KEY FINDINGS

- “Republicans lost the messaging battle on the [tax] issue, per a Sept. 2 polling memo prepared for the Republican National Committee. Their poll found that by 61% to 30%, voters said the law benefits “large corporations and rich Americans” over “middle class families.” The memo attributed this to message discipline from the tax bill’s opponents. Another RNC memo media story reported this about our core message : “[T]he challenge for GOP candidates is that most voters believe that the GOP wants to cut back on (Medicare and Social Security) in order to provide tax breaks for corporations and the wealthy.”

- Recent Polls by Fox News and Gallup also found that most voters (60% and 64% respectively) say they have seen no increase in the paychecks due to the tax cut law. By a margin of 46% to 39%, Americans say they disapprove of the 2017 Tax Cuts and Jobs Act, according to Gallup.

- Republican candidates for the U.S. Senate and U.S. House, and their allied outside groups, are running a lot of tax ads this cycle, but few are mentioning the new Trump-GOP tax law that is the signature legislative accomplishment of this Congress.

- Taxes are the top issue for GOP TV ads—just under 30% of U.S. Senate and U.S. House GOP ads that ran from Jan. 1 through Sept. 11 mentioned taxes, per a Kantar Media/CMAG analysis for the Huffington Post. The study examined ads that aired nearly 400,000 times. However, just under 12% of all GOP TV ads mentioned the Trump-GOP tax cuts.

- Similar findings were made by the Wesleyan Media Project, which reviewed TV ads for federal offices between June 1 and July 29. Tax ads ranked first in U.S. Senate races (32%) and second in U.S. House races (27%). Explicit references to the Trump-GOP tax law occurred in just 6% of U.S. Senate spots and 15% of U.S. House airings.

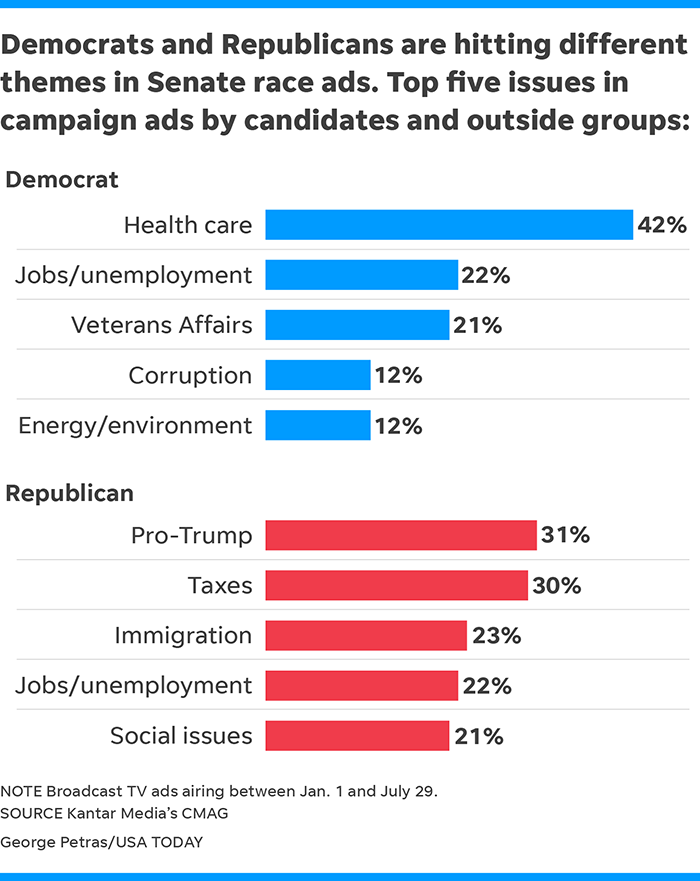

- An analysis of broadcast ads in U.S. Senate races from Jan. 1 to July 29 by Kantar Media/ CMAG for USA Today found that Republicans and their allied outside groups ran ads about President Trump most frequently (31% of the time) followed closely by taxes (30%).

- American Action Network, a 501c4 arm of House Speaker Paul Ryan’s Congressional Leadership Fund (the main Super PAC supporting House Republicans), announced it was running tax ads worth $8.5 million between January 1 and Tax Day on April 15. Since then it has not made any new announcements that it is running tax ads, but it has announced two rounds of ads on the opioid crisis since June that cost $4.5 million.

- ATF’s review of GOP tax ads contained in this analysis, found they typically accuse Democrats of favoring higher taxes or to a lesser extent opposing a “middle class tax cut.

