Ford & GM Savings Went In Part to Huge Compensation for Executives & Boards

The two U.S.-based automakers claiming they can’t afford union demands for better pay certainly can’t blame their tax bills: over the past five years Ford and General Motors have paid an average combined tax rate of just 1% on over $42 billion in total pre-tax income. And while some of those tax savings have found their way into rapidly rising compensation packages for the firms’ top executives and board members, wages of rank-and-file workers have lagged. Those are the findings of a report from Americans for Tax Fairness on the earnings, taxes and payouts of the two American corporations locked in contract negotiations with the United Auto Workers, which has threatened a strike as soon as next week over the firms’ intransigence on wages.

Key Facts

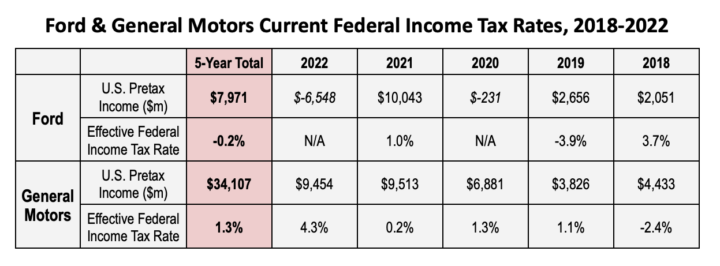

- GM and Ford made a total of $34 billion and $8 billion respectively, over the past 5 years, but paid an effective federal tax rate of only 1.3% and negative 0.2%.

