The Honorable Ron Wyden

Chairman, Senate Committee on Finance

219 Dirksen Senate Office Building

Washington, D.C. 20510

Dear Mr. Chairman:

On behalf of the Americans for Tax Fairness, a coalition of hundreds of national and state-based organizations, I am writing to express our significant concerns with the Enhancing American Retirement Now (EARN) Act, which the committee is scheduled to mark-up tomorrow. We are concerned that, over time, this legislation will:

- Exacerbate inequality by giving the rich more tax breaks to shelter more investment income for longer and failing to meaningfully assist low- and middle-income workers and their families to save for retirement.

- Increase the racial wealth gap, not reduce it.

- Reduce federal revenues beyond the 10-year window when the true cost of giveaways to the wealthy will fully manifest themselves.

We are especially concerned that the complex set of phase-ins, the encouragement of Roth IRAs and 401(k)s, the revenue losing measures, and the dozens of smaller provisions in the law—as well as the lack of analysis of its long-term cost and distributional impact—mean that the risks of the legislation are not now well understood. We urge you not to proceed without a full review of the legislation’s impact on inequality, the racial wealth gap, and the long-term impact on the federal budget. The analysis we set out below indicates the proposal would do more harm than good on these criteria.

Analysis of key components of the EARN Act

The Chairman’s mark of the EARN Act is very similar to the Securing a Strong Retirement (SECURE) Act (H.R. 2954), bipartisan legislation that passed the House of Representatives earlier this year. But sound policy is more important than bipartisanship. Numerous critiques of the SECURE legislation and the current major flaws of our retirement savings system, which need to be addressed in retirement tax legislation, have been published in recent months. These analyses form the basis of this letter of concern about the EARN Act:

- Center for American Progress: Tax Breaks for Retirement Savings Do Not Help the Workers Who Need Them Most

- Center on Budget and Policy Priorities: House Bill Would Further Skew Benefits of Tax-Favored Retirement Accounts

- Tax Policy Center:

- Washington Center for Equitable Growth: Retirement tax incentives supercharge the fortunes of wealthy Americans

- Washington Post op-ed by Daniel J. Hemel, NYU Law School: The American retirement system is built for the rich

- Daniel J. Hemel and Steve Rosenthal, Tax Policy Center: Mega-IRAs, Mega-401(k)s, and Other Mega-Retirement Accounts, submitted as a statement for the record to the Senate Finance Committee hearing: “Building on Bipartisan Retirement Legislation: How Can Congress Help,” July 28, 2021

- Michael Doran, University of Virginia Law School: The Great American Retirement Fraud

Criteria for Retirement Security Reform that Should Guide EARN Legislation

We believe three core principles should form the foundation of retirement tax system legislation such as the EARN Act:

- Any new incentives should strongly favor those at the greatest risk of retirement insecurity—low- and middle-income workers and their families—rather than skew toward the wealthy thereby exacerbating inequality.

- New incentives should significantly reduce, not exacerbate, the racial wealth gap.

- The cost of the legislation, including costs that extend beyond the 10-year window when the tax giveaways fully take effect, should be transparent not hidden by accounting games such as the use of Roth IRAs, or delaying revenue losing measures. Ideally, these costs should be truly paid for by scaling back so-called Mega IRAs and other provisions used as tax shelters by the ultra-wealthy.

Unfortunately, we believe the EARN Act fails on these core principles.

Our retirement tax system is broken. Each year, it showers hundreds of billions of dollars of tax breaks primarily on the richest and Whitest households. But few of these incentives reach the households that need help the most. That’s because many lower- and middle-income workers and their families spend their full paychecks on immediate necessities and lack adequate income to save for retirement.

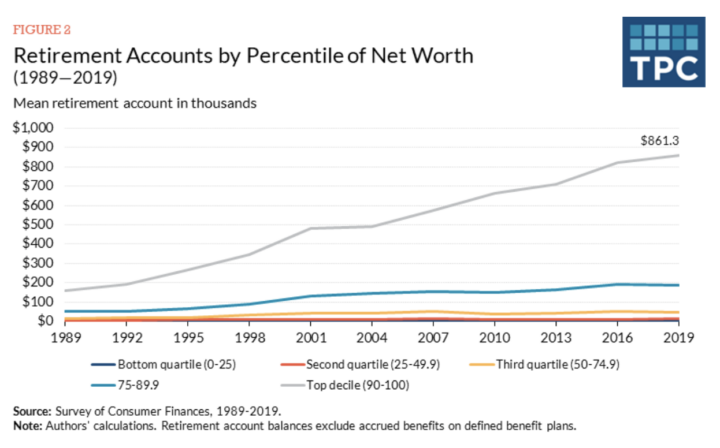

The retirement account balances for the wealthiest households vastly outpaced other households. A chart in the Appendix from the Tax Policy Center using Federal Reserve data shows that the average retirement account balance for a household in the richest 10% was $861,000 in 2019, whereas the average balance for the bottom 50% was just under $7,000—a figure that is so low because so few have retirement accounts.