- Even though the “progressive” message frame on tax issues is winning with voters, Democrats are running relatively few tax ads—they are prioritizing health care issues.

- Tax issues did not register among the top five issues for Democratic ads in either U.S. Senate or U.S. House races, according to two Kantar/CMAG studies.

- Health care ads dominate among Democrats. They have been aired an astounding 63% of the time in House races and 42% and 28% of the time in two studies of Senate contests.

- Yet, in two high-profile House special elections since the tax law passed—Ohio and Pennsylvania—the GOP candidates and Super PACs supporting them started out with ads touting the Trump-GOP tax cuts but later abandoned them due to ineffectiveness.

DETAILED NATIONAL ANALYSIS

Kantar Media/CMAG for the Huffington Post

This analysis reviewed Republican tax ads run from Jan. 1 through Sept. 11 (per the authors). It found that just under 30% of GOP ads mentioned taxes—the top issue for these ads. The study examined 1,039 individual TV ads that aired a total of 396,607 times. But most of the Republican ads stayed away from touting the new tax law—just under 12% of all GOP TV ads have mentioned the Trump-GOP tax cuts.

Wesleyan Media Project (Tables 9 & 10)

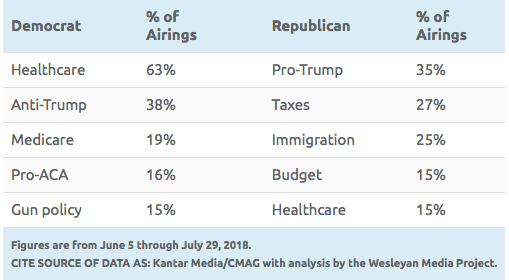

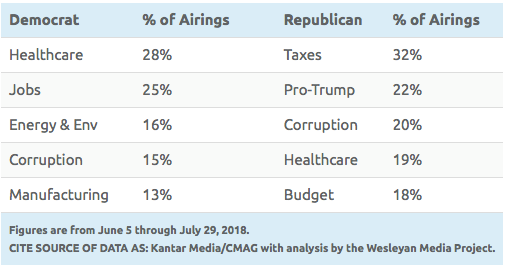

This analysis, which covers ads for federal offices between June 1 and July 29, had findings like those from USA Today. [See charts below] Tax ads ranked first in GOP U.S. Senate races, with nearly a third (32%) of airings, and second in GOP U.S. House races, with one out of every four (27%) ads discussing taxes. However, explicit references to the Trump-GOP tax law were much less common—just 6% of U.S. Senate spots and 15% of U.S. House airings.

Pro-Democratic ads for U.S. House attacked the tax law in just 12% of their spots. Like in the USA Today report, the Wesleyan analysis finds that Democrats’ ads are overwhelmingly talking about healthcare—an astonishing 63% of the time in U.S. House races and 28% in U.S. Senate races. For the first time in several election cycles, Democrats are explicitly making favorable references to the Affordable Care Act.

Kantar Media/CMAG for USA Today

This analysis covered TV ads in U.S. Senate races from January 1 through July 29. For Republicans and their allied outside groups, their top two out of five ad topics were about President Trump (31%) followed closely by taxes (30%). [See chart below]

On the Democratic side, tax ads were not among the top five topics. Forty-two percent of the TV ads run by Senate Democratic candidates and allied outside groups focused on health care. They ran 56,000 ads and spent a total of $17 million opposing Medicare cuts, vowing to protect people with pre-existing conditions and fighting for lower drug prices.

Unlike Democrats, Republican Senate candidates and allied outside groups have shown few ads about health care. They have spent the most on tax ads ($14 million) running 43,000 spots. A majority of those were paid for by outside GOP groups, not candidates. Ads supporting President Trump cost $10.5 million and ran 45,000 times.

Kantar Media/CMAG for Bloomberg

This October article looks at ad spending by The Congressional Leadership Fund, the largest spending political group during the midterm cycle. The article points out that the CLF began the year vowing to focus its advertising on the Trump-GOP tax cut law, but has actually mentioned it in just a fraction of its TV ads.

“The data underscore concerns among Republicans that the 2017 tax law — championed by President Donald Trump and GOP congressional leaders — hasn’t gained traction with voters ahead of the Nov. 6 election that will determine control of the House and Senate,” the article states.