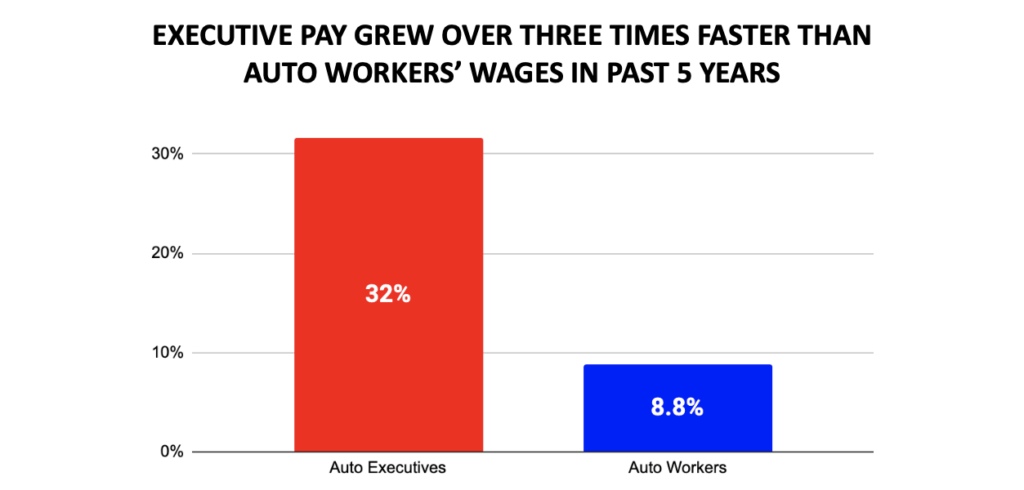

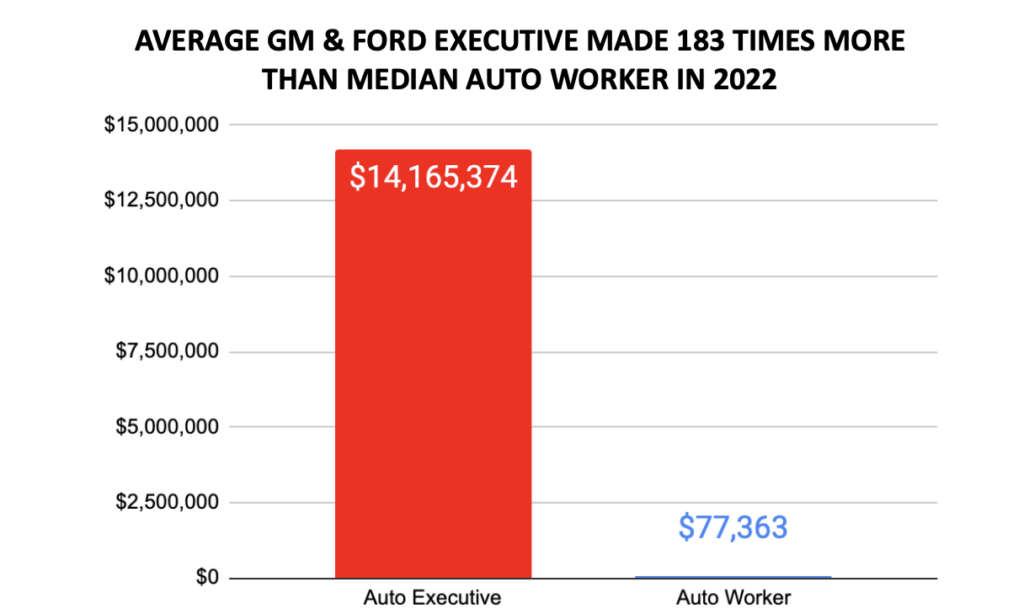

- Average executive pay at GM and Ford grew by 32% over the past 5 years, while median auto worker pay grew by just 8.8% over the same period, widening the executive-to-worker pay gap to 183-to-1.

- Over that same period, GM and Ford paid out a combined total of $14 billion in dividends (34 times more than they paid in taxes), spent $3.6 billion on stock buybacks (nine times more than they paid in taxes), and lavished $614 million on top company executives (50% more than they paid in taxes).

150,000 unionized auto workers are demanding a fair share of corporate profits in their current contract negotiations with manufacturers. With a September 15th strike deadline looming, General Motors and Ford are refusing to meet UAW’s demands, claiming that what workers are asking for is unreasonable. An Americans for Tax Fairness analysis of GM and Ford’s most recent SEC filings finds that what is truly unreasonable is how the auto giants get away with paying practically nothing in federal taxes while further enriching their top executives with huge pay packages and their shareholders with dividend payments and stock buybacks.

Source: Americans for Tax Fairness

Source: Americans for Tax Fairness

“Ford and GM have thrown their priorities into reverse,” said David Kass, ATF’s executive director. “They’re overcompensating their already wealthy executives, board members and shareholders, while shortchanging the workers and nation that made their success possible. They need to offer serious proposals for sharing the wealth with rank-and-file employees and start paying their fair share of taxes. In its oversight of the current labor negotiations, the NLRB must ensure these corporations treat their workers justly; and in its upcoming budget negotiations, Congress must ensure big corporations like Ford and GM are contributing what they should to America’s fiscal health.”

Ford and General Motors are ranked #19 and #21 of the largest publicly traded corporations in the United States, and reported a combined income over $42 billion in pre-tax U.S. income from 2018 through 2022. Yet they paid on average just 1% in federal taxes over those five years, and in some years they actually paid a negative rate. The corporate tax rate is 21%, meaning the two automakers enjoyed a roughly $8.2 billion tax-break windwall.

Some of those tax savings found their way into the pay envelopes of the GM and Ford’s top executives and board members. Executive salaries shot up by one-third (32%) over that five-year period—top executives at the domestic automakers made an average of $14.2 million each last year. Meanwhile, the median wages of Ford and GM employees have gone up just 8.8% over the past five years, only half as fast as the rate of inflation.

Source: Americans for Tax Fairness

Source: Americans for Tax Fairness

In 2022, Ford CEO James Farley made 323-times more than his median employee, while the top boss at GM, Mary Barra, made 281-times more than the average worker in her company. On top of the $652 million in executive salaries, GM and Ford paid the members of their corporate board of directors $51 million over those five years. According to a well-known survey from several years ago, corporate board members as a whole work an average of 248 hours annually–meaning the total 27 board members of the two firms were each compensated at roughly $1,860 per hour in 2022 alone.

Source: Americans for Tax Fairness

Source: Americans for Tax Fairness

But executive and board compensation pales in comparison to the billions GM and Ford spent enriching their shareholders with stock buybacks and dividend payments. The two automakers together paid their corporate shareholders—who are predominantly ultra-wealthy—$14.1 billion in dividends over the past five years. That is about 34 times more than they paid the federal government in taxes. Additionally Ford and GM bought back $3.6 billion of their own stock, which raises the share price for owners without making any real reinvestment. The amount Ford and GM spent on stock buybacks could have been used to give a $18,000 bonus to each of their nearly 200,000 American employees.

