To: Interested Parties

From: ALG Research, Hart Research and Americans for Tax Fairness

Re: Poll shows strong desire for higher taxes on the wealthy and corporations

A new national poll commissioned by Americans for Tax Fairness finds that there is strong support for raising taxes on the wealthy and corporations, that it is a top-tier priority issue for voters, and that highlighting it boosts support for President Biden’s economic plans.

This poll shows that by focusing on ensuring that the wealthy and corporations pay their fair share of taxes, Democrats can both strengthen their ability to pass their economic agenda and demonstrate that they are the party looking out for average Americans, while Republicans continue to look out for the wealthy and big corporations. Below are key findings from the poll:[1]

- Ensuring that the wealthy and corporations pay their fair share in taxes is a top priority for voters. “Ensuring that the wealthy and corporations pay their fair share of taxes” (43% extremely important) ranks second among 20 potential issue priorities for President Biden and Congress tested in this poll, making it as important as “creating jobs” (42%) and even more important than “rebuilding America’s infrastructure” (33%).

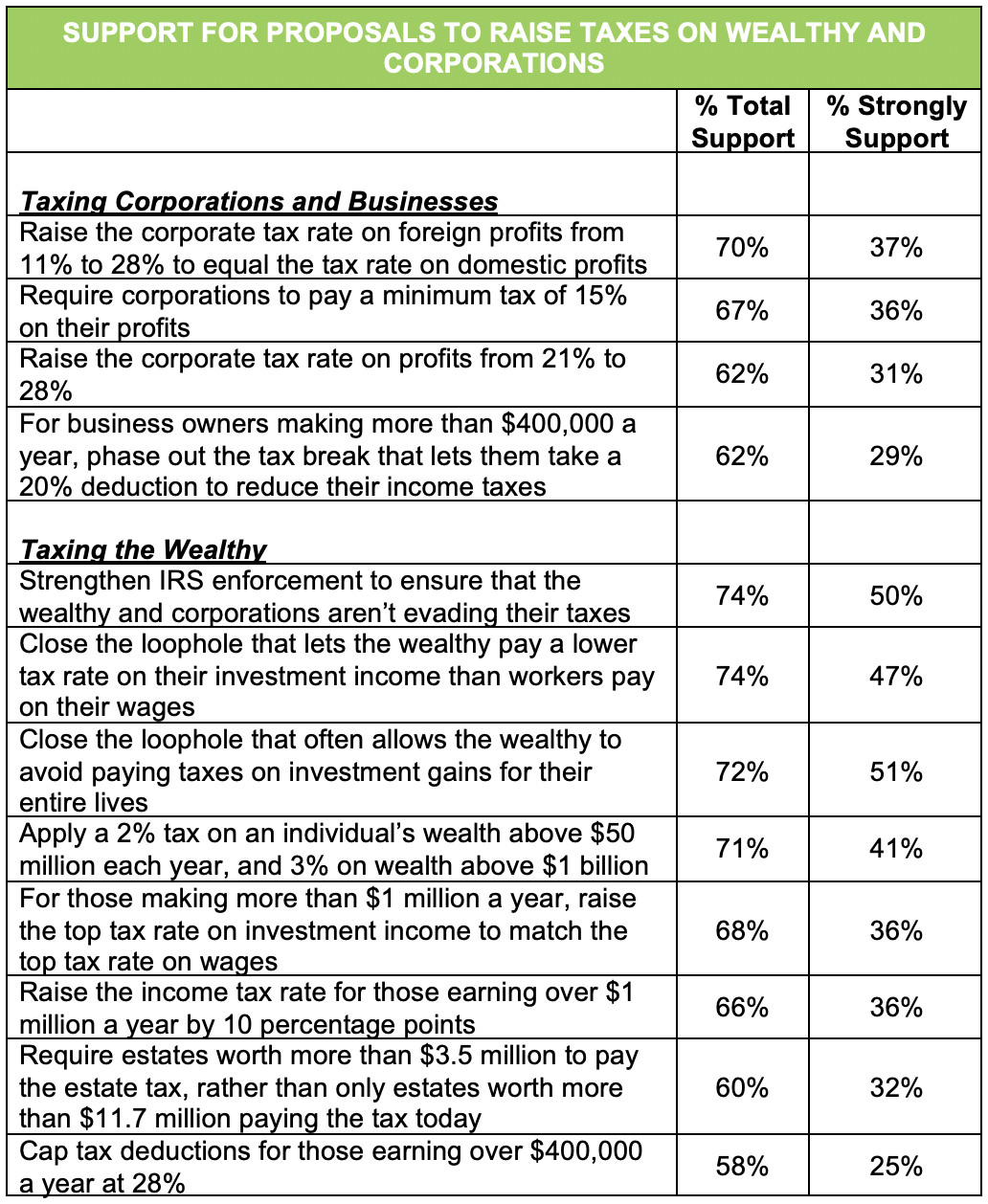

- There is broad support for President Biden’s proposals to raise taxes on the wealthy and corporations. Over two-thirds of voters (69%) support raising taxes on the wealthy and corporations, and support among Independents is just as high (68%). Support for raising taxes on those earning more than $400,000 a year is similarly high (67%), while 62% support raising the corporate tax rate from 21% to 28%. Indeed, every proposal to raise taxes on the wealthy and corporations tested in the survey is supported by at least 55% of voters, with most generating over two-thirds support. [See detailed results at the end of this memo].

- Voters believe that raising taxes on the wealthy will help the economy by a 29-point margin. Only 22% of voters think raising taxes on those earning over $400,000 a year will hurt the economy, while 51% believe it will help it. Independents also believe it will help the economy by a 26-point margin (45% help economy / 19% hurt economy).

- Voters overwhelmingly prefer raising taxes on the wealthy and corporations to borrowing and increasing the debt or to increasing user fees. By a 7-to-1 ratio, voters prefer funding Biden’s economic plan by raising taxes on the wealthy and corporations (58%) over borrowing and increasing the debt (8%). They also oppose expanding user fees for drivers as a way to raise revenue by an 11-point margin (41% support / 52% oppose).

- Support for Biden’s tax proposals stems from voters’ belief that the wealthy and corporations get special treatment more than concern about income inequality. Voters respond most strongly when we emphasize closing loopholes for the wealthy and corporations or cracking down on their tax cheating. “Ensuring the wealthy and corporations pay their fair share in taxes” (43% extremely important) is seen as much more important than “reducing income inequality” (26%) or “reducing the wealth gap between rich and poor” (28%).