WESLEYAN MEDIA PROJECT (TABLES 9 & 10)

Top Five Issues/Mentions in U.S. House Advertising

Top Five Issues/Mentions in U.S. Senate Advertising

KANTAR MEDIA/CMAG FOR USA TODAY

One important effect from the Trump-GOP tax cuts: Wealthy Republican donors are using their windfall to contribute even more to their candidates, according to the New York Times in Trump Tax Cut Unlocks Millions for a Republican Election Blitz.

GOP HAS LOST THE TAX MESSAGE WAR; VOTERS BELIEVE GOP WILL PAY FOR TAX CUTS BY SLASHING VITAL SERVICES

An early September polling memo prepared for the Republican National Committee (RNC) by its polling firm declared that “we’ve lost the messaging battle on the [tax] issue.” Their poll found that by 61% to 30%, voters said the law benefits “large corporations and rich Americans” over “middle class families.” It was a 36-point margin (63% to 27%) with self-identified independent voters. The survey results were even more lopsided among Democrats while most Republican voters still maintained the tax cuts benefit the middle class.

The RNC survey attributes the messaging success to a disciplined attack by progressive forces. During the entire tax fight the tax reform community, including Americans for Tax Fairness, allied groups, and lawmakers emphasized that Republicans in Congress intended to pay for the $2 trillion cost of the Trump-GOP tax cuts, which mainly benefit the wealthy and corporations, by slashing vital services like Medicare, Medicaid, Social Security and more.

According to another Bloomberg media account of the RNC’s September internal polling memo, Republican candidates are backing off mentioning their support for the Trump-GOP tax cuts in their campaign ads because the measure presents a dilemma for them:

“Special attention should be paid to the messaging regarding Social Security and Medicare,” the polling memo notes. “[T]he challenge for GOP candidates is that most voters believe that the GOP wants to cut back on these programs in order to provide tax breaks for corporations and the wealthy.”

The GOP survey said motivating “soft supporters” was key to electoral success: Voters who “somewhat approve” of Trump and those who support his policies but not his leadership style will be especially difficult because the issues soft Republicans care about most are ones involving government spending and are typically associated with Democrats.

“The survey found that increasing funding for veterans’ mental health services, strengthening and preserving Medicare and Social Security, and reforming the student loan system all scored higher than Trump’s favored subjects of tax cuts, border security, and preserving the Immigration and Customs Enforcement agency.”

Other surveys confirm the view that most voters have not seen the benefit of the Trump-GOP tax cuts. A Fox News poll in September found that 60% of registered voters have seen no increase in the paychecks as a result of the tax cuts. (Significantly, 56% of voters in the Fox poll believes things in the country are rigged to favor the wealthy.) Similarly, a Gallup poll in October found nearly two-thirds of Americans, 64%, say they have not seen an increase in their take-home pay as a result of lower federal income taxes, and 51% of Americans say the law has not helped their family’s financial situation.

If voters believe that Republicans want to cut Medicare and Social Security to pay for their tax cuts for the wealthy it’s partly because that’s exactly what Republicans say they want to do. Weeks after the first tax cuts were enacted, President Trump’s budget proposed cutting $1.3 trillion from Medicare, Medicaid and the Affordable Care Act (ACA) to shrink the deficit. Not long after that, House Republicans proposed slashing $5 trillion from critical services, including $2 trillion from Medicare, Medicaid and the ACA. They are likely to propose even deeper cuts to these services should a second round of tax cuts become law, which is estimated to cost more than $3 trillion and is likely to be voted on in the U.S. House the last week of September.

2018 CASE STUDIES

PENNSYLVANIA 18th CD SPECIAL ELECTION (MARCH): CONOR LAMB (D) VS. RICK SACCONE (R)

The Pennsylvania special election held in March 2018 is one of the clearest examples of how the Trump-GOP tax cut was used by Democrats against Republicans instead of the other way around. The Democrat, Conor Lamb, won in a surprising upset by two-tenths of one percent. Donald Trump won the district by nearly 20 points in 2016.

- Republicans began with an ad highlighting the Trump-GOP tax cut as a “$2,900 tax cut for middle class families,” resulting in raises, bonuses and jobs. It also slammed Lamb for opposing the tax cuts. Then they dropped it and replaced with an ad tying Lamb to Pelosi and favoring sanctuary cities.

- Lamb, meanwhile, ran an ad attacking the Republican tax cuts, saying it would add $1.5 trillion to the deficit and that most families would see their tax cuts “wiped out by higher health care premiums.” The ad also said “their next plan is to cut Medicare and Social Security.”

