Stingy Wage Hike. 8

ExxonMobil (#2): No Real Investment Boost 9

General Motors (#10): Huge Tax Cuts, More Offshoring, Big Layoffs. 9

Hewlett Packard Enterprise (#107): Strong On Buybacks, Weak On Workers. 9

Home Depot (#23): Tax Cuts Beat Bonuses By A Lot 9

Kimberly-Clark (#163): Tax Cut Will Facilitate Layoffs. 9

Koch Industries: Big Tax Cut But No Worker Benefits. 10

Lowe’s (#40): Shareholders Before Workers. 10

Netflix (#261): Streaming Profits, Blocking Taxes. 10

Pepsico (#45): Plus Or Minus For Workers, All Plus For Shareholders. 10

Pfizer (#57): Taxes Down, Drug Prices Up. 11

Verizon (#16): Tax Cuts Dwarf Bonuses. 11

Walmart (#1): Bonuses…And Layoffs. 11

Wells Fargo (#26): The Truth Accidentally Revealed?. 12

INTRODUCTION

The gloomiest predictions about the impact of the Trump-GOP corporate tax cuts are coming true. Corporate tax receipts are collapsing, deepening deficits that Republicans want to pay for through cuts to vital public services like Medicare, Medicaid and education. Lower taxes have helped corporate profits soar, but corporations are overwhelmingly using those higher earnings to reward their already wealthy shareholders rather than share the wealth with their workers.

Far from ending the offshoring of profits and jobs, the new corporate tax rules have left most of the incentives in place for corporations to ship earnings overseas and actually created new lures for firms to send production and employment there as well. And a provision that makes new equipment purchases more attractive may be costing jobs through increased automation.

Meanwhile, there’s no evidence that the corporate tax giveaway has played any significant role in the economy’s recent performance or in the slow and steady, decade-long recovery of the job market from the Great Recession.

President Trump and Republicans in Congress made several promises when they rammed through Congress the Trump-GOP tax cuts, formally known as the Tax Cuts and Jobs Act (TCJA), in late December of 2017, which are proving to have been empty.

KEY FEATURES AND EFFECTS OF THE TCJA ON CORPORATIONS

- The law’s main focus was cutting corporate taxes. The corporate tax rate on domestic profits was cut by 40%—from 35% to 21%. This change alone cost about $1.3 trillion over 10 years, per the Joint Committee on Taxation.

- The law was sold as a boon to the middle-class, but it primarily benefits the wealthy. That’s because it’s the rich who own most corporate stock and therefore benefit most from the corporate tax cuts. The richest 1% are expected to get over a fifth (21%) of the tax cuts this year, according to the Tax Policy Center. By 2027 when the law is fully implemented, 83% of the tax cuts will go to the top 1%.

- The law mostly fails in its promise to end profit shifting by corporations to offshore tax havens. Multinational corporations’ profit shifting lowers U.S. corporate taxable income by about $300 billion a year, according to the Congressional Budget Office (CBO, p. 127). The TCJA will only reduce that profit shifting by $65 billion. In other words, 80% of the existing profit shifting that is taxable in the U.S. will continue under the new law. The TCJA also gave U.S. corporations with accumulated offshore earnings a tax cut of over $400 billion on those profits, per the Institute on Taxation and Economic Policy.

- Moreover, the TCJA actually encourages offshoring of American jobs. It effectively taxes foreign profits of U.S. firms at half the rate on domestic earnings, giving corporations added incentive to outsource jobs and shift profits. Under another provision of the law, the more factories corporations build in foreign countries, the less U.S. tax they pay on foreign profits.

CONTRARY TO GOP PROMISES, THE TAX LAW HAS BALLOONED FEDERAL DEBT

- Proponents of the TCJA, most notably Treasury Secretary Steve Mnuchin, claimed the tax cuts would pay for themselves through greater economic activity generating higher tax revenue from lower rates. Instead, the deficit is increasing considerably due to the tax cuts:

- The corporate tax cuts in particular show no sign of paying for themselves: corporate tax revenue dropped by about a third, or by $92 billion, from fiscal year 2017—before the TCJA—to FY 2018, according to the Treasury Department. [Figure 1]

- That big drop in corporate tax revenue explains the lion’s share of the $113 billion increase in the federal deficit between FY 2017, when it was $666 billion, and FY 2018, when it rose to $779 billion.