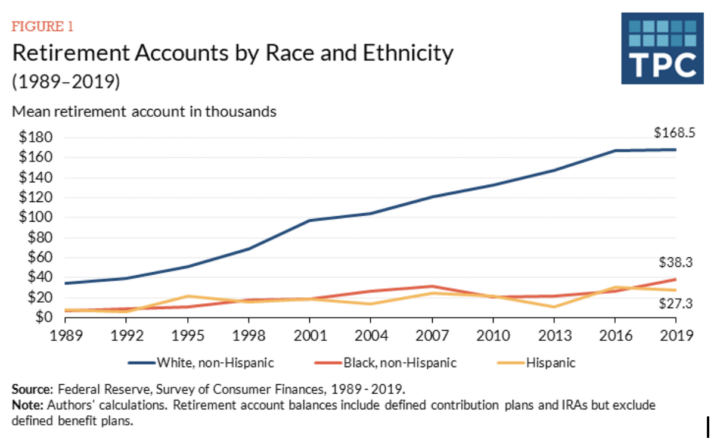

The problem is similar when it comes to retirement accounts by race. Another chart in the Appendix from the Tax Policy Center using Federal Reserve data shows that in 2019 white families held an average account balance of $168,500, whereas Black and Hispanic families held $38,300 and $27,300, respectively. And while 57% of White families held retirement assets, only 35% of Black families and 26% of Hispanic families had savings in retirement accounts.

At a more granular level:

- As of 2019, nearly 29,000 taxpayers had amassed “mega-IRAs”—individual retirement accounts with balances of $5 million or more. Meanwhile, about half of households had no retirement accounts at all.

- In 2018, the most recent year for which data is available, 58% of taxpayers with wage income made no contribution to 401(k)-style plans; the average contribution for those who made contributions was $5,500 and just 8.5% reached the contribution cap.

- As of 2020, 63% of households had no IRA accounts.

The EARN Act will do little to correct these disparities and is likely to make them worse. Its beneficiaries are overwhelmingly the already wealthy and their asset management firms that will earn even fatter fees. While making the Saver’s Credit a government refundable match is a solid first step, taken as a whole, the $1,000 annual credit would do little to help the workers and families most at risk of having insufficient savings in their old age.

Benefits of the EARN Act for American Workers and Families

There are several provisions of the bill that make some marginal improvements over the SECURE 2.0 Act and/or over existing law by modestly helping low-and middle-income people whose retirements are less secure:

- It improves the existing Saver’s Credit, which subsidizes retirement account contributions for those with low or moderate incomes: It does this by, beginning for 2027, providing a 50% government match for contributions up to $2,000 by low- and middle-income taxpayers to IRAs, 401(k)s and other retirement accounts. That extra $1,000 a year could add a small boost to the account balances of the low- and middle-income households, but it would still leave them with far less than the new incentives for the wealthy in the bill. It would also increase the number of people who qualify for a credit by phasing out the match for income between $41,000 and $71,000 for joint returns.

- It will encourage workers’ participation in 401(k) and 403(b) retirement plans: By encouraging employers with a tax credit to automatically enroll their workers in retirement plans (unless the workers opt out); allowing employers to consider employees’ student loan payments for purposes of matching contributions; and requiring employers to expand part-time worker coverage. However, we prefer the automatic enrollment provisions in the SECURE 2.0 Act, which would require companies to create auto-enrollment rather than induce them with a tax break. At the same time, we caution that auto-enrollment requires strong notice and education to avoid transfer of earnings workers need to make ends meet into restricted accounts where funds are not available to meet short-term needs.

Unfortunately, these improvements do not correct the fundamental flaws in our retirement system and other provisions described below would provide even greater retirement tax benefits to those who need it the least.

Concerns with the EARN Act

- The EARN Act raises the age for required minimum distributions, encouraging tax sheltering by the wealthy. The Chairman’s mark delays the required distributions from IRAs and 401(k)s from age 72 to age 75 beginning in 2032—hiding the significant revenue loss outside the budget window. Required minimum distributions (RMD) help ensure that retirement savings that were untaxed earlier in life are ultimately taxed during the individual’s life. Delaying the start of distributions will help the rich shelter their income for longer periods of time and pass on more wealth to their heirs. Delaying required distributions will not help lower-income retirees who depend on their savings to make ends meet and who typically have a much shorter life expectancy than the wealthy.

