New Report Shines Spotlight on Republicans’ Fraudulent Claim That They Are The Party of “Deficit Reduction”

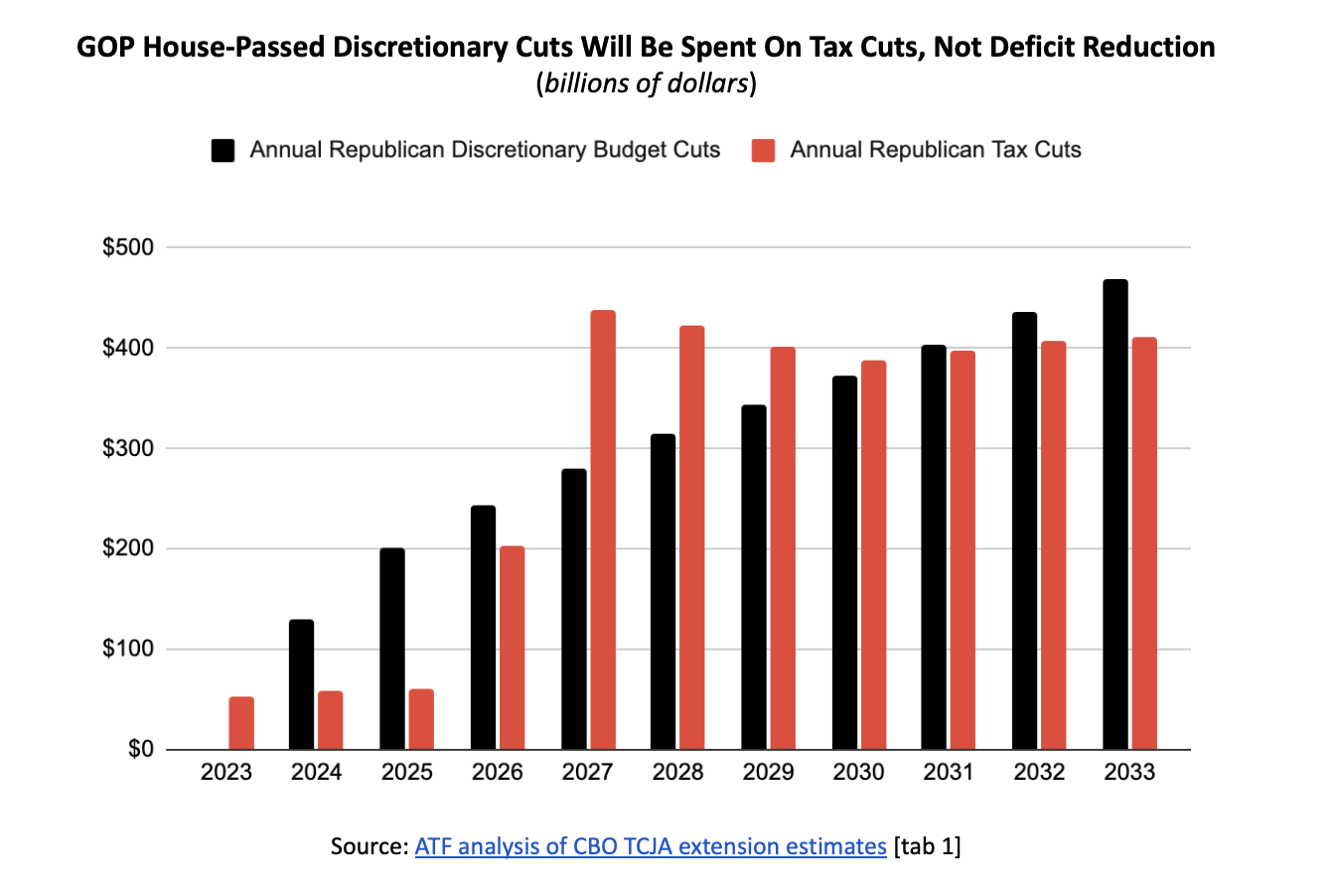

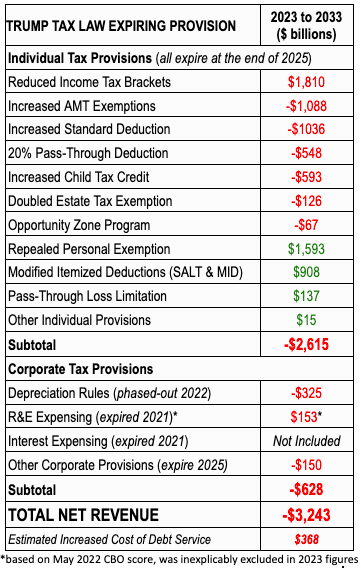

WASHINGTON, D.C. – Permanently extending expired and expiring parts of the 2017 Trump-GOP tax law—as Republican leaders have promised to do—would add at least $3.5 trillion to the national debt over the next decade (including $370 billion in increased borrowing costs), the Congressional Budget Office reported yesterday. The $3.2 trillion in lost revenue from these tax giveaways would erase all of the $3.2 trillion of discretionary budget cuts that House Republicans passed earlier this month as their price for preventing a federal default and instant recession.

“As the CBO report makes clear, the GOP is fine with piling on more government debt if it means shielding their rich friends and benefactors from paying their fair share of taxes,” said David Kass, executive director of Americans for Tax Fairness. “We know Republicans’ long-time strategy is to gut the programs and services that working families rely on and transfer those public dollars directly into the pockets of the ultra-wealthy. But it’s still shocking to see the cycle play out so brazenly.”

