10% surtax on incomes over $2 million could raise $635 billion over 10 years

The United States is one of the most economically unequal nations in the developed world, with income and wealth gaps not seen here in almost 100 years.[i] Most of the income and wealth gains of the last decade have gone to the richest 0.1%—households with annual incomes of $2.4 million and wealth of at least $32 million.[ii]

The richest 0.1% now own more than the bottom 80%.[iii] The richest 1% own far more than the bottom 90%.[iv]

The tax code contributes to this inequality by favoring income from wealth over income from wages and salaries. The richest 0.1% receives two thirds of their income from investments—they get their money mostly from Wall Street.[v] Working families depend on wages—they earn their living on Main Street. But our rigged system taxes most investment income from wealth at a top rate of 20%, whereas the income from work is taxed at a top rate of 37%.

We need a new direction to create a society and an economy that works for all of us, not just those at the top. That means the wealthiest Americans must pay their fair share of taxes so we can better protect Social Security, Medicare and Medicaid, and invest in education, affordable childcare, decent housing, infrastructure, clean renewable energy and more.

THE MILLIONAIRES SURTAX

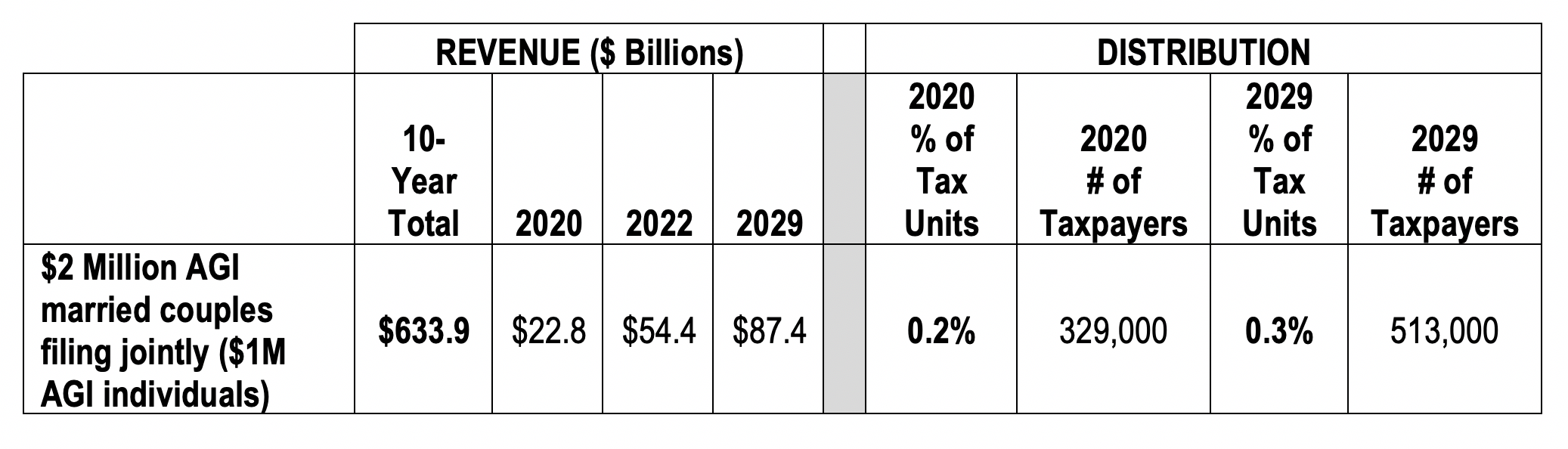

Major progressive tax reforms are needed to ensure that the richest Americans pay their fair share. Sen. Chris Van Hollen (MD) and Rep. Don Beyer (VA) have introduced identical bills that provide an excellent start: the Millionaires Surtax (S. 2809 / H.R. 5043). This legislation, which is likely to garner broad support among lawmakers, places a Millionaires Surtax on a taxpayer’s income above $2 million—near the income threshold for the richest 0.2%. In other words, 99.8% of taxpayers would not pay the surtax. This would raise $635 billion over 10 years per a Tax Policy Center estimate.

