After 24 Years of a Tax Code Rigged in Their Favor, U.S. Billionaires Are Now Worth a Record $6 Trillion

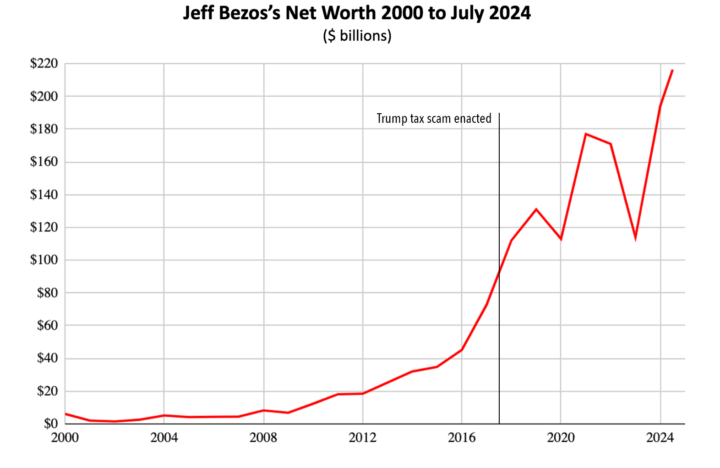

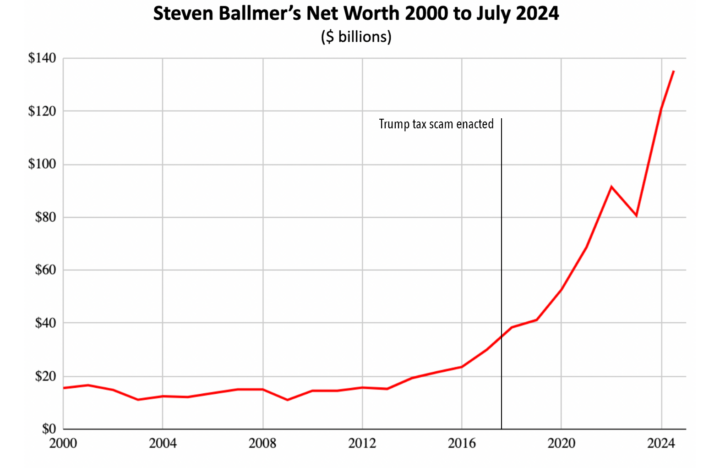

America’s roughly 800 billionaires are collectively worth a record $6 trillion as of July 11, the most money ever amassed by the nation’s ultra wealthy, and nine times more than the billionaire class held at the beginning of the 21st century, according to a new analysis of Forbes data by Americans for Tax Fairness (ATF). Billionaire wealth has more than doubled, up by more than $3.1 trillion, since the passage of the 2017 Trump-GOP tax law, which was heavily slanted towards the rich.

Source: Americans for Tax Fairness

“The failure to adequately tax the astronomical growth in billionaire wealth over the last quarter century has helped create this unprecedented concentration of financial power,” said David Kass, ATF’s executive director. “Reaching this dubious milestone is yet one more reason not to renew the expiring Trump-GOP tax cuts for the rich that are set to sunset next year, and instead use their expiration as an opportunity to pass real tax reforms that ensure billionaires and other super-wealthy people finally pay their fair share.”

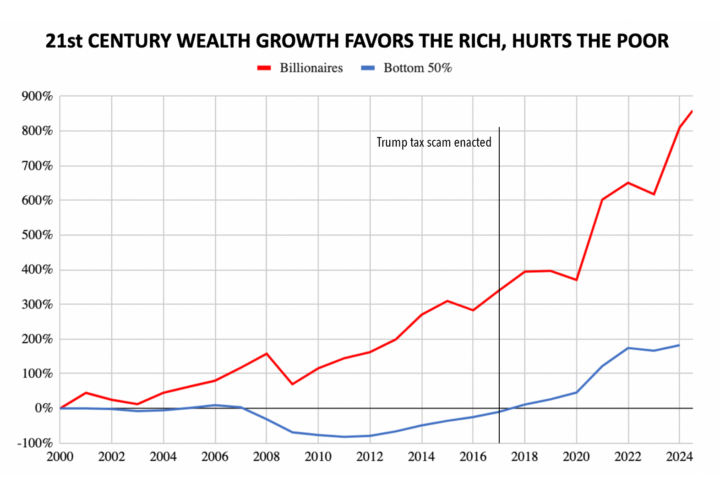

The ninefold jump in billionaire wealth this century left the rest of Americans behind, the ATF analysis found. The collective net worth of the bottom half of American society–accounting for more than 66 million households–has grown nearly five times slower than the wealth of billionaires this century. Moreover, COVID-related transfer payments likely account for a large part of that wealth growth among the bottom 50%, since it’s almost all happened since 2020.

Source: Americans for Tax Fairness

Because of this extreme disparity in wealth growth, the nation’s handful of billionaire households this century became richer than the collective wealth of tens of millions of families in the bottom 50%. The billionaires rocketed past the bottom 50% in wealth during the Great Recession that destroyed so much middle- and working-class wealth. The nation’s 800 billionaires alone now hold roughly 3.8% of the entire nation’s wealth, while the roughly 66 million American families in the bottom half control just 2.5%.

Source: Americans for Tax Fairness

Many of the components of the Trump-GOP tax law set to expire at the end of 2025 benefit the wealthy, including billionaires. A lower top tax rate, the weakened Alternative Minimum Tax (AMT), an enfeebled estate tax and other handouts to the rich in that law have undoubtedly contributed to the buildup of billionaire wealth in recent years. Republicans have generally said they want to extend all the expiring parts of the law, at a cost of some $5 trillion.

Source: Americans for Tax Fairness

Other parts of the tax code that predate the Trump law play an even bigger role in the growth of billionaire dynasties. They include the nearly half-off tax discount on prominent forms of investment income; the shielding of lifetimes of capital gains from any tax at all (the “stepped-up basis” loophole); and the failure to tax gains in assets that go unsold (“unrealized” gains), despite the very real economic benefits offered by those gains to their wealthy owners.

President Biden and leading congressional Democrats have proposed multiple solutions to the dilemma of undertaxed billionaires. They include ending the investment-income tax discount and closing the stepped-up basis loophole on the highest incomes; annual taxation of the unrealized gains of the nation’s wealthiest households; and taxing the value of the biggest fortunes.

ATF’s report is the latest in a four-year series by the group revealing the troubling growth in billionaire wealth and the use of that billionaire wealth to distort our democracy.