The Unity Task Force of the Biden and Sanders presidential campaigns released a 110-page set of recommendations on July 8 covering a wide array of public policy proposals, including progressive tax proposals. Below is Americans for Tax Fairness’s analysis of the proposals and a statement from Frank Clemente, ATF’s executive director.

“We welcome the Unity Task Force’s recommendations calling for the wealthiest Americans to ‘shoulder more of the tax burden’ and for raising corporate tax rates, equalizing tax rates between workers and investors and returning the estate tax to its ‘historical norm.’ We look forward to working together to develop and flesh out the agenda further given the level of inequality in America, the challenges of these extraordinary times and the detailed tax plans both candidates released during the campaign. As Vice President Biden and Senator Sanders have both shown in their tax plans, we need major reforms to our tax system that ensure the wealthy and corporations pay their fair share of taxes so we have the additional trillions of dollars needed to create an economy that works for all of us,” said Clemente.

Vice President Biden, Senator Sanders, Elizabeth Warren, Pete Buttigieg and Michael Bloomberg, put out detailed tax plans that ATF has analyzed here.

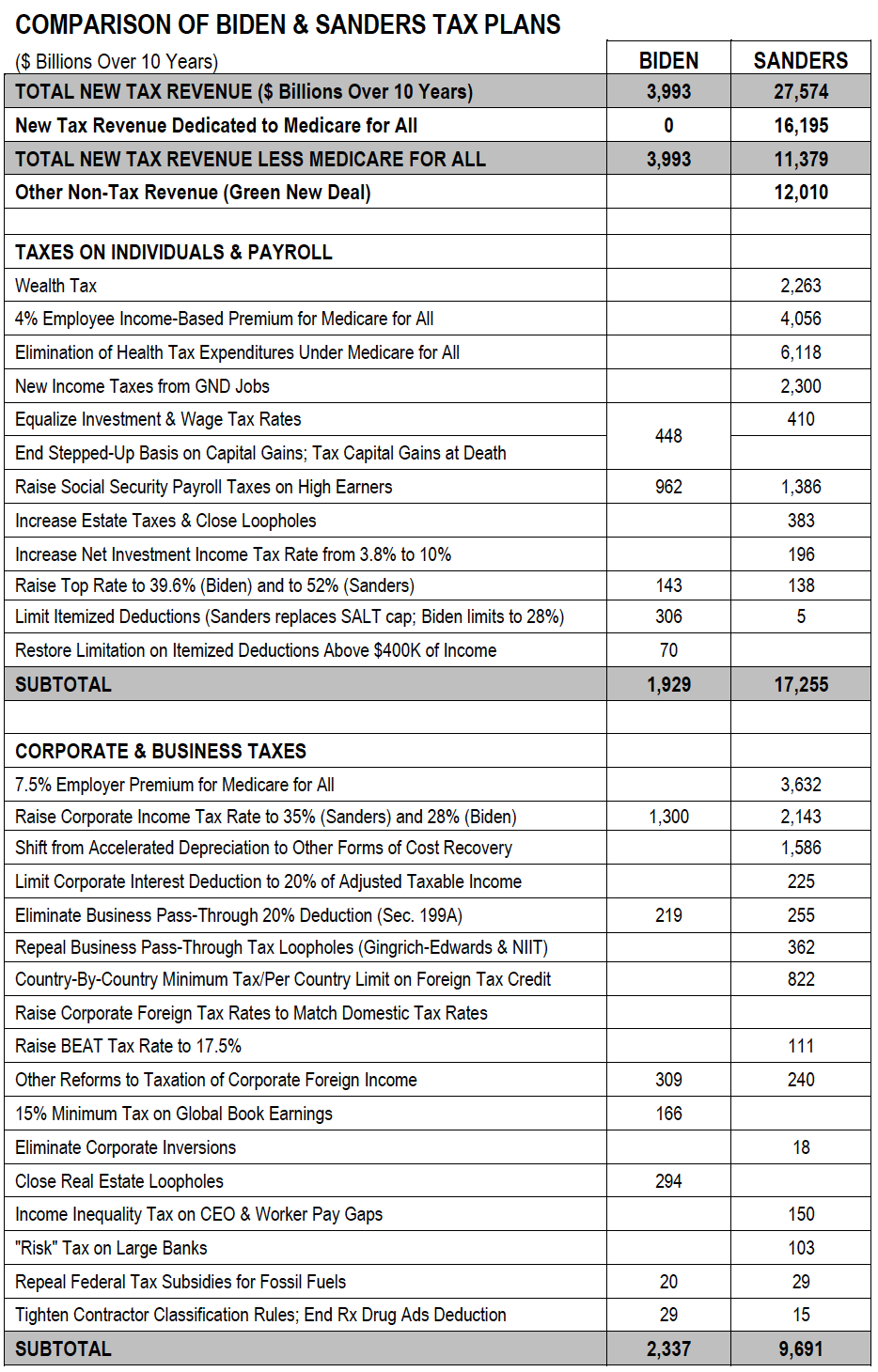

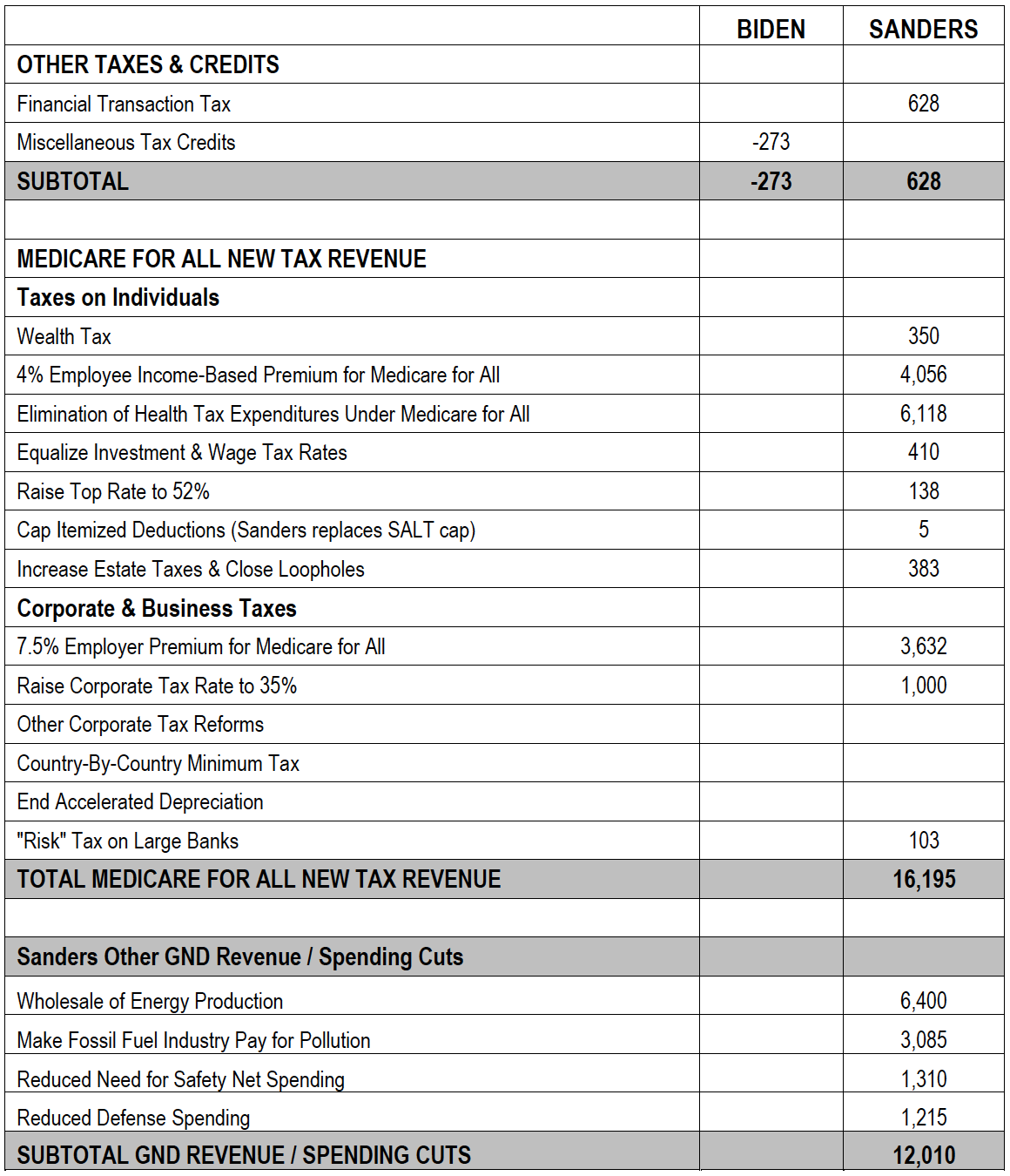

- Biden’s tax plan raised $4 trillion for investments from 13 specific progressive tax-reform proposals, according to the ATF analysis.