Here’s how the Millionaires Surtax would work:

- A 10-percentage-point surtax would be applied on all income above $2 million for married couples filing jointly and $1 million for single filers. (It would apply to a taxpayer’s modified Adjusted Gross Income (AGI).[vi]) The surtax would be assessed on all income: wages and salaries and investment income, such as from stock dividends and stock sales.

- The surtax would raise the top tax rate on wages and salaries from 37% to 47% (plus the 3.8% in Medicare taxes on the highest earners).

- The top capital gains tax rate would rise from 20% to 30% (plus a 3.8% surcharge on net investment income of the highest earners—married taxpayers filing jointly with modified AGI above $250,000 a year and singles above $200,000[vii]).

- The surtax will close the gap between the top tax rate on wages and salaries compared with the top tax rate on investment income. Currently the 20% investment tax rate is a little over half (54%) of the 37% top tax rate on wages and salaries. That increases to nearly two-thirds (64%) with the surtax.

- The surtax would not be indexed for inflation.

- The surtax will raise $635 billion over 10 years, per the Tax Policy Center.[viii]

- In 2020, it will raise about $23 billion and grow to $87 billion by 2029. The lower revenue in the early years assumes that taxpayers will sell investments ahead of the tax taking effect and reduce capital gains realizations for the first few years after the tax is in effect, but then revert to more normal behavior later.

- In 2020, about 0.2% of tax units will be affected—that is, fewer than 2 out of every 1,000 tax units, or 329,000 tax filers. In other words, 99.8% of tax units will not pay the surtax.

- In 2029, slightly over 0.3% of tax units will be affected—just over 3 out of every 1,000 tax units, or about 513,000 taxpayers. So, 99.7% of taxpayers will still not pay the surtax in 2029.

Source: Tax Policy Center, Sept. 23, 2019

Source: Tax Policy Center, Sept. 23, 2019

ADVANTAGES OF A MILLIONAIRES SURTAX

- The Millionaires Surtax RAISES substantial revenue needed to help narrow the income and wealth gaps. The $635 billion it raises could help make healthcare and housing more affordable, improve early childhood education and reduce the cost of higher education, rebuild infrastructure and meet other neglected needs. These public investments would help boost the income and wealth of typical households.

- The Millionaires Surtax is SIMPLE. It is easy to implement, enforce and explain to the public. That’s because it is simply added onto the existing structure of tax rates in the current system—it does not require a major overhaul of the existing tax system or the creation of a major new tax.

- The Millionaires Surtax is primarily FOCUSED on the richest 0.2%. These are taxpayers making more than $2 million a year for married couples and $1 million a year for an individual.

- The Millionaires Surtax applies EQUALLY to income from wealth and income from work. All forms of income above $2 million ($1 million per individual) would be taxed—sky-high CEO salaries as well as gains and dividends from Wall Street investments.

- The Millionaires Surtax is DIFFICULT TO AVOID. The very wealthy will be less able to game the system since the surtax applies equally to all forms of income.

- The Millionaires Surtax enjoys BROAD PUBLIC SUPPORT. According to a recent poll by Hart Research Associates, almost three in four voters (73%) support a Millionaires Surtax. The Millionaires Surtax has great appeal to key swing groups like independents (76% support) and moderates (76% support). Even a majority of Trump voters (57%) and Republicans (53%) favor the policy, despite its being identified explicitly as a Democratic[ix]

- Congress has HISTORY WITH SURTAX LEGISLATION.

- In 2009, the House of Representatives voted to include a 5.4% surtax on AGI above $1 million for joint filers (but $500,000 for individuals) as a financing mechanism in the Affordable Care Act (ACA).[x] It would have raised $460 billion.[xi] The surtax was later replaced in the ACA by the 3.8% Net Investment Income Tax, which is applied to investment income of a married couple filing jointly with $250,000 in income and a single with income above $200,000.

- In 2011, the Senate proposed a 5.6% surtax above $1 million (but $500,000 for married couples filing individually) as part of a stimulus bill that would have temporarily cut payroll taxes, modernized schools, improved infrastructure, assisted the unemployed, put hundreds of thousands back to work and eased the pain of millions still reeling from the Great Recession.[xii] This surtax would have raised $450 billion.[xiii]

In short, the Millionaires Surtax is an idea whose time has come.

