Now House Republicans Hope to Use a Government Shutdown to Gut IRS’s Newly Restored Focus on Rich Tax Cheats

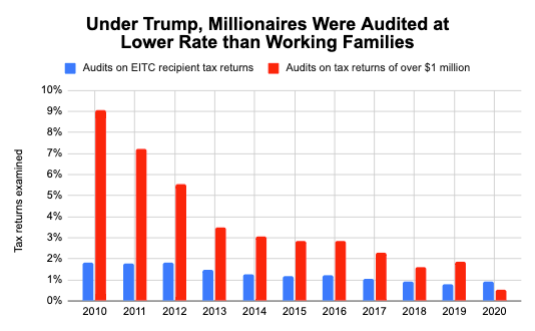

Recently published data from the Internal Revenue Service (IRS), analyzed by Americans for Tax Fairness (ATF), reveals that during the last year of the Trump administration—2020—working families receiving the Earned Income Tax Credit (EITC) were audited at a higher rate than households with income over $1 million for the first time. Throughout the last decade, independent experts warned that years of GOP-led budget cuts were forcing the agency to drastically pull back on auditing the ultra-wealthy, even as audit rates for EITC recipients held steady, leading the two rates to converge. In fact, audits of millionaires have dropped 92% over the last decade thanks to Republican efforts to starve the IRS of adequate resources. This revelation comes just before a looming government shutdown where House Republicans are proposing to cut IRS funding by $67 billion.

Source: Americans For Tax Fairness

With the passage of the Inflation Reduction Act last year, the IRS secured $80 billion to reverse this trend, allowing the IRS to begin cracking down on rich tax cheats while improving customer service and re-opening taxpayer assistance centers to eliminate the kinds of errors behind most EITC audits. House Republicans’ latest government funding proposal would gut $67 billion of that critical funding from the IRS, directly crippling the agency’s newly invigorated work pursuing tax evasion by the wealthy and big corporations.

Wealthy tax cheats have capitalized on the lack of effective enforcement. The Senate Finance Committee yesterday revealed that between 2017-20—under the Trump administration’s watch—1.5 million rich tax evaders failed to pay the Treasury up to $66 billion. Many evaded their taxes by simply refusing to even file a return. About half of those unpaid taxes (plus fines and penalties)—$34 billion—were owed by fewer than 1,000 individuals, each with income over $1 million; about a quarter was owed by 58 scofflaws who each enjoyed an annual income of over $10 million.

Even though the IRS determined that several thousand non-filers each owed at least a half million dollars in unpaid taxes over those years, due to lack of funding for the agency only a few dozen had been prosecuted or otherwise pursued. Clearly, most rich tax cheats are willing to gamble on the“audit lottery” because under Republican IRS funding levels they have been unlikely to lose.

“Extreme MAGA Republicans are demanding that their rich donors get a green light to evade taxes as the price of keeping our government open,” said David Kass, Americans For Tax Fairness’s executive director. “Just as restored IRS funding contained in the Inflation Reduction Act that President Biden and congressional Democrats enacted last year is beginning to bear fruit in the form of tougher tax enforcement on wealthy and corporate tax cheats, House Republicans want to return to the lawless days of rampant tax evasion by the nation’s wealthiest. The Senate Finance Committee’s revelations of non-filing among the rich makes it clear we need more high-end tax enforcement, not less.”

The IRS recently announced they now have the capacity to pursue an additional 1,600 millionaires who owe at least $250,000 each and 75 corporations averaging $10 billion in assets. Republicans are desperately trying to claw that money back from the IRS in service of their ultra-rich donors who have the most to gain from a weakened IRS.

However, prior to the Inflation Reduction Act, IRS annual funding had declined by 20% in recent years on an inflation-adjusted basis, from around $15 billion in 2010 to $12 billion in 2021. That budget decline included a 25% cut to the IRS enforcement budget. Agency staffing had dropped by 22% since 2010, falling from more than 94,500 full-time equivalent workers in 2010 to only about 73,500 in 2021. Enforcement staff had been slashed by 31%, with the number of dedicated revenue agents dropping over 40%.