- President Trump’s 2020 budget shows that he plans to tackle the ballooning deficit due to his tax cuts by slashing Medicare, Medicaid, the Affordable Care Act, education and most other critical services for working families, rather than by reversing the tax windfall he gave to the wealthy and corporations. In fact, he wants to double down on his tax cuts that expire in 2026, by extending them at a cost of $1 trillion. Senate Republican leaders have called for similar attacks on services for working families by proposing to slash Social Security, Medicare and Medicaid.

SOARING CORPORATE PROFITS SPURRED BY TAX CUTS WENT TO SHAREHOLDERS, NOT WORKERS

- President Trump promised that corporations would use their tax cuts to give the typical American household a $4,000 pay raise, lead corporations to “shower their workers with bonuses,” produce “massive investments” and stop corporations from outsourcing jobs and shifting profits offshore.

- While corporate tax revenues plunged in 2018 after passage of the TCJA, corporate profits soared by 16.2%. They rose from $1.75 trillion in 2017 to $2.03 trillion in 2018. [Figure 2]

- Contrary to the president’s promises of universal pay hikes flowing from the corporate tax cuts, only 4.3% of American workers have received a bonus or raise ascribed to the TCJA [Figure 3].

- Corporations are mostly using their tax cuts and rising profits to buy back their own stock, which principally further enriches wealthy shareholders and top corporate executives.

- S. corporations have announced $994 billion in share repurchases since the TCJA was passed, according to ATF’s comprehensive database of how corporations are spending their tax cuts. [Figure 4] Separately, CNN has reported that “Corporate America celebrated the first full year under the new tax law by rolling out a record-setting $1 trillion of stock buybacks.”

- That’s 140 times more than the $7.1 billion corporations have given their workers in bonuses or pay hikes tied to the tax law. [Figure 4]

- Stock buybacks overwhelmingly benefit the wealthy because they are the ones who own the vast bulk of corporate stock. The richest 10% of households own 84% of all stock, including indirect ownership through pensions and retirement accounts. The top 1% own 40% of all shares.

Figure 1: Corporate Tax Revenues Collapse from TCJA

Source: Federal Corporate Tax Receipts from U.S. Treasury, Monthly Treasury Statement,

Table 7, accessed March 11, 2019. Fiscal year monthly data presented on a calendar year basis.

Federal corporate tax revenue collapsed in 2018—the first year of the Tax Cuts and Jobs Act—falling by nearly one-third, or $92 billion, from $286 billion in 2017 to $194 billion in 2018. This 32% drop occurred because the Trump tax cuts reduced the corporate tax rate from 35% to 21% and expanded the immediate deduction of equipment purchases, in addition to other corporate revenue-losing measures.

Figure 2: Corporate Profits Up, Corporate Tax Revenues Down

Source: Bureau of Economic Analysis, 2016-18 figures from page 16, table 9.

https://www.bea.gov/system/files/2019-03/gdp4q18_3rd_1.pdf

2013-15 figures from page 15, table 11. https://www.bea.gov/system/files/2019-02/gdp4q15_3rd.pdf

While corporate tax revenues plunged in 2018 after passage of the TCJA, corporate profits soared by 16.2%. They rose from $1.75 trillion in 2017 to $2.03 trillion in 2018.

Figure 3: Few Employers Have Announced Raises or One-Time Bonuses

Americans for Tax Fairness estimates that only 4.3% of workers (6.8 million out of 157 million) have been promised wage increases or one-time bonuses related to the tax cuts. Just 413 of 5.9 million employers have announced such worker benefits.

Figure 4: Corporate Tax Cuts Going Mostly to Wealthy Shareholders & CEOs

So far, 157 corporations are projected to save $79 billion in tax cuts in 2018. That’s 11 times more than the $7.1 billion corporations have promised workers through one-time bonuses and wage hikes. Since the tax cuts were passed, corporations have announced stock buybacks of $994 billion—140 times more than what corporations have promised workers in pay hikes. Buybacks mostly benefit the wealthy, who own most corporate stock.