- Politico: “Republicans backed away from their signature tax-cut law in the final days of a closely watched special House election in the Pittsburgh suburbs — even though it’s the very accomplishment on which they had banked their midterm election hopes.”

- CNBC: “After Republican outside groups initially unleashed a barrage of ads in the district slamming Saccone’s Democratic opponent…for opposing the tax plan, their attacks have recently focused on other issues like immigration. Democrats in the district think the change came because the tax ads did not resonate with voters as much as the GOP hoped.”

OHIO 12TH CD SPECIAL ELECTION (AUGUST) – TROY BALDERSON (R) VS. DANNY O’CONNOR (D)

This Ohio special election in August 2018 was a nail-biter: Balderson won by just 1,680 votes in a very reliably Republican district that Donald Trump had won by 11 points. The two candidates will face each other again in November. Taxes played a prominent role in this election, but for the Democrat.

- At the start of this race, Republicans ran an ad touting the “middle-class tax cuts” for saving families over $2,500 a year and accusing Democrat Danny O’Connor of “standing with Nancy Pelosi” to raise taxes.

- But after proving ineffective, Republicans soon phased it out in favor of an ad attacking O’Connor on immigration and other issues.

- Meanwhile, O’Connor’s ad took his Republican opponent Troy Balderson to task for supporting “a corporate tax giveaway that racks up trillions in debt forcing massive tax hikes on our kids.”

- A DCCC ad in support of O’Connor that began near the end of the campaign focused even more exclusively on tax tradeoffs, saying the Republican tax bill “could fuel push for Medicare, Social Security cuts.”

- By July 30, the O’Connor campaign and the DCCC had spent more going after Balderson on the tax bill than Republican groups spent promoting it. The DCCC alone spent $238,000 on an ad buy supporting O’Connor between July 20 and July 30.

- Washington Post: “In the race for Ohio’s 12th congressional district, one party is on the airwaves talking about the 2017 Tax Cuts and Jobs Act more than the other: The Democratic Party. Even as the economy has grown this year and as Republicans have held rallies and events to celebrate its benefits — from scattered worker bonuses to companies promising not to send jobs out of the country — the tax cut has not emerged as a galvanizing issue.”

- New York Times: “Democrats are weaponizing the tax law — which is mired in only middling popularity — against Republican opponents in some key races. Their critiques have been fed by government statistics showing that wages for typical American workers have not risen over the past year, after adjusting for inflation, even though Republicans promised the tax cuts would unleash rapid wage growth.”

SENATE & HOUSE ADS FROM BOTH PARTIES

SENATE MAJORITY PAC (D) – Super PAC controlled by Senate Democrats

Noteworthy tax ads it has run are:

Indiana: SMP ad supporting Sen. Joe Donnelly in March defended his vote against the tax cut law and the Koch Brothers’ attack ads. https://youtu.be/bXJ1eVxgSdU

A later SMP ad focuses on Donnelly’s effort to end tax breaks for corporations that outsource jobs. https://www.youtube.com/watch?v=4PcYTA1izoU

Missouri: The Koch Brothers-funded Americans for Prosperity hit Sen. Clair McCaskill with an ad in February blasting her vote against the Trump-GOP tax cuts. It talks about tax reform sweeping Missouri, paychecks going up, and McCaskill voted against tax cuts for families. https://youtu.be/nUjMHa-Kg8g

The SMP responded in March with an ad in support of McCaskill against her opponent Josh Hawley who supported the Trump-GOP tax cuts that gave most of the benefits to the richest 1% and corporations, added $1.5 trillion to the deficit and threatens Medicare and Social Security. https://youtu.be/x2OMpcNIJgY

In August, the SMP switched to an ad knocking Hawley for being against healthcare plans that include coverage for preexisting conditions and being in the pocket of insurance companies. https://youtu.be/Jnw7nYg1098

The Koch Brothers, meanwhile, launched a $2 million ad campaign in August also dealing with healthcare, knocking McCaskill for her support for the Affordable Care Act, which the ad claims led to higher health care costs. https://youtu.be/8rSu5NhzFOg

North Dakota: A SMP ad supporting Sen. Heitkamp rebuts Rep. Kevin Cramer’s attacks. The ad says she voted for fiscally responsible tax cuts, but that Cramer voted for tax cuts that increased the deficit by $1.9 trillion and jeopardizes Social Security and Medicare to pay for it. https://www.youtube.com/watch?v=k4sls8nvaDU