A National Academy of Sciences study found that among men born in 1960, those in the top income quintile could expect to live 12.7 years longer at age 50 than men in the bottom income quintile. It also found that women in the top quintile would live 13.6 years longer than women in the bottom quintile. The Center for Disease Control reports that in 2018 Whites at birth were expected to live 4.2 years longer than Black Americans, 78.6 years vs. 74.7 years. The RMD delay does not benefit those who die before age 75.

- The larger catch-up limits in the EARN Act reward higher-income savers. The EARN Act would allow individuals near retirement age to make additional catch-up contributions to their retirement accounts. Currently, the underlying annual contribution limit for tax-favored employer-sponsored retirement accounts is $20,500. However, people aged 50 or above can contribute an additional $6,500, for a total of $27,000 of annual tax-favored contributions. The Chairman’s mark would raise that $6,500 limit to $10,000 (indexed for inflation) for 60-, 61-, 62- and 63-year-olds.

Further increasing contribution limits to retirement accounts only rewards those with the disposable income to contribute more. It is obvious that those who can afford to make $10,000 in additional contributions to their retirement plans have high incomes and other savings. According to a Vanguard survey of its account holders, only 15% of eligible account holders currently make these “catch up” contributions and over half of those make more than $150,000 a year.

- Encouraging Roth IRAs favors the wealthy and increases long-term costs. The EARN Act’s giveaways to the wealthy are offset by more giveaways to the rich: encouraging savers to favor Roth accounts over traditional accounts. Expanding the use of Roth accounts will increase revenues in the first 10 years, since taxes are paid before amounts are contributed to a Roth account. (By contrast, savers get immediate tax deductions when they contribute to a traditional IRA or 401(k), which loses revenue up front). However, the long-term budget impact increases costs since Roth account distributions are tax free upon withdrawal. Under the Chairman’s mark, the Roth IRA provisions raise $39 billion in the first 10 years—to make it look like the bill’s costs are offset—but these revenues are a mirage since the measure will cost even more in later years since withdrawal of both the principal and investment earnings from Roth accounts are tax-free.

There is a Better Way

We believe the Finance Committee should take a different approach in order to create a more equitable retirement system that gives workers and their families more opportunity to have a secure retirement. The options below would help advance that goal and are explained in greater detail in the reports noted at the beginning of his letter:

- Lower, rather than raise, contribution limits for the wealthy: For example, it should prevent those who contribute to 401(k)s or IRAs from also contributing to cash balance plans. Today, lawyers and other professionals can contribute $100,000+ annually to these retirement plans, amassing millions in these and other plans.

- Rein in Mega IRAs: A small number of wealthy households have exploited loopholes to accumulate massive balances in tax-favored retirement savings accounts. According to the Center for American Progress, in 2019 just less than 500 taxpayers held accounts of more than $25 million, with an average balance of $154 million. These so-called mega IRAs have skyrocketed in number over the past decade: Between 2011 and 2019, the total number of accounts with balances of $5 million or more nearly tripled from 9,057 to 28,615. Wealthy investors can use these accounts to avoid paying capital gains taxes43 on appreciated assets and as a strategy to dodge estate taxes otherwise due on accounts passed on to heirs. They propose several reforms to curb the use of qualified retirement plans as huge tax shelters for the wealthy.

- Establish a lifetime limit on all tax-favored retirement benefits—as proposed by the Obama-Biden administration. Under the Obama-Biden proposal, once an individual reached the cap, she could no longer make additional contributions or receive additional defined benefit accruals, though her balance could continue to grow with investment earnings. An individual still could use tax-favored retirement savings arrangements to ensure a comfortable retirement for herself and her spouse, but IRAs, defined contribution plans, and defined benefit plans would no longer be tools for preserving dynastic wealth.

- Raise Supplemental Security Income (SSI) asset limits to improve financial security for low-income elderly and disabled people, as recommended by the Center on Budget and Policy Priorities. SSI provides monthly cash assistance to older and disabled people with very low incomes. To be eligible, they may not have savings of more than $2,000 ($3,000 for a couple). We recommend that a bipartisan proposal from Senators Rob Portman and Sherrod Brown be added that would raise those limits to $10,000 and $20,000, respectively, indexed to inflation. This would allow many more elderly or disabled people with modest savings and very low incomes to get SSI support.

This week, the Finance Committee will consider dozens of amendments to retirement tax rules. Some are helpful, to a small degree. Some are harmful. And many are technical—and harmless. But, most importantly, none of them pursue fundamental reform of our retirement tax system that we believe is necessary now.

Sincerely,

Frank Clemente

Executive Director

APPENDIX