Richest 748 Americans’ Wealth Up 77% Since Cuts Passed, Tops $5 Trillion; Debt Caused by Trump Tax Cuts Now Used By GOP As Excuse to Cut Services

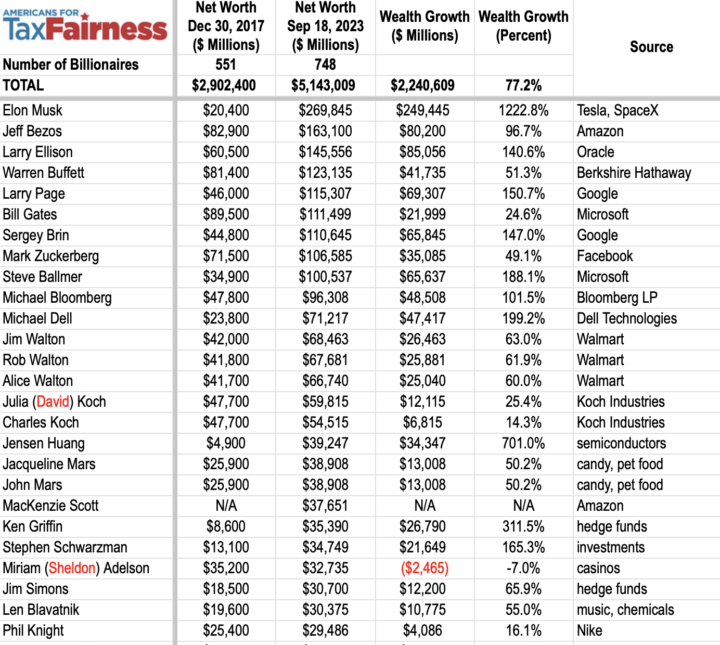

The collective fortune of America’s 748 billionaires topped $5 trillion in September 2023, a near record high, and up an astounding $2.2 trillion (77%) since enactment of the Trump-GOP tax law—a reckless handout so heavily slanted towards the rich that it undoubtedly contributed to billionaires’ eye-popping wealth growth over the past nearly six years. Parts of the Trump-GOP tax law have already expired, or are scheduled to expire at the end of 2025, but Republicans want to make the whole package permanent at an estimated cost of $3.8 trillion—billions of which will undoubtedly flow into billionaires’ already bursting bank accounts.

Billionaire wealth growth was calculated by Americans for Tax Fairness (ATF) based on data collected from Forbes. It’s the latest report from ATF in a series tracking billionaires’ rising riches that began early in the pandemic.

Promoted as a boon to ordinary Americans, the Trump-GOP tax law has failed working families while moving even more money to the pockets of the ultra-wealthy. This contrast is nowhere more visible than in the explosion of billionaire wealth compared to the assets of working Americans: the nation’s handful of billionaires now hold one-and-a-half times more wealth than the entire bottom half of society of around 165 million people.

Elon Musk experienced the greatest wealth boom, his fortune growing over eleven-fold, to nearly $270 billion. Personal-computer mogul Michael Dell tripled his fortune, while Amazon founder Jeff Bezos doubled his to more than $163 billion. Demonstrating the political power that grows alongside rising wealth, Oracle executive chairman Larry Ellison–who’s forty percent, or over $85 billion, richer than he was when the GOP tax law came into effect–plans to reward one of his GOP benefactors with tens of millions of dollars in campaign contributions.

Source: Americans for Tax Fairness

“The staggering runup of billionaire wealth since the passage of the Trump-GOP tax law is a sure indicator of who that law was meant to serve–and who it would go on serving if Republicans succeed in their plan to make its expiring provisions permanent,” said David Kass, executive director of Americans for Tax Fairness, “Instead of extending tax breaks for billionaires, Congress should be working to better tax them through President Biden’s Billionaire Minimum Income Tax and other reforms in how we tax the super-wealthy.”

Under current law, almost none of that wealth gain–billionaires’ biggest form of income–will likely ever be taxed. Investment gains are only taxed when the underlying asset is sold, but billionaires and other hyper-wealthy people don’t need to sell in order to benefit: they can obtain low-interest loans against their rising fortunes and live luxuriously tax-free. And when the gains are handed down to the next generation, they completely disappear for tax purposes.

A prior ATF analysis of leaked billionaire tax returns data found that they paid an effective federal income tax rate of just 4.8% over six years. Yet despite the evidence that billionaires and other wealthy elites are not paying their fair share, Republicans are working hard to cut their taxes even more. Corporate tax breaks Republicans passed through the House tax-writing committee this summer–the first step in their effort to make expiring provisions of the Trump law permanent–would give the richest 1% of households and foreign investors 71% of the money in the first year, while offering middle income families a paltry $50 on average.

Worse than the Republicans’ desire to give their political donors huge tax cuts is that they want hard-working Americans to pay for them through reduced public services. The spending plan House Republicans put forth as the price of averting a government shutdown would:

- Slash funding by 80% for schools serving low-income students, which would impact 26 million students and eliminate up to 226,000 educator jobs;

- Kick 82,000 kids out of preschool;

- Raise housing costs by eliminating Housing Choice Vouchers for 20,000 families, including approximately 6,000 seniors citizens; and cut the HOME Investment Partnerships Program, meaning 20,000 fewer affordable homes would be built;

- Undermine critical health research and increases the likelihood of future pandemics by cutting $3.8 billion from the National Institutes of Health;

- Increase the risks of lead exposure for 78,000 children by rescinding over $564 million in funding for lead-paint removal;

- Increase energy costs for rural Americans by slashing $2 billion of funding for agricultural producers and rural small businesses that convert to renewable energy systems.

At a time when child poverty has more than doubled due to Republicans refusal to renew expanded child tax credits, the tax and spending priorities of Republicans should be reversed. Billionaires’ collective wealth growth of $2.2 trillion would be more than enough to pay for a 10-year expansion of the CTC to $3,600 per-child.

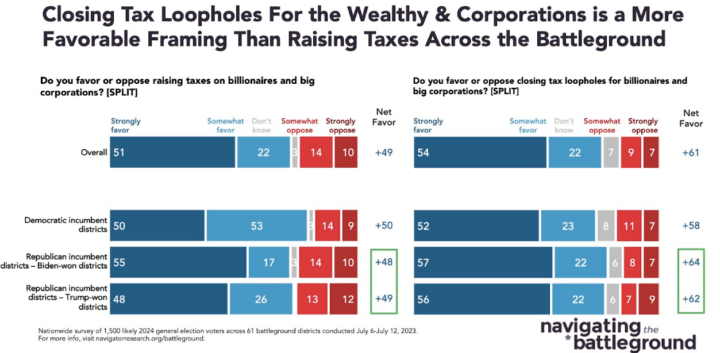

Raising taxes from billionaires and the corporations they control is incredibly popular. A recent survey from August 2023 conducted by Navigator/Impact Research in 61 battleground congressional districts found that 73% of likely voters favor raising taxes on billionaires and big corporations, and slightly more (76%) at least support closing tax loopholes that benefit those two classes of super-wealthy taxpayers.