Now worth $318 billion, Musk’s wealth climbed $109 billion in just three weeks, but little if any will be taxed even if Build Back Better Act becomes law

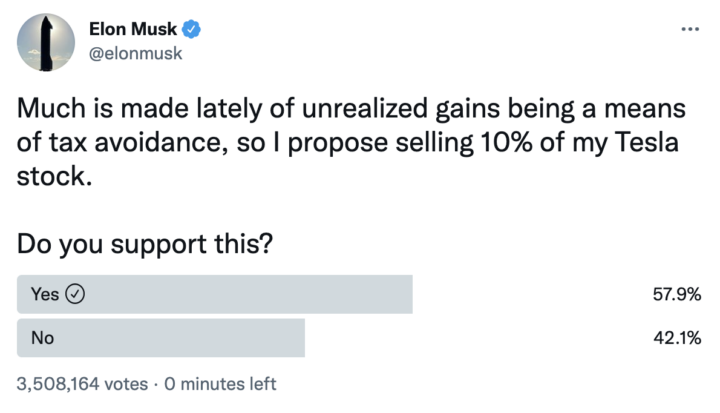

58% in Musk’s Twitter poll say he should sell 10% of Tesla stock to pay taxes on his unrealized gains

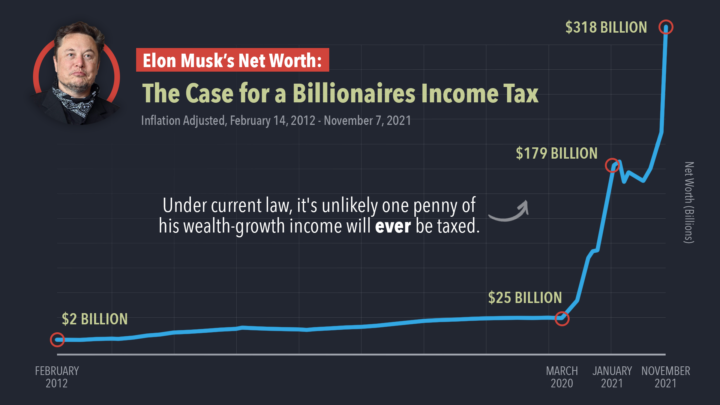

Offering the best argument imaginable for the Billionaires Income Tax now before Congress, Tesla founder Elon Musk is now worth a staggering $318 billion, his fortune having rocketed up from $2.4 billion in February 2012 to $25 billion in March 2020 at the start of the pandemic to $318 billion today, according to Forbes data analyzed by Americans for Tax Fairness. That’s more than a 12-fold increase during the pandemic and an increase of $109 billion in just the past three weeks. [See charts below and this table.]

Startlingly, not a penny of that income income growth from Musk’s wealth will likely ever be taxed under our current out-of-whack tax system, or under the reform proposed in the Build Back Better Act that is expected to be voted on in the House of Representatives the week of November 15. Perhaps out of embarrassment, that’s why Musk sent the following tweet yesterday with this 24-hour Twitter poll question, which voters supported 57.9% to 42.1%.

“While it’s good news that it looks like Elon Musk will finally be paying some taxes on his enormous growth in wealth, billionaires shouldn’t only have to pay taxes when they volunteer to do so,” said Americans for Tax Fairness Executive Director Frank Clemente. “Under our current, rigged tax code, it’s mandatory for working families to pay each and every year while billionaires only pay when they feel like selling off their assets. Under the Billionaires Income Tax, as proposed by Senate Finance Chairman Ron Wyden, Musk would also pay every year on the income derived from his wealth growth.”

Source: Forbes billionaires data analyzed by Americans for Tax Fairness

The gaping loophole in the tax code that Musk and other billionaires take advantage of would be shut by legislation proposed by the Senate’s chief tax writer, Finance Committee Chairman Ron Wyden. His Billionaires Income Tax (BIT) would tax the income from the growth in wealth of billionaires annually, just as workers’ wages are taxed all year, every year. Impacting fewer than a thousand fabulously rich Americans, the BIT could raise more than $550 billion to help fund the Democrats’ $1.75 trillion Build Back Better (BBB) plan of social and environmental investments.

President Biden has endorsed the tax, which also has the blessing of Sen. Kyrsten Sinema, the Democratic senator otherwise most averse to higher taxes on the wealthy.

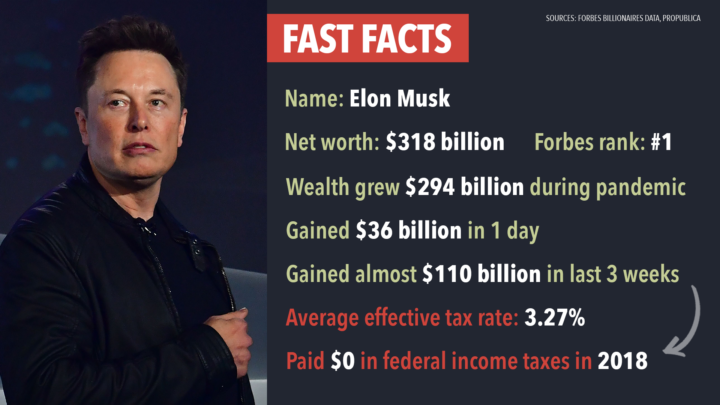

Sources: Forbes billionaires data analyzed by Americans for Tax Fairness; ProPublica, June 8, 2021

Three-hundred billion is a number so vast it’s hard to fathom: 300 billion seconds is almost 10,000 years, meaning Musk has more dollars than there are seconds of recorded history. Musk’s personal wealth now exceeds the economies of all but 38 of the biggest nations, including South Africa, Pakistan, Chile and Portugal.

Under current law, the staggering growth in Musk’s wealth and other billionaires have enjoyed in recent years is not taxed unless the underlying assets are sold. But the super-rich don’t have to sell to monetize their gains—they can instead live off loans borrowed at cheap rates against their rising fortunes. And when those gains are passed along to the next generation, they completely disappear for income-tax purposes.

It’s because of this privileged treatment of income from wealth that Musk, Jeff Bezos, Michael Bloomberg and other billionaires have in many years paid zero federal income tax, according to ProPublica analysis of their IRS tax returns. It’s also why the 400 wealthiest Americans have in recent years paid an average federal tax rate of only 8.2% when the rising value of their stock holdings is counted as income, according to White House economists. That’s a lower rate than essential employees like firefighters, nurses and police officers pay on their wages.

The Billionaires Income Tax is extremely popular with the voting public: in key battleground Congressional districts, support for Build Back Better increased by up to 43 percentage points when poll respondents were told it would be paid for with the BIT. Support among undecided independent voters in states with competitive Senate races shot by up to 50 percentage points.