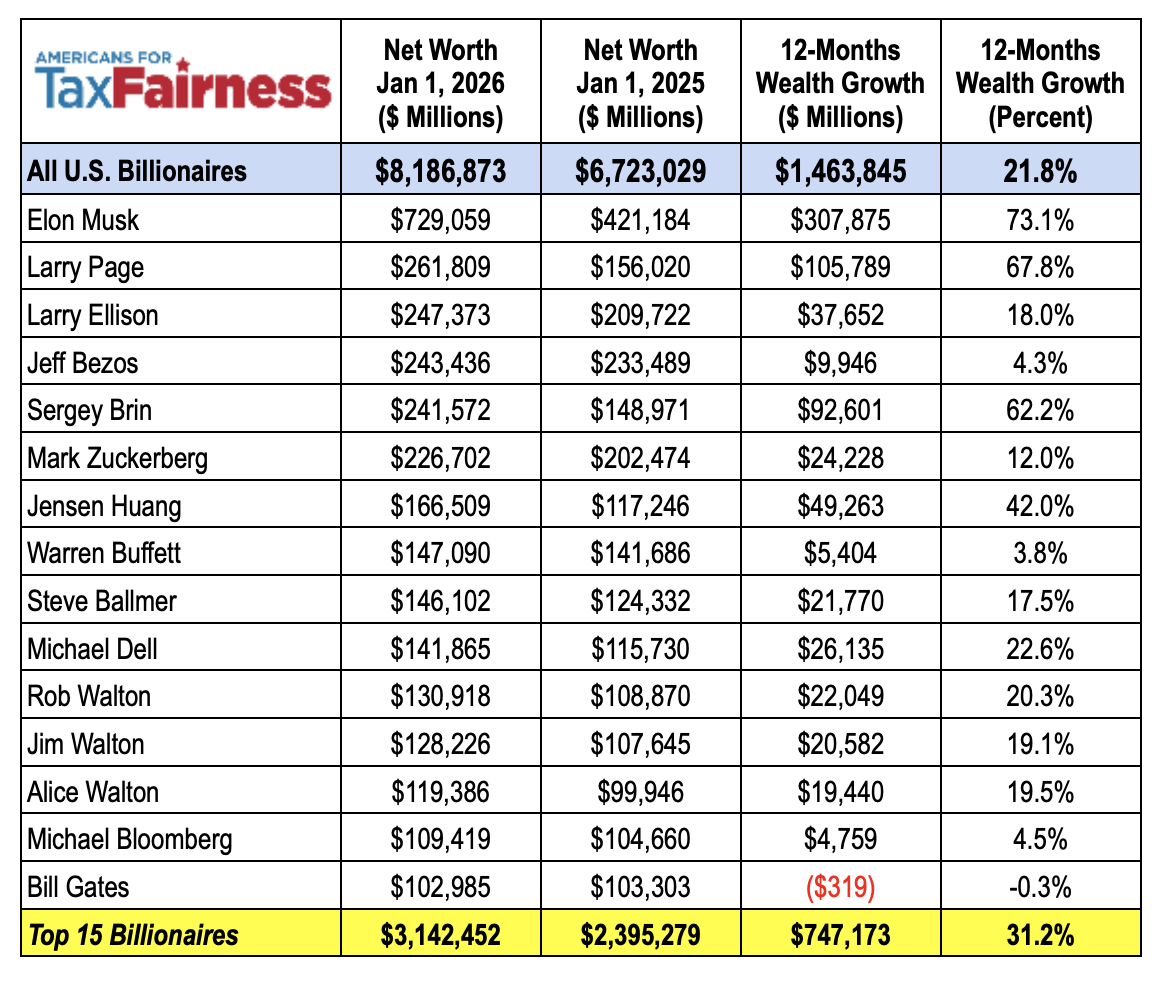

22% Boost in 2025 Lifted Total Wealth of Nation’s Billionaires to $8.2 Trillion

Even as families struggle with unaffordable healthcare, housing and groceries, billionaires are flourishing in Donald Trump’s America: their total wealth jumped by over a fifth (22%) during 2025, rising from $6.7 trillion to $8.2 trillion, according to a new report from Americans for Tax Fairness (ATF) based on Forbes data. The number of billionaires also increased, from 814 to 935. And because of a gaping loophole, it’s possible none of their wealth growth will ever be taxed.

“It turns out the members of Billionaires Row at Donald Trump’s inauguration were right to celebrate his swearing in, since it meant a trillion and a half dollar increase in their class’s collective fortune,” said David Kass, ATF’s executive director. “Because of the Republican failure to renew premium tax credits, the cost of healthcare has skyrocketed this year for millions of families. Meanwhile, ordinary Americans cannot afford a decent place to live and every trip to the supermarket induces sticker shock. We could address the affordability crisis if billionaires paid their fair share of taxes on their wealth-growth income–thankfully there’s a bill in Congress from Sen. Ron Wyden (D-OR), Rep. Steve Cohen (D-TN), and Rep Don Beyer (D-VA) that would require them to do just that.”

Source: Americans for Tax Fairness analysis of Forbes data

The concentration of wealth reflected in the latest numbers is breathtaking. The world’s richest man, Elon Musk, is now worth over $700 billion, or more than the entire Forbes 400 list of richest Americans in 1997 (unadjusted for inflation). The 14 wealthiest billionaires at the beginning of 2026 are worth more than every American billionaire combined from as recently as 2020.

Under current law, the wealth growth of billionaires can escape taxation completely, even though it is their most important form of income. Unless they sell the underlying assets, the current recipients of that growth owe nothing–and when the assets are inherited, those wealth gains simply disappear for tax purposes.

The Billionaires Income Tax introduced last year by Sen. Wyden and Reps. Cohen, and Beyer would annually tax the wealth growth of America’s ultra rich. Tax on publicly priced assets like stocks and bonds would be due each year; that on hard to appraise assets like private businesses and fine art would still be due only at the profitable sale of the asset, but with interest charged for the tax-free years. The plan–which would also apply to non-billionaire households with over $100 million in income three consecutive years–would raise over $500 billion in revenue over 10 years.