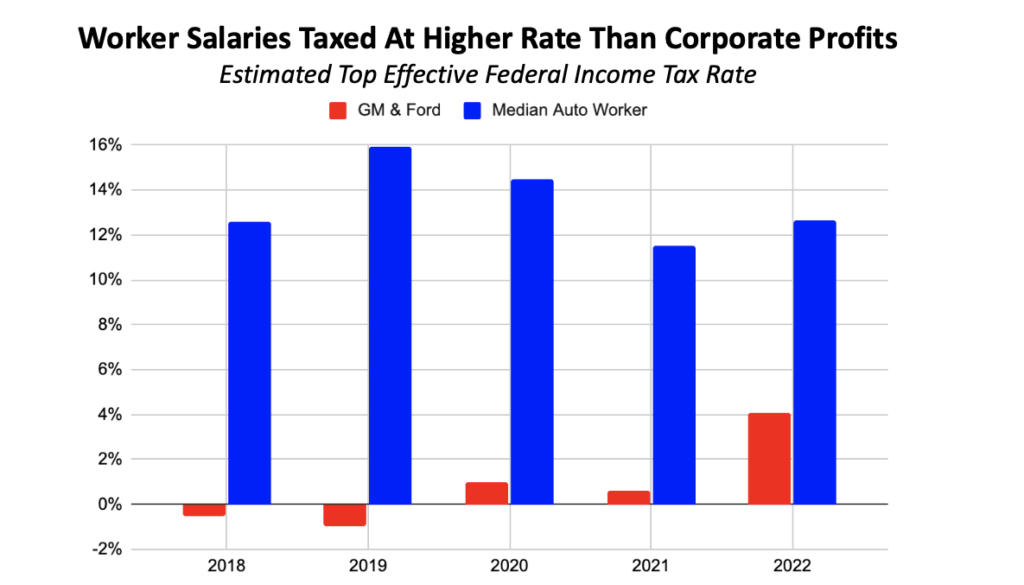

The tax system is rigged to benefit multinational corporations over the workers who keep them running. While Ford and GM are able to use dozens of loopholes and exemptions to artificially reduce their tax bill, the vast majority of their workers are stuck footing the bill. Based on Ford and GM’s SEC reported employee income data, we project that the median auto worker could have been paying up to 16% in income taxes on their salary, while GM and Ford never paid more than 4.5% in the last half decade.

Source: Americans for Tax Fairness

Source: Americans for Tax Fairness

IN BIDEN’S ECONOMY UNION WORKERS ARE BEGINNING TO WIN AGAIN

The UAW’s firm stance in negotiating for substantially better pay is part of a larger resurgence of the American labor movement. The decline of that movement over the past 40 years–along with the concurrent rigging of the tax code in favor of the wealthy–are both significant contributors to the nation’s widening wealth and income gaps. The renewed strength of labor–this year unions across the country have won the biggest pay increases in over 15 years– can, along with fair-share tax reforms, narrow those gaps. Some of the most prominent worker wins recently include:

- UPS Drivers got a 48% average pay raise over the next 5 years;

- American Airlines pilots got a 46% wage increase over the next 4 years;

- Delta Airlines pilots got at 34% wage increase over the next 4 years;

- West Coast dockworkers got a 32% wage increase over the next 6 years;

- Kaiser Permanente nurses in California got a 22.5% wage increase over the next 4 years.

The new 1% stock buyback tax, enacted by President Biden and congressional Democrats as part of 2022’s Inflation Reduction Act (IRA), has already raised $3.5 billion in new revenue just in the first half of 2023. The IRA’s 15% corporate alternative minimum tax will finally end the scandal of huge profitable corporations paying little or nothing in federal income taxes. The IRA’s long-overdue restoration of adequate funding for the IRS will allow it to crack down on corporate tax cheats.

And more corporate tax reforms are being proposed. President Biden and Senator Wyden (D-OR) have proposed raising the stock buyback tax from 1% to 4% to discourage the practice further. Representative Doggett (D-TX) has introduced legislation to close a major loophole that allows corporations to deduct the cost of multi-millionaire bonuses for executives from their taxes.