Wisconsin: A SMP ad supporting Sen. Tammy Baldwin criticizes the rigged system that gave a huge tax cut to the richest 1% but leaves Wisconsin behind. Baldwin supports tax breaks for the middle-class and has voted over 50 times to do it—tax cuts that work for child care, education and retirement. https://www.youtube.com/watch?v=3HkV6e-6J0o

DEMOCRATIC SENATORIAL CAMPAIGN COMMITTEE (DSCC)

Nevada: The DSCC has been very quiet on the ad front this election cycle. However, they just launched an ad with the Jacky Rosen for Nevada campaign that put a critique of the Trump-GOP tax cuts center stage. In the ad, Rosen says she favors “fiscally responsible middle-class tax cuts,” as opposed to the tax cuts her opponent voted for that favor the rich, add trillions to the national debt and will lead to cuts in Medicare and Social Security. Rosen is running against Republican Dean Heller, the only GOP member of the Senate’s tax-writing committee running for reelection this year and the only Republican senator up for reelection in a state Hillary Clinton carried in 2016. Heller touted the tax law’s effectiveness shortly after it was enacted, but observers say he has since backed off talking about the law, a sign Republicans are on the defense, according to The Hill. His ad from August obliquely mentions he favors lower taxes and accuses Rosen of wanting to raise taxes, but doesn’t explicitly mention the tax cut law he helped write.

SENATE LEADERSHIP FUND (R) – Super PAC controlled by Senate Republicans

SLF has run few ads this cycle and only one we could find that focused on tax issues.

Indiana: The ad criticizes Sen. Joe Donnelly for voting against the tax bill. It claims the tax law is helping a manufacturer grow his business, and the tax cuts should be made permanent. But Donnelly voted no on tax cuts and on lower taxes for small businesses and families. https://www.youtube.com/watch?v=-x60h2r_D3M

ONE NATION (R) – Senate Leadership Fund’s 501(c)4 sister organization

Roughly 25-30% of SLF’s recent ads are tax related. Many of the rest cover veterans, immigration, character and ethics issues. Roughly 25% may be positive for the Republican incumbent or the Republican challenger. Noteworthy tax ads it has run are:

Indiana

Sen. Joe Donnelly: Tax-focused ad that criticizes Donnelly for voting no on tax cuts, claims the tax cuts are working and that they should be made permanent. https://www.youtube.com/watch?v=AYzOZqjLGf4

Sen. Joe Donnelly: A May ad focused on how the tax cuts are giving bonuses and raising wages and creating more jobs; Donnelly voted against the tax bill and it’s $2,000 tax break for families; it’s time to make the tax cuts permanent. https://www.youtube.com/watch?v=uQZxONfNksU

Nevada: Rep. Jackie Rosen (D) running for Senate: The economy in Nevada is coming back, but Rosen has voted to keep taxes high on families and small businesses. She should help Nevada families by making their tax cuts permanent. https://www.youtube.com/watch?v=BrJuSd-VrEQ

Tennessee: Rep. Marsha Blackburn (R) who is running for Senate: Tax cut focused ad that says they are working and they need to be made permanent. https://www.youtube.com/watch?v=kXIO4bBkb0M

West Virginia: Sen. Joe Manchin: Trump speaking says Manchin voted for Obama 84% of time, for Obamacare, for Hillary Clinton and voted no on the Trump tax cuts. https://www.youtube.com/watch?v=cfOw7y9AU3M

HOUSE MAJORITY PAC (D) – Super PAC Controlled by House Democrats

Noteworthy tax ads it has run are:

New York 19, Rep. John Faso (R): Faso took nearly $200,000 from insurance interests and cast the deciding vote in favor of their corporate tax cuts while imposing an age tax on seniors. https://www.youtube.com/watch?v=mZaXUwTzTUQ

New Jersey 03, Rep. Tom MacArthur (R): Ad criticizes MacArthur for voting for the tax bill that resulted in the loss of the SALT deduction and higher taxes for the people of New Jersey. https://www.youtube.com/watch?v=LueqapiyVfg

Iowa 03, Rep. David Young (R): Young voted for a tax bill that gives health insurers a huge tax cut even though the bill raises taxes on the middle class and raises the debt $1.9 trillion. https://www.youtube.com/watch?v=KRZRxHJlK8k

Kansas 03, Rep. Kevin Yoder (R): Yoder took $2 million from special interests and gave them $266 billion in tax breaks; most Americans will pay higher taxes and the deficit will go up $1.9 trillion. Similar ads ran in a number of races. https://www.youtube.com/watch?v=ttF7ZR3mSKs

CONGRESSIONAL LEADERSHIP FUND (R) – Super PAC controlled by House Republicans

In the 2018 election cycle, CLF has spent more than $88 million to aid Republican House candidates — more than any group, according to the Center For Responsive Politics. It has put out 31,220 broadcast spots in the first nine months of 2018. But just 17.3 percent referred to the tax cut law, according data from Kantar Media’s CMAG.