EXAMPLES OF HOW CORPORATIONS ARE SPENDING THEIR TAX CUTS

ALTRIA GROUP (Rank #154 on Fortune 500 list in 2019): SHARE BUYBACKS DWARF BONUSES

The tobacco giant announced a new $1 billion corporate share buyback program in February 2018—in the immediate wake of the new tax law—and then expanded it to $2 billion that May. Those share repurchases, which overwhelmingly enrich already wealthy shareholders, are worth 83 times more than the company’s $24 million one-time bonus program for employees, which was spread among 7,900 workers.

AMAZON (#8): DELIVERING ZERO U.S. TAXES ON BILLIONS IN PROFITS

Amazon, the huge online retailer, just finished its second year in a row paying absolutely no U.S. income taxes on a combined $17 billion in profits, according to the Institute on Taxation and Economic Policy (ITEP). In fact, the company paid less than zero, receiving a total of $270 million in tax rebates over those two years. This continues a decade-long pattern in which Amazon—at one point last year valued at over $1 trillion—paid an average of just 3% federal tax on its $27 billion in cumulative profits. The statutory rate was 35% over all those years, except for last year, when it was 21%. Amazon’s CEO, Jeff Bezos, is the world’s richest person with a fortune estimated at more than $130 billion.

Various unidentified tax credits accounted for Amazon’s tax-free status in 2017 and 2018, plus the company’s exploitation of the notorious stock options loophole. Amazon used this accounting maneuver to avoid a combined $1.2 billion in state and federal taxes from 2008-15.

Amazon went years without collecting state and local sales taxes, giving it an unfair price advantage over brick-and-mortar stores that doomed many Main Street shopping strips. It recently encouraged local communities to bid against each other to see who could offer the biggest incentives, including tax breaks, for the chance to host a second Amazon headquarters. Activists in New York City objected so strongly to the giveaways to a company worth hundreds of billions of dollars that Amazon cancelled its initial plans to establish a head office there.

ANTHEM (#29): BIG TAX CUT, RELATIVELY LITTLE FOR WORKERS

In February 2018, Anthem said it would contribute $58 million to employee retirement accounts. The big health insurer will get a tax cut windfall of $662 million, 11 times more than the retirement contributions, according to Just Capital. It increased its dividend and the company’s CFO assured financial analysts that approximately 50% of the benefits of tax reform would eventually end up in shareholders’ pockets.

APPLE (#4): BIG PAYOUT TO INVESTORS, “NEW INVESTMENTS” NOT LINKED TO TAX PLAN

Apple has shared little of its tax-cut wealth with its employees or the country, but is instead further enriching its wealthy shareholders with the single biggest stock buyback announced by any company in the wake of the new tax law.

Apple got an estimated $5.9 billion tax cut in 2018, per Just Capital, nearly 20 times more than the approximately $300 million Apple gave its employees through a one-time stock-grant bonus. On top of that annual tax cut, another part of the Trump-GOP tax law—a deep discount on accumulated offshore profits—handed the company a tax cut of over $40 billion, per ATF calculations. That’s 133 times more than the company’s employee bonuses.

In January 2018, Apple announced accelerated “investment and job creation,” touting a planned “$350 billion contribution” to the U.S. economy and the addition of 20,000 jobs over the next five years. Despite claims made by President Trump and his allies, nowhere in its announcement does Apple link any of its plans to the recently enacted tax law. Nor does it say its $350 billion “contribution” to the economy is a new investment—and for good reason, since it included standard, ongoing business expenses like employee wages and purchases from domestic suppliers. As the New York Times noted, once you subtract a one-time tax payment on its offshore profits (misidentified as a new investment) and the amount the company already planned to invest prior to the new law, any spending that’s actually new comes to a relative pittance for a company approaching a trillion-dollar market value.

Apple’s claim of creating 20,000 jobs should also be taken with a grain of salt. In Apple’s announcement, it noted it currently has 84,000 U.S. employees. That number is up from 80,000 at the end of 2016 and 76,000 in 2015. If it were to keep adding jobs at this rate, it would have added 20,000 U.S. jobs over the next five years even without the tax cuts.

