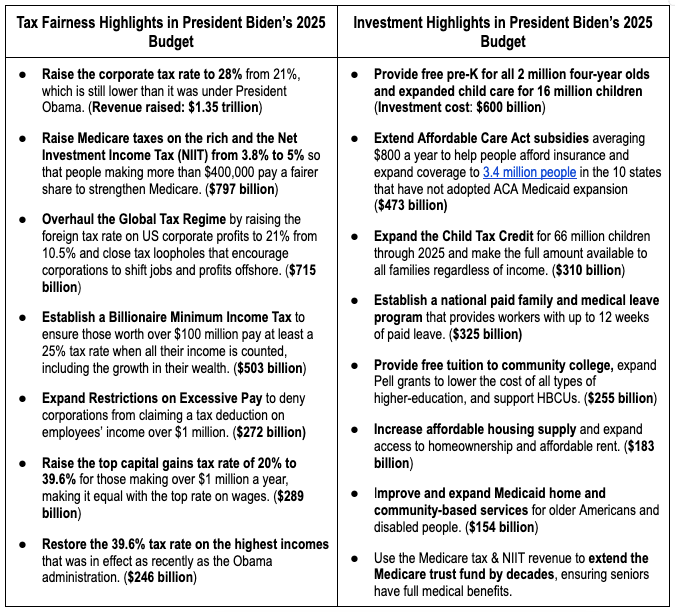

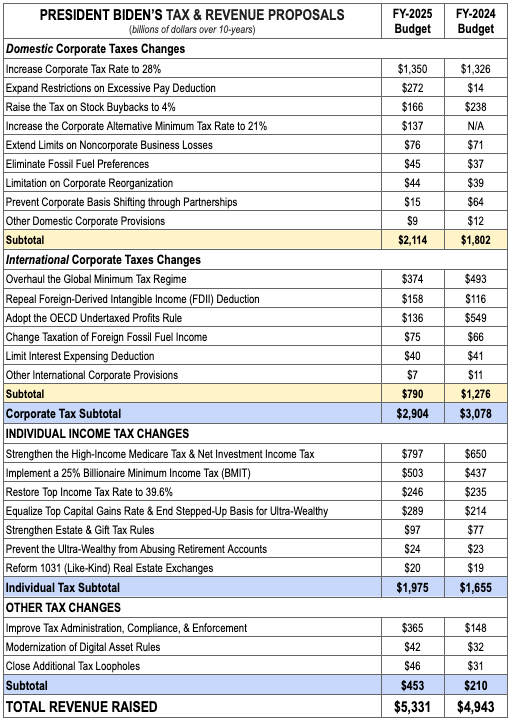

President Biden’s fiscal year 2025 budget, released today would raise nearly $5.3 trillion in tax revenue over the next 10 years exclusively from fairer taxes on the rich and big corporations, $388 billion more revenue than was generated from his budget last year. This latest budget would invest $2.3 trillion to preserve and expand vital public services for working families and reduce the national debt by nearly $3 trillion. Taxes would not go up for any household making less than $400,000 a year. (Revenue and spending figures are for 10 years except where noted.)

“In the face of uniform resistance from Republicans in Congress, President Biden continues his effort to force the rich and corporations to pay their fair share of taxes and use the revenue to lower costs and expand opportunities for working families,” said David Kass, executive director of Americans for Tax Fairness.

“For the fourth straight year and in keeping with promises that he made to the American people when first seeking office, the president has put forth a tax-and-spending plan that would substantially raise taxes on the wealthiest households and most profitable corporations and invest the money in healthcare, childcare, education, housing and other vital public services. His proposal would also reduce government debt while not raising a penny of extra taxes on any family making less than $400,000 a year.

“With his latest budget President Biden has made clear once again that he is on the side of parents, kids, seniors and other ordinary Americans and not in the pocket of wealthy special interests like his GOP opponents.”

Sources: U.S. Office of Management and Budget, U.S. Treasury Dept. “Green Book”, White House Fact sheet

Sources: U.S. Treasury Dept. “Green Book”, March 2024 — U.S. Treasury Dept. “Green Book”, March 2023