According to the CMAG data, the proportion of ads sponsored by the group touting the Trump-GOP tax cuts peaked in February at 72.8 percent. In August, when CLF ad spending surged in House districts across the country, 14.4 percent of its ads mentioned the tax law. Its ad spending continued to rise In September, but the proportion of ads mentioning the tax cut law was just 16.8 percent.

Most of their recent ads are not focused on the federal tax law. That may be due in part to the candidate not being an incumbent who voted for the legislation. The ads are more focused on the candidate’s character and ethics issues. Ads infrequently mention taxes or mention their support for higher taxes as one of several objections.

Noteworthy tax ads it has run are:

Iowa 03, attacking Cindy Axne (D): The ad attacks Rep. David Young’s opponent for wanting to increase the “death tax.” https://youtu.be/wfUsBF_c2qM

Maine 02, attacking Jared Golden (D): Golden is running against Rep. Bruce Poliquin. The attack is typical of how Republicans are using the tax issue in ads. It says Golden repeatedly voted to raise taxes while in the state legislature, opposed tax relief that would save Maine families $2,000, and supports a government takeover of healthcare costing $32 trillion. https://www.youtube.com/watch?v=h7NM2-5PiGc

Nebraska 02, attacking Kara Eastman (D): The ad criticizes her for supporting a health care plan costing $32 trillion, a free-public college tuition plan costing $600 billion opposing the tax law, which saves families $2,500. https://www.youtube.com/watch?v=v9gfCMYsGxU

Pennsylvania 01, attacking Scott Wallace (D): Wallace is running against Rep. Brian Fitzpatrick. The ad attacks Wallace for inheriting $100 million and repeatedly failing to pay his own taxes. Now he wants to go to Congress to raise our taxes. https://www.youtube.com/watch?v=6AZmpVjEmRY

ARIZONA

A CNN analysis of Kantar Media/CMAG ad data from the recent competitive Arizona senate race is typical. It shows how Republicans focused on immigration and security issues in their TV advertising, while also emphasizing their pro-Trump bona fides. Those were the top three TV ad themes by spending through the week of August 21 — “immigration” ($2.45 million), “pro-Trump” ($1.77 million), and “public safety” ($1.58 million).

On the other side, Democrat Kyrsten Sinema and supportive outside groups have made health care central to their messaging. Democrats have spent over $3.46 million on “health care” ads, with “taxes” ($1.58 million) and “veterans affairs” ($1.1 million) the second- and third-most discussed topics. Also, one of the tax issues raised by Sinema concerns the “age tax” in the GOP health care bill, an issue that is being raised by other Democratic candidates.

Krysten Sinema ad

https://youtu.be/6_d3qkINlB8

FLORIDA

Across both parties, candidates and outside groups have spent $14.7 million on ads discussing health care (with $9.7 million of that total devoted specifically to ads about Medicare). Health care ad spending was ahead of “taxes” ($14.1 million), “Social Security” ($7.69 million), and “social issues” ($5 million) and “term-limits” ($5 million), according to the CNN analysis. Broken down by party, Democrats have put the greatest emphasis on health care ($7.98 million), followed by “social issues” ($5 million), “call to action” spots ($2.9 million) and “Social Security” ($2.9 million).

For example, an ad from Senate Majority PAC (SMP), a Super PAC run by Senate Democrats, features an ER doctor listing health care issues and criticizing Scott’s policies as governor while praising Nelson’s efforts.

The Republican tax cuts, and tax policy generally, have been a key theme in GOP messaging in the Florida Senate race. Florida Republicans have spent $11.29 million on ads discussing taxes, while also stressing health care ($6.75 million) and “term-limits” ($5 million) — a tactic conservatives have seized on to cudgel Nelson, a four-decade veteran of politics.

Scott ad against Nelson on taxes focuses on the number of times he’s raised taxes in 40 years of votes https://youtu.be/HGvN-YIV-Os

SMP ad against Rick Scott focuses on health care https://youtu.be/q73Wx-DJ34g