AT&T (#9): SPOTTY SERVICE TO EMPLOYEES

The first benefits to employees from the TCJA came from AT&T: President Trump announced at a December 2017 ceremony celebrating passage of his tax legislation that the company was offering $1,000 bonuses, worth about $200 million. But just before and after passage of the tax cuts, the telecom giant had announced about 1,300 layoffs, with more to come. In fact, since the tax law took effect in January 2018, AT&T has eliminated over 10,000 union jobs, according to analysis by the Communications Workers of America. These layoffs came after CEO Randall Stephenson promised that the tax cuts would allow the company to create 7,000 new jobs.

Moreover, AT&T’s estimated $2 billion tax cut in 2018 per Just Capital, is 10 times the $200 million in one-time bonuses it granted workers. That yearly tax cut is on top of the $20 billion one-time tax benefit it got from the new law at the end of 2017. Finally, the union representing its workers claimed the bonuses were actually a result of labor negotiations, not tax-cut-inspired employer generosity. The company had good reason to curry favor with the White House: the administration sued in 2017 in an ultimately unsuccessful attempt to stop AT&T’s takeover of Time Warner.

BANK OF AMERICA (#24): BULK OF BIG TAX CUT GOES TO SHAREHOLDERS, NOT WORKERS

The TCJA handed Bank of America an estimated $2.5 billion tax cut in 2018, according to Just Capital, which it mostly shared with stockholders, not workers. That’s 17 times more than the $145 million in one-time bonuses workers received. An even more lopsided comparison: the bank announced in June 2018 that it was buying back over $20 billion of its own stock, raising the value of shares remaining in the hands of its mostly wealthy investors. That repurchase is worth 138 times more than workers’ bonuses. Flush with tax-cut savings and not content to just stiff its workers, BofA in 2018 raised costs for its poorest customers by imposing fees on small accounts.

BOEING (#27): PAYING LITTLE EVEN BEFORE TAX CUTS, NO PAYOUTS TO WORKERS

President Trump’s visit to a Boeing factory in March 2018 to talk up his corporate tax giveaway was the wrong place to showcase the need for lower corporate taxes or to argue workers will benefit. Over the past decade, the giant plane maker paid an average effective federal income tax rate of just 8.4%, according to ITEP, far below what many working families pay. Thanks to loopholes and special breaks, for half of that decade Boeing actually paid less than zero—gaining tax benefits in five separate years rather than sending a payment to the Treasury.

Nonetheless, the company will still profit from the new tax law: by its own estimate, pocketing a one-time benefit of $1 billion, and by one outside analysis, saving nearly $520 million in 2018 alone. But it won’t send any of that money directly to workers in the form of higher wages, as President Trump and his fellow Republican authors of the law had promised corporations would do. Instead, Boeing announced a net $11 billion increase in its stock repurchase plan, which will overwhelmingly benefit wealthy shareholders and top executives, not workers.

Soon after the Trump-GOP tax law was enacted in late 2017, the company unveiled a $300 million spending program to indirectly assist employees through charitable giving, workforce development and “infrastructure enhancements.” But that investment represents less than 3% of what it plans to give shareholders through buybacks alone, and it does nothing to boost workers’ take-home pay.

BROADCOM: LAYOFFS, NO PAY HIKES & BILLIONS FOR INVESTORS

Since the Trump-GOP tax law was enacted, California semiconductor-maker Broadcom has authorized $12 billion in stock buybacks; given zero tax-cut-related raises or bonuses to employees; and in November 2018—just in time for the holidays—announced over 300 layoffs in the New York City area because of a merger. (This came after the announcement of 1,100 worldwide layoffs—the number in the U.S. wasn’t specified—resulting from an earlier merger that year.) Broadcom’s boss was the highest paid of any chief executive of a company in the S&P 500 stock index in 2017: CEO Hock Tan got a pay package worth over $100 million, 2,000 times the average American worker’s salary.

CENTURYLINK (#163): CHRISTMAS BONUSES CANCELLED

The very week the GOP corporate tax cut passed Congress, telecom provider CenturyLink told workers expecting their regular year-end bonuses that none were coming in 2017.