- Informing voters that Biden’s economic plan will be funded by higher taxes on the wealthy and corporations makes the plan more popular. President Biden’s economic plan is a robust 58% when voters learn about its key investment components, including the plan’s estimated cost of $4 trillion. Significantly, support for the plan is 4 points higher (62%) when the plan description includes language about the plan being funded by higher taxes on the wealthy and corporations. Additionally, 67% of voters say they are more favorable towards Biden’s plan because it would raise taxes on those making over $400,000 and on corporations.

- Recommended Messaging to Strengthen Support for Biden’s Tax and Economic Plans:

Suggested Core Message

Last year, 55 of America’s biggest corporations paid no federal income taxes, and the wealth of just 650 billionaires rose by 50%, while millions of working Americans suffered. This plan will build an economy that rewards work, not just wealth. It ensures the wealthy and big corporations pay their fair share of taxes and does not raise taxes on anyone making under $400,000 a year. And it supports investments in affordable healthcare, infrastructure, eldercare, childcare, clean energy and education, to create millions of jobs and build an economy that works for all of us.

- For more conservative audiences, we should replace the messaging on investments above with messaging on how the plan reduces outsourcing and boosts U.S. manufacturing, and the support it provides for small businesses.

This plan will eliminate tax breaks that encourage corporations to outsource jobs and shift profits to offshore tax havens, and will invest in strengthening American manufacturing, helping to keep and create more American jobs here at home.

This plan will help small businesses recover and compete with big corporations. It will close loopholes that allow big corporations to avoid paying their fair share of taxes and provide more support to small businesses to get them back on their feet and hire more workers.

- It is important to highlight that Biden’s plan would NOT raise taxes on those making less than $400K. This makes 69% of voters more favorable to his plan and generates even more intense support (41% much more favorable) than how the plan will be paid for (35% much more favorable).

- Non-college educated women, particularly those under 50, are important targets for increasing support for President Biden’s economic plan. They represent a disproportionate share of voters who are either undecided on the President’s economic plan or shift their position on it following messaging.

- Every proposal we tested related to raising taxes on the wealthy and corporations was supported by at least 55% of voters, with most generating support with over two-thirds of voters. The specific proposals and their level of support were:

[1] This memo is based on the results of a nationwide online survey of N=1,104 registered voters conducted by ALG Research and Hart Research May 20-25, 2021. The survey included an oversample of N=299 Independent voters, and interviews were conducted in English and Spanish. The 95% confidence interval for the survey is +/- 3.45%.