[i] World Inequality Database USA, 1913-2014. https://wid.world/country/usa/. Also, at The Washington Post, “Wealth concentration returning to ‘levels last seen during the Roaring Twenties,’ according to new research” (Feb. 8, 2019). The source is Gabriel Zucman, World Inequality Database.

[ii] For income see Internal Revenue Service (IRS) Statistics of Income (SOI) Division data as of 2016, adjusted. (Oct. 2018) https://www.irs.gov/pub/irs-soi/16in01etr.xls. The AGI for the richest 0.1% was $2,124,117 in 2016 (row 40). The authors assumed an increase of 3.5% a year over three years based on the 15-year average, resulting in a figure of about $2.4 million in 2019. For wealth see Emmanuel Saez and Gabriel Zucman, University of California, Berkeley, “Dynamic Documentation for Senator Warren’s Wealth Tax Policy Analysis” (accessed Aug. 8, 2019). See 7 – Visualization. http://wealthtaxsimulator.org/analysis/#7_-_visualization The graph’s X-axis shows $32.68 million in wealth for a member of the richest 0.1%.

[iii] The Washington Post based on World Inequality Database.

[iv] Center for American Progress, “Ending Special Tax Treatment for the Very Wealthy” (June 4, 2019), Figure 2. https://www.americanprogress.org/issues/economy/reports/2019/06/04/470621/ending-special-tax-treatment-wealthy/

[v] Economic Policy Institute (EPI), “Starting Fundamental Tax Reform from the Top: A Surtax on the Top 0.1 Percent” (June 2019), Slide 3. https://americansfortaxfairness.org/wp-content/uploads/Josh_Bivens_tax_the_rich.pdf

[vi] AGI is comprised of all forms of a taxpayer’s annual income less deductions. Income includes wages/salaries, dividends, capital gains, interest income, royalties, rental income, alimony and retirement distributions. Deductions include certain retirement plan contributions, medical expenses, alimony payments, half of the self-employment tax, unreimbursed business expenses, some school tuition and more.

[vii] See IRS, “Questions and Answers on the Net Investment Income Tax,” or NIIT. Per the IRS, taxpayers will owe the tax if they have net investment income from interest, dividends, capital gains, rental and royalty income, etc. and also have modified adjusted gross income over $250,000 for married couples filing jointly and $200,000 for singles. https://www.irs.gov/newsroom/questions-and-answers-on-the-net-investment-income-tax

[viii] Tax Policy Center revenue estimates and distributional analysis explained by Americans for Tax Fairness, “Tax Policy Center Revenue Estimates For 10% Surtax Proposals” (Sep. 2019). https://americansfortaxfairness.org/wp-content/uploads/Explanation-of-TPC-Surtax-Revenue-Estimate-10.15.19.pdf

[ix] Hart Research Associates Memorandum, “The Millionaires Surtax” (Nov. 1, 2019). http://surtax.org/wp-content/uploads/2019/11/ME-12697-ATF-Millionaires-Surtax-short.pdf

[x] Center on Budget and Policy Priorities, “House Health Bill’s High-Income Surcharge is Sound and Well Targeted” (Nov. 23, 2009). https://www.cbpp.org/research/house-health-bills-high-income-surcharge-is-sound-and-well-targeted.

[xi] Joint Committee on Taxation, “Estimated Revenue Effects of the Revenue Provisions Contained in H.R. 3962, The ‘Affordable Health Care for America Act,’ As Amended” (Nov. 6, 2009).

https://www.jct.gov/publications.html?func=startdown&id=3628

[xii] Govtrack.us, “S. 1660, American Jobs Act of 2011” (accessed Aug. 8, 2019). https://www.govtrack.us/congress/bills/112/s1660. Obama White House Archives, “The American Jobs Act” (Sept. 8, 2011). https://obamawhitehouse.archives.gov/blog/2011/09/08/american-jobs-act.

[xiii] Congressional Budget Office, “Letter to Senate Majority Leader Harry Reid” (Oct. 7, 2011).

http://www.cbo.gov/sites/default/files/cbofiles/attachments/s1660.pdf