CISCO SYSTEMS (#62): WHAT DOESN’T GO TO INVESTORS WILL GO TO DEALS

Cisco Systems announced in the wake of the TCJA’s deep U.S. tax discount on accumulated offshore profits that it would return to the U.S. $67 billion in overseas earnings held in cash. It can avoid nearly $10 billion in U.S. taxes it previously owed on that money before the Trump-GOP corporate tax giveaway, per an ATF analysis. The company said it would spend a good chunk of the money on stock buybacks and increased dividends, and apparently use much of the rest buying other companies. True to its word, Cisco has increased its stock buyback program by $40 billion, the third largest amount by any corporation since the TCJA was enacted. Cisco has not announced any plans to share its tax-cut wealth with employees.

COMCAST (#33): TAX CUTS & SHARE BUYBACKS DWARF BONUSES

Comcast reported in an SEC filing that it was granting $171 million in one-time employee bonuses due to the tax cut. But that’s dwarfed by its estimated tax cut of $1.7 billion, according to Just Capital, which is 10 times larger. And it’s returning billions to its shareholders through $5 billion in stock buybacks in 2018 —29 times more than it will return to workers—plus a 21% dividend hike.

Comcast claims it will spend $50 billion for infrastructure investments over five years, in part because of the tax cuts and the repeal of the net neutrality rule. But it was likely to spend that much anyway. In 2017, Comcast spent $9.6 billion in capital expenditures, and at that rate it should easily spend $50 billion over five years once inflation is factored in. Despite this planned investment, Comcast has announced 290 layoffs in Atlanta this year, and last year quietly terminated about 500 employees at sites around the country. (Though the earlier layoffs came after the tax bill’s passage seemed likely, it was before final passage of the law so they’re not included in ATF’s data.)

DISNEY (#55): WANT YOUR BONUS? ACCEPT STINGY WAGE HIKE

Disney announced it would distribute $125 million to its employees in 2018 through one-time $1,000 bonuses and spend $50 million to create a new higher-education benefit program. But Disney’s estimated 2018 tax cut of $1.2 billion, per ITEP, is nearly 10 times more than the bonuses. What’s more, Disney tried using the payouts as a labor bargaining chip, telling its unionized employees negotiating a new contract in February 2018 that they had to accept its latest offer by August 31 or lose the bonuses. (A deal was ultimately reached before the deadline.)

EXXONMOBIL (#2): NO REAL INVESTMENT BOOST

Giving the new tax law partial credit, in January 2018 ExxonMobil announced $50 billion in proposed investments over five years, but acknowledged that almost a third of the figure ($15 billion) was for projects planned before the law was enacted. What’s more, the company’s financial reports reveal it made over $50 billion in domestic investments during the recent 2012-16 five-year period, a time when oil prices hit rock bottom and the company would presumably be most loath to invest. Thus, the new tax law didn’t apparently lead to any higher level of corporate confidence or investment—nor did it prompt the company to share any of its newfound wealth with its workers.

GENERAL MOTORS (#10): HUGE TAX CUTS, MORE OFFSHORING, BIG LAYOFFS

The nation’s largest automaker reported that it got a tax cut of $157 million in the first 9 months of 2018, with more to come in future years thanks to the TCJA’s 40% cut in the corporate tax rate. In addition, it likely got a one-time tax break of hundreds of millions of dollars more on its $6.5 billion of accumulated offshore profits. Despite these tax-cut goodies that were meant to spur domestic investment, in June 2018 GM announced it would build its Chevrolet Blazer in Mexico rather than the United States. Then in November, it said it would close five North American plants (four in the U.S.), laying off almost 15,000 workers.

HEWLETT PACKARD ENTERPRISE (#107): STRONG ON BUYBACKS, WEAK ON WORKERS

HPE’s CEO announced in February 2018 that because the tax law made it easier to access off-shore cash (at a deep discount), the company would be “increasing our shareholder return commitment and our investment in employees.” Wealthy shareholders immediately learned the size of their bounty: $7 billion through 2019 from share repurchases and a 50% dividend hike. Workers were promised higher 401(k) matching amounts and tuition assistance for continuing education, but no dollar amounts were announced.