- Sanders’ tax plan raised $11.4 trillion for investments from 26 specific tax reform proposals, not counting his Medicare for All plan, according to the ATF analysis. Adding in Medicare for All, Sanders raised an additional $16.2 trillion from 13 specific tax reform proposals.

Below is a detailed analysis of the Unity Task Force’s recommendations including a two-page table of the specific tax proposals advanced by Biden and Sanders. In addition, there’s a summary of the tax provisions in the 2016 Democratic Party Platform.

SPECIFIC TAX POLICY STATEMENTS FROM UNITY TASK FORCE RECOMMENDATIONS

Policy Statements

- A guiding principle across our tax agenda is that the wealthiest Americans can shoulder more of the tax burden, including in particular by making investors pay the same tax rates as workers and bringing an end to expensive and unproductive tax loopholes. (p. 15)

- Limit the ability of wealthy taxpayers to defer and avoid taxes on income (especially that relate to financial investments), tax liabilities of ultralarge banks to promote financial stability and fund investments in American productivity, and expand payroll taxes on upper-income taxpayers to fund more generous Social Security benefits. (p. 75)

- Corporate tax rates, which were cut sharply by the 2017 Republican tax cut, must be raised, and “supply-side” or “trickle down” tax cuts must be rejected. (p. 15)

- Estate taxes should also be raised back to the historical norm. (p. 15)

- We will eliminate trade and tax policies that promote the offshoring of pharmaceutical manufacturing (and medical equipment manufacturing) and raise prices on medications for American patients. (pp. 21 and 71)

- We will eliminate tax breaks for prescription drug advertisements. (p. 32)

- Expand the Child and Dependent Care Tax Credit (CDCTC) to provide a fully refundable, advanceable tax credit. (p. 78)

- Saving for retirement: Address retirement-saving penalties for caregivers, eliminate WEP/GPO which penalize the Social Security benefits of many public workers, and equalize the tax benefits—totaling over $200 billion per year—for retirement saving. (p. 73)

- Expand the EITC to older workers. (p. 73)

General Statements

- We will work to reform the tax code to be more progressive and equitable, and reduce barriers for families who qualify to benefit from targeted tax breaks. Our tax system has been rigged against the American people by big corporations and their lobbyists, and by Republican politicians who dole out breaks to their biggest donors while leaving families to struggle. (p. 15)

- Our program of reform will provide immediate, marked relief for working families, including more generous, refundable tax credits to benefit low- and middle-income families, and easier and more equitable access to tax provisions that help working families build wealth, such as equalizing tax benefits for retirement contributions and providing more accessible tax breaks for homeownership. (p. 15)

- Change the tax code to further help working families: Reform the tax code to be more progressive and equitable, while also reducing barriers for families who are eligible for benefits from receiving targeted tax breaks. Provide more generous refundable tax credits to benefit low and middle-income families, including more equitable access to tax provisions that build wealth and support working families. (p. 65)

- Use taxes as a tool to address extreme concentrations of income and wealth inequality. As a means of strengthening tax progressivity and paying for investments in U.S. productivity, increase taxes on the wealthiest Americans by limiting unequal and unproductive tax expenditures. (p. 75)

HIGHLIGHTS OF 2016 DEMOCRATIC PARTY PLATFORM TAX POLICY PROPOSALS

The 2016 platform was more progressive than all of the previous Democratic platforms since 1960.

Taxing the Wealthy

- Multimillionaire surtax

- Improved estate tax

- Buffet rule instituted

- Carried interest tax break repealed

- Increasing payroll taxes on income above $250,000 to fund Social Security

- Financial transactions tax, but recognizes a diversity of opinion in the caucus

Taxing Corporations

- Ending tax breaks to ship jobs overseas

- Crackdown on corporate inversions

- No tax deferrals on corporate profits held abroad

- Ending tax breaks for big oil and gas and provide credits for renewables

Other

- Expanded Earned Income Tax Credit (EITC) and Child Tax Credit (CTC)

- Repeal of the 40% tax on higher cost health insurance plans

- Tax relief for the middle class

- Expanded New Markets Tax Credit

- Tax relief for small businesses

MORE DETAILED STATEMENTS ABOUT TAX POLICIES FROM UNITY TASK FORCE RECOMMENDATIONS

Enacting Robust Work-Family Policies (p. 15): Democrats will also work to enact universal, high-quality prekindergarten programs for 3- and 4-year-olds, and expand the Child and Dependent Care Tax Credit to help make child care more affordable, and make significant new investments to increase quality child care options for parents and improve compensation and benefits for child care providers.

