America’s Ultimate Tycoons Over Half Again Richer Than They Were Pre-Covid

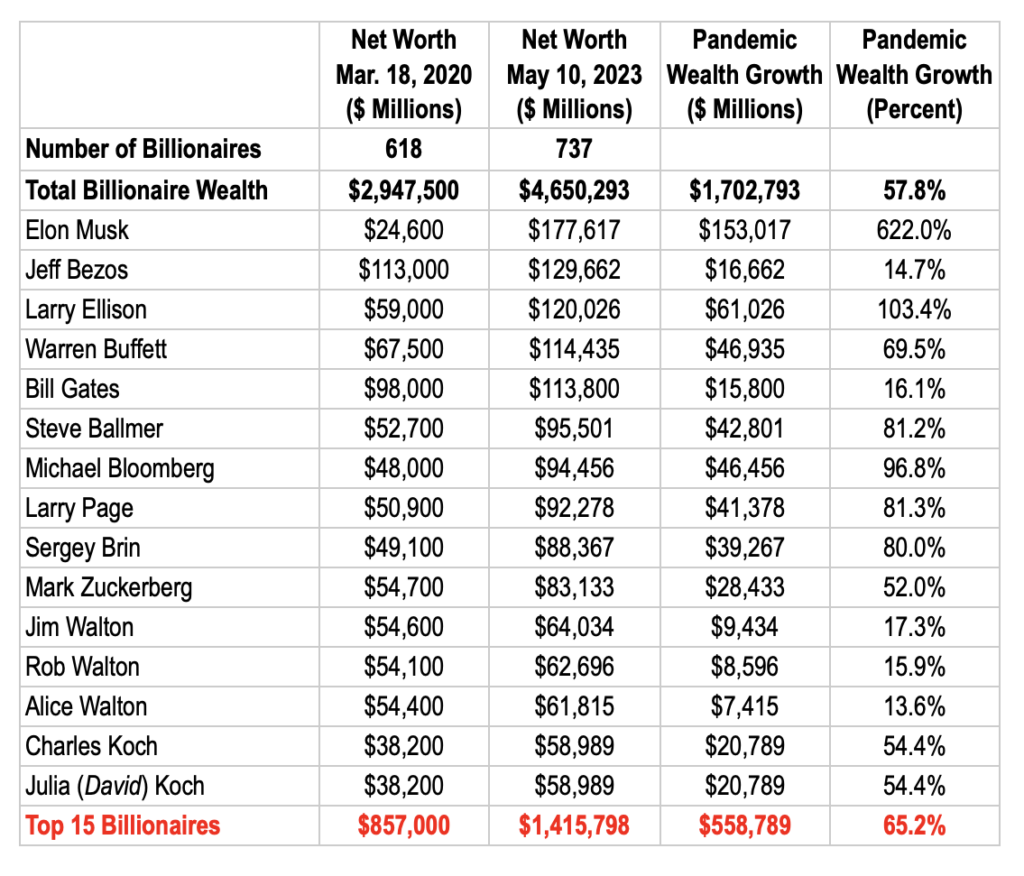

WASHINGTON – Proving that nothing stops the rich from getting richer—not even a national health emergency with millions of casualties—America’s billionaires grew $1.7 trillion, or 58%, more wealthy during the approximate three years of the federally declared Covid pandemic. The nation’s roughly 700 billionaires are now worth a collective $4.7 trillion, more than the entire bottom half of society or around 165 million people. And, because of massive loopholes in our tax code, none of that immense billionaire wealth growth may ever be taxed.

“Billionaire wealth ballooned even as American society deflated during our nation’s worst public health emergency in a century,” said David Kass, executive director of Americans for Tax Fairness, which has tracked billionaire wealth growth with periodic reports throughout the pandemic. “It’s just another sign that billionaires float in a world high above the concerns of regular people, a world in which they often get to decide when and if to pay taxes. We need real tax reform that ensures they pay their fair share of taxes.”

Twitter owner and Tesla and SpaceX CEO Elon Musk experienced the greatest pandemic wealth boom by far, his fortune growing over seven-fold to more than $150 billion. Among the top 15 billionaires, Oracle CEO Larry Ellison and business-media mogul Michael Bloomberg got the next biggest wealth bumps: both their riches roughly doubled, Ellison’s to over $60 billion and Bloomberg’s to $46 billion.

Billionaires rest at the pinnacle of a top-heavy economy in which the richest 1% hold a third of all wealth and the top 10% almost three-quarters. This hyper-concentration of wealth destabilizes our economy and distorts our democracy. Billionaires spent a record $1 billion trying to influence the 2022 congressional elections, a record for a midterm campaign and 300 times more than they spent as recently as a dozen years ago.

Despite their vast fortunes, billionaires sometimes pay no federal income taxes and often pay lower tax rates than ordinary Americans when all their forms of income (including unsold investment gains) are counted. The top tax rate on the kind of passive investment income that mostly supports billionaires is only about half the top tax rate on wage income. The tax loophole known as “stepped up basis” makes inherited investment gains—potentially including the entire $1.7 trillion of billionaire pandemic profits—simply disappear for tax purposes.

President Biden has proposed a Billionaire Minimum Income Tax that would ensure households worth over $100 million pay at least a 25% federal income tax rate on all their income—including the annual increase in their wealth. Senate Finance Committee chairman Ron Wyden authored a similar plan that would only target billionaires. Biden’s plan would raise $437 billion over 10 years, Wyden’s $550 billion.

Defining the Pandemic

Though Covid-19 continues to circulate and sicken, because it’s no longer a crisis in its scope or severity the Department of Health and Humans Services declared an end to the pandemic public health emergency on May 11, 2023. A reasonable start date for the pandemic is March 14, 2020, when the Federal Emergency Management Agency announced President Trump’s emergency declaration allowing for federal reimbursement of Covid costs incurred by local governments. A few days later, March 18, was the date Forbes picked to measure billionaire wealth for the 2020 edition of its annual billionaires report.