HOME DEPOT (#23): TAX CUTS BEAT BONUSES BY A LOT

Home Depot’s $8 billion profit last year ranked it 26th among the Fortune 500, no doubt boosted by its estimated $1.4 billion tax cut, estimated by Just Capital. The company celebrated its tax-cut bonanza by showering its wealthy shareholders with $7.5 billion in stock buybacks. Its workers didn’t make out as well. Home Depot gave $200 to $1,000 bonuses to hourly workers, depending on length of employment. Home Depot’s 2017 financial report states that the bonuses cost $72 million—just a little over one-twentieth of the tax cut. Meanwhile, stockholders got buybacks worth 100 times more than the bonuses.

KIMBERLY-CLARK (#163): TAX CUT WILL FACILITATE LAYOFFS

The consumer products company (maker of Huggies, Kleenex and Kotex) told investors the tax cut will make it easier to cover costs associated with shedding 10 manufacturing facilities and laying off up to 5,500 workers. But it assured Wall Street analysts that there would still be plenty of tax-cut money left over to “allocate significant capital to shareholders.” In its final financial filing for 2017 the company said it planned $700-900 million in stock buybacks during 2018 and a 3.1% increase in its dividend. (Because these buybacks were not the result of a new board authorization, but rather fulfilling an existing one that preceded the new tax law, they are not included in ATF’s database.) There has been no announcement that the company’s remaining workers are getting any bonus or pay increase.

KOCH INDUSTRIES: BIG TAX CUT BUT NO WORKER BENEFITS

The Koch brothers are tied for 11th richest person in the world, with each worth over $50 billion. ATF estimated that the Koch brothers and/or their company, Koch Industries, could save between $1 billion and $1.4 billion every year from the GOP tax cut. Yet, the firm has not announced any plan to share the wealth with its workers.

LOWE’S (#40): SHAREHOLDERS BEFORE WORKERS

The big-box retailer has announced $15 billion in new stock buybacks since the Trump-GOP tax law was enacted, placing it in the top 20 of corporate share repurchasers. By comparison, the company has announced worker bonuses of between $150 and $1,000, depending on length of service. Generously assuming the full $1,000 bonus for all the firm’s 260,000 workers, the cost of the stock buybacks would be more than 50 times greater than the $260 million cost of employee bonuses. (Workers are also receiving improved benefits.) Lowe’s estimated tax cut in 2018 alone was nearly $700 million, per Just Capital.

NETFLIX (#261): STREAMING PROFITS, BLOCKING TAXES

Netflix, the popular source of streaming video, managed to make a record profit of nearly $850 million in 2018 and yet pay less than zero in federal income taxes (it actually got a $22 million rebate), per ITEP. This wasn’t the first time the company enjoyed a negative U.S. tax rate: in both 2013 and 2015, Netflix got money back instead of paying into the system. In 2015, it had the highest negative tax rate (-28.7%) of any company in an ITEP study of over 250 profitable firms. The stock options loophole—in which companies inflate the cost of options used to pay top executives—explains a lot of Netflix’s ability to dodge taxes.

PEPSICO (#45): PLUS OR MINUS FOR WORKERS, ALL PLUS FOR SHAREHOLDERS

On February 13, 2018, PepsiCo simultaneously announced layoffs and tax-law-related bonuses, saying less than 1% of its 110,000-person workforce, or under 1,100 workers, would be let go and that the bonuses would total $100 million. It offered no guidance on the number of bonus recipients or how much each would get up to a $1,000 maximum. Announced benefits for shareholders were more precise: a nearly 50-cent, or 15%, hike in the dividend, which will cost the company roughly $700 million a year based on the current number of shares outstanding—plus a $13 billion net boost to its share buyback program.

So, in the first year of the TCJA, Pepsi decided to give shareholders 137 times more than it gave workers ($13.7 billion vs. $100 million). Of course, only those workers who weren’t laid off got anything. The company was expected to get a $1.4 billion tax windfall in 2018, according to Just Capital—14 times more than the bonus payouts.