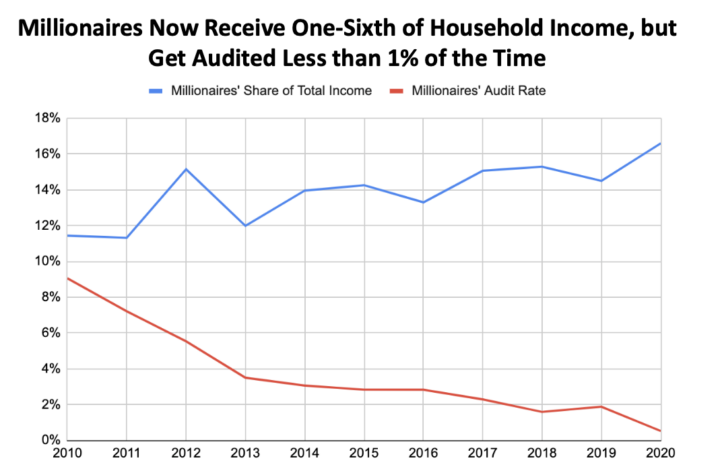

A starved IRS is great news for the super rich and mega-corporations. The top 1% of highest income households evaded $163 billion—or 28%—of the total of unpaid or underpaid taxes in 2019, according to the Treasury. So even as this small group of millionaires’ share of the national income grows, the likelihood that their tax returns will ever be examined has dropped precipitously.

Source: Americans For Tax Fairness

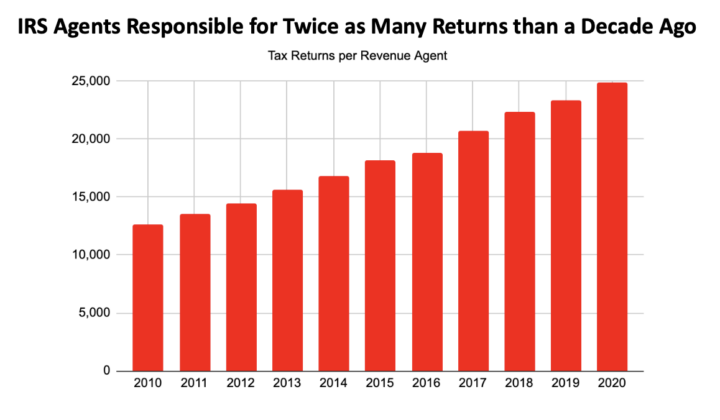

The number of revenue agents at the IRS, the only agency employees with sufficient training and experience to examine complex tax returns of the ultra-rich, fell from 14,750 in 2010 to 8,350 in 2020—a decline of 43%—even as the number of tax returns filed grew by 21.3 million during that same period. The new funding provided through the Inflation Reduction Act is being used to reverse this understaffing. Within months of receiving new funding the IRS has already recovered $38 million from 175 high-income tax cheats, reduced tax assistance wait times from 27 minutes to 4 minutes, and cut the tax backlog by 80% from a peak of 13.3 million returns in 2022 to 2.6 million at the end of the 2023 filing season.

Source: Americans For Tax Fairness

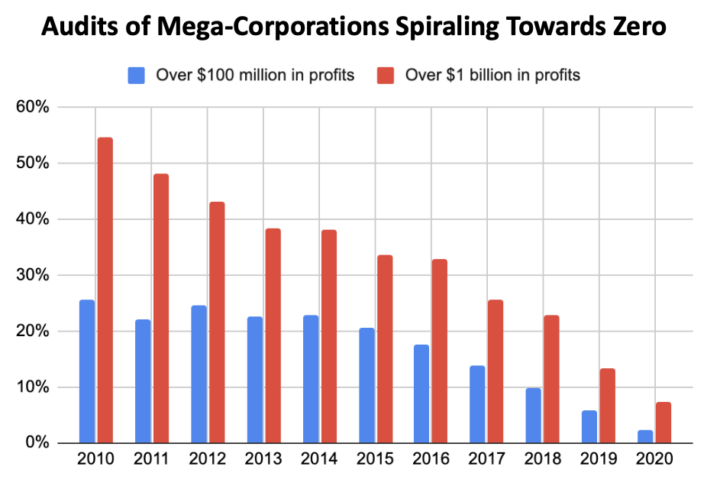

Source: Americans For Tax Fairness

Mega-corporations have also benefited dramatically in the past decade from an underfunded IRS. It used to be that about half of all billion-dollar corporations were audited each year to ensure they were not using illegal accounting tricks to get out of paying their fair share of taxes. But over the past decade, audits of corporations with over $1 billion of income have dropped 87%, to an historic low. Audits of corporations with over $100 million of income have dropped by 91%.

Source: Americans For Tax Fairness

House Republicans’ efforts to cut IRS funding also would widen the deficit they claim to care about. Earlier this year, when House Republicans first attempted to slash a similar amount of IRS funding, the Congressional Budget Office reported that such a move would reduce federal revenue by $186 billion over the next decade since the IRS would have the ability to recover less revenue from wealthy tax cheats. Giving free rein to wealthy tax cheats is also bad politics, based on ATF’s compilation of polling results. American voters consistently support enhanced funding for the IRS to crack down on tax evasion by big corporations and their uber-wealthy stockholders.