The $3.5 trillion increase in debt from permanently extending provisions of the 2017 law that have either expired or will expire after 2025 would be on top of the $1.7 trillion the Trump tax law has already added to the national debt, demonstrating once again that Republican budget cuts are just a smokescreen to subsidize massive tax cuts for the very wealthy and corporations. It also doesn’t include the additional $628 billion in corporate tax giveaways (discussed below) that Republicans are pushing. And while the House-passed GOP bill would cut an estimated total of $4.8 trillion from future deficits, it does so by relying on massive cuts to vital programs, including a $460 billion roll back of President Biden’s student loan forgiveness plan, $570 billion from eliminating green energy and climate incentives, and $550 billion in reduced interest payments.

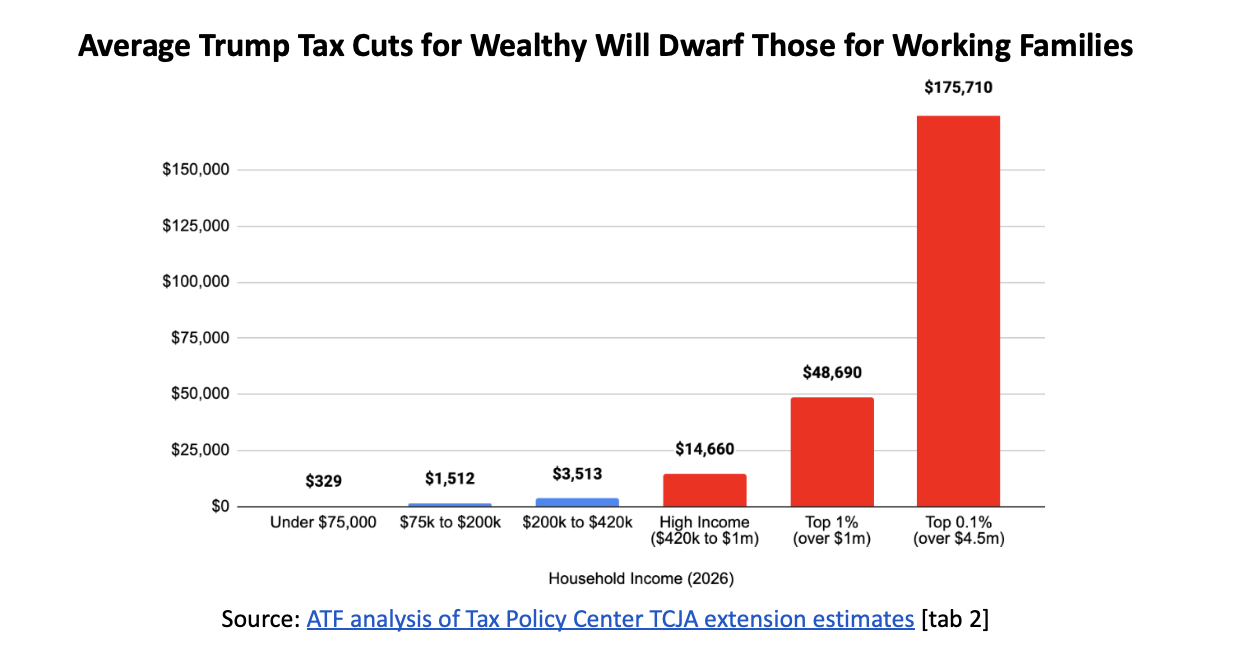

The Trump tax provisions Republicans want to permanently extend are heavily slanted towards the wealthy: households with incomes over $4.5 million would get an average tax cut of $175,000 in the first year alone. Those with incomes over $1 million would get a nearly $50,000 tax cut. Meanwhile, most taxpayers—55%, or 102 million households making less than $75,000 a year—would get an average tax cut of just $330 a year—less than a dollar a day. Households making under $50,000 a year would get an average tax cut of less than $200— about 50 cents a day.

In contrast, the cuts House Republicans are demanding in exchange for temporarily lifting the debt ceiling so America can pay its bills would, among other impacts: jeopardize healthcare coverage for 21 million people; strip 1.7 million women and children of nutrition assistance; threaten food aid going to another 900,000 individuals; raise housing costs for 640,000 Americans; and reduce or impair other public services for veterans, students, rail and air travelers and more.

Republican leadership has strongly signaled their plans to bring to a vote permanent extension of the expired and expiring Trump tax cuts, with nearly all House Republicans already on record supporting the plan, including 96 members of the caucus co-sponsoring legislation to make it permanent. The House Way and Means Committee is expected to introduce legislation to retroactively restore corporate tax components that have already expired.

The most regressive provisions in the Trump tax extension package include the expanded estate tax exemption, which would only benefit the heirs of couples worth over $14.4 million; the passthrough business deduction, which gives over half its tax benefit to just the top 1% households; and the Opportunity Zone program, where participants in in a recent study were found to have an average annual income of $4.9 million.

Furthermore, these figures do not include the at least $628 billion corporate tax giveaways Republicans plan on passing on top of the deep (and permanent) corporate tax cuts they enacted in 2017, which slashed the official corporate income tax rate by three-fifths, from 35% to 21%. The year after the Trump tax law went into effect, corporations with over $10 million in assets saw their effective tax rate drop from 16% in 2014 to just 9% in 2018, while 9,000 wealthiest multinational corporations paid an effective rate of just 7.8%. Nevertheless, corporate giants are lobbying hard to roll back the positive few pay-fors in the Trump tax law, and Republicans seem eager to oblige.

Congress should oppose renewing the Trump tax cuts for the wealthy and instead significantly raise taxes on the rich and corporations so they pay closer to their fair share. President Biden’s budget does just that, by raising $5 trillion in new revenue. Republicans refusal to negotiate on any tax loophole closures as part of a debt ceiling package is hypocritical. Americans for Tax Fairness urges members of Congress to pass a clean debt ceiling deal.

###