We will work to reform the tax code to be more progressive and equitable, and reduce barriers for families who qualify to benefit from targeted tax breaks. Our tax system has been rigged against the American people by big corporations and their lobbyists, and by Republican politicians who dole out breaks to their biggest donors while leaving families to struggle. A guiding principle across our tax agenda is that the wealthiest Americans can shoulder more of the tax burden, including in particular by making investors pay the same tax rates as workers and bringing an end to expensive and unproductive tax loopholes. Corporate tax rates, which were cut sharply by the 2017 Republican tax cut, must be raised, and “supply-side” or “trickle down” tax cuts must be rejected. Estate taxes should also be raised back to the historical norm.

Our program of reform will provide immediate, marked relief for working families, including more generous, refundable tax credits to benefit low- and middle-income families, and easier and more equitable access to tax provisions that help working families build wealth, such as equalizing tax benefits for retirement contributions and providing more accessible tax breaks for homeownership.

Building A Fair System of International Trade (p. 20): We will eliminate trade and tax policies that promote the offshoring of pharmaceutical manufacturing and raise prices on medications for American patients.

Guaranteeing Universal Early Childhood Education (p. 23): We recognize that learning starts at birth, and the exorbitant costs of safe, quality child care present a significant economic burden to families. Democrats support making child care and dependent tax credits significantly more generous to save working parents thousands of dollars per year on child care costs.

Bringing Down Drug Prices and Taking on the Pharmaceutical Industry (p. 32): For too long, prescription drug companies have gamed the system to justify their price increases by any means available. Democrats will crack down on anti-competitive efforts to manipulate the patent system or collude on prices. And we will eliminate tax breaks for prescription drug advertisements. And we will eliminate tax breaks for prescription drug advertisements.

Child care (p. 65): Provide child care support for working Americans through universal access to pre-K, increased support for child care, including expanded funding for child care providers and more generous tax credits for parents that are fully refundable.

Change the tax code to further help working families (p. 65): Reform the tax code to be more progressive and equitable, while also reducing barriers for families who are eligible for benefits from receiving targeted tax breaks. Provide more generous refundable tax credits to benefit low and middle-income families, including more equitable access to tax provisions that build wealth and support working families.

Saving for retirement (p. 73): Address retirement-saving penalties for caregivers, eliminate WEP/GPO which penalize the Social Security benefits of many public workers, and equalize the tax benefits—totaling over $200 billion per year—for retirement saving.

Support older Americans (p. 73): Pass anti-discrimination legislation, expand the EITC to older workers, and reduce older-American poverty rates by increasing SSI asset limits and increasing the benefit levels, including raising the minimum benefit.

Banking, Federal Investment, Economic Power for All (p. 75): Building a More Progressive Tax System: Use taxes as a tool to address extreme concentrations of income and wealth inequality. As a means of strengthening tax progressivity and paying for investments in U.S. productivity, increase taxes on the wealthiest Americans by limiting unequal and unproductive tax expenditures. In addition, limit the ability of wealthy taxpayers to defer and avoid taxes on income (especially that relate to financial investments), tax liabilities of ultralarge banks to promote financial stability and fund investments in American productivity, and expand payroll taxes on upper-income taxpayers to fund more generous Social Security benefits.

Budgeting (p. 75): The budget process should also be examined to determine whether better evaluating the economic and fiscal impacts of tax expenditures can lead to more efficient, equitable, and productive tax policies. Official scorekeepers should be fully transparent in their methods, including making their forecasting models public (as does the Federal Reserve) and strive to increase the gender, racial, and academic diversity on both their staff and their Panel of Economic Advisors.

Safe, Affordable Child Care (p. 78): Expand the Child and Dependent Care Tax Credit (CDCTC) to provide a fully refundable, advanceable tax credit.

Affordable Care Act Marketplace (p. 93): Increase tax subsidy to ensure greater affordability through lower premiums and cost-sharing linked to gold plan.