PFIZER (#57): TAXES DOWN, DRUG PRICES UP

The pharmaceutical giant behind Viagra, nerve medication Lyrica, and pneumonia vaccine Prevnar is getting massive benefits from the Trump-GOP tax cuts while continuing to raise prices on its prescription drugs. Pfizer was estimated to get a $2 billion tax cut in 2018 alone, per Just Capital. On top of that, it will save $25.5 billion in U.S. taxes on the nearly $200 billion in profits the company has spent years aggressively shifting to offshore tax havens, per ATF. Proof of this overseas accounting sleight-of-hand is that despite recording over 40% of its sales in the U.S. between 2007-16, Pfizer’s reported zero U.S. profits over that span.

While the company responded to the TCJA by announcing $100 million in one-time employee bonuses, that amount is dwarfed 200-to-1 by the total of $20 billion in stock buybacks it announced in two $10 billion tranches: one just before passage of the final bill and another almost exactly one year later. (Only the second $10 billion is included in ATF’s database, which is restricted to buybacks announced after the bill was signed into law.)

Meanwhile, Pfizer raised prices for its top-selling drugs by about 30% on average between January 2017 and March 2018, including by about 10% shortly after passage of the tax law. Pfizer announced another round of steep price hikes in July 2018. After a public outcry, the company delayed that latest round of price gouging—but only until November, when the relentless upward march of prices continued.

VERIZON (#16): TAX CUTS DWARF BONUSES

The telecom giant, which made $30 billion in profits last year, is estimated to have received a $4 billion tax cut in 2018. That’s more than 10 times larger than the $380 million in one-time bonuses the company promised to pay workers.

WALMART (#1): BONUSES…AND LAYOFFS

On the same day, January 11, 2018, that Walmart announced it was raising its minimum wage to $11 an hour, expanding some parent-related benefits, and giving one-time bonuses to eligible employees, it also announced it was closing 10% of its Sam’s Clubs warehouse stores, wiping out around 9,400 jobs. Tax-cut proponents took credit for the first announcement but refused blame for the second. The Sam’s Club closures were followed swiftly by reports that Walmart was eliminating 3,500 co-manager positions. A few weeks later, the retailer announced another layoff of up to 499 workers at its Arkansas headquarters. In February, Walmart announced it was eliminating department manager positions in many of its stores, while declining to give details on how many employees would be affected.

Walmart says it will spend $700 million on bonuses and raises in 2018. While the bonus figure of $1,000 was widely reported, less publicized was that only workers with 20 years of service at Walmart would get the full amount. Employees working there less than 2 years would get only $200. This is significant because the average American worker has just over 4 years on the job (which would warrant a $250 bonus from Walmart), and the retail industry has a higher-than-average turnover rate, so most Walmart employees will be on the lower end of the bonus range. As for the minimum wage increase, it is likely that this was more related to competition for workers with other retailers and pressure from unions and advocates than to the tax cuts.

Meanwhile, Walmart got more than twice as much as the $700 million in bonuses and wage increases from a 2018 tax cut estimated at around $1.7 billion, according to Just Capital.

WELLS FARGO (#26): THE TRUTH ACCIDENTALLY REVEALED?

Just Capital estimated the TCJA saved Wells Fargo $2.2 billion in 2018, more than 8 times the $268 million it spent on minimum wage increases last year. The bank apparently has better uses for that money, such as buying back shares of its own stock—worth over $40 billion, or about 150 times the value of the wage increases—thus further enriching its shareholders. Meanwhile, Wells Fargo’s customers have suffered so many abuses that the federal government has imposed unprecedented sanctions on the bank. Despite that blatant mismanagement, the bank boosted its CEO’s pay by 36% in 2018, to a total compensation of $17.4 million.

When Wells Fargo announced in December 2017 it would raise its starting salary to $15 an hour, a spokesman explicitly confirmed that the raises were not a result of the tax cuts, but instead part of an ongoing process of raising entry-level salaries. (The spokesman later backtracked and claimed the two were related.) In any case, there will be fewer new employees receiving the higher minimum in coming years, as the bank announced the following month it would be closing 800 branches.