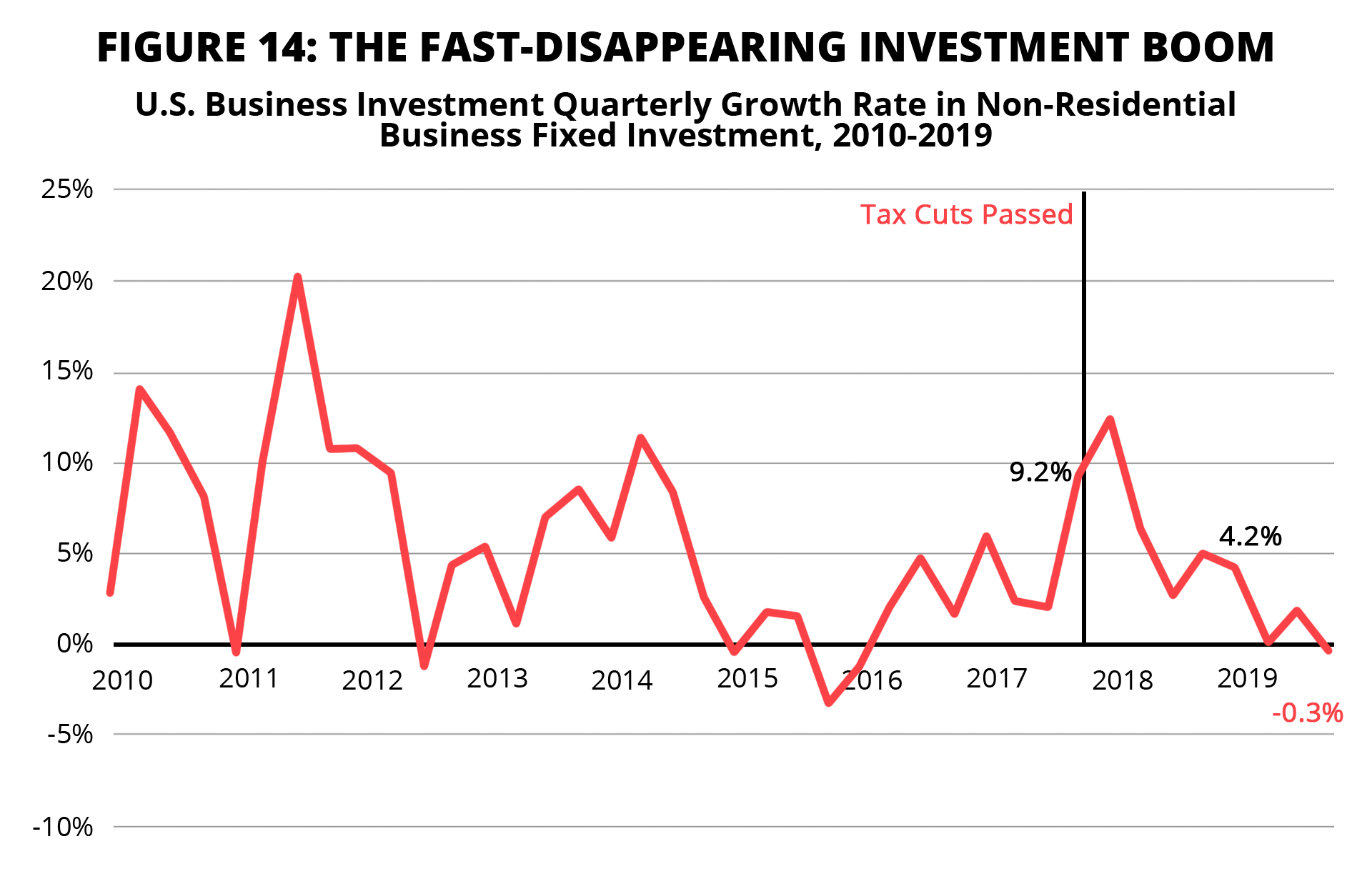

“I would expect capital spending to really take off if the tax bill passes.” – CEA Chair Kevin Hassett, Oct. 17, 2017 [Washington Post]

Source: BEA, National Accounts (NIPA): Section 1, Table 1.1.1, Line 9: “Percent Change From Preceding Period In Real Gross Domestic Product: Gross private domestic investment: Fixed investment: Nonresidential.” https://apps.bea.gov/iTable/iTable.cfm?reqid=19&step=2 – reqid=19&step=2&isuri=1&1921=survey

Supporters claimed the Trump-GOP tax law—specifically, the big corporate tax cut—would lead to a business investment boom. But after a growth spurt in the first quarter of 2018, the rate of new capital investment declined, coming in flat at 0.0% for the second quarter in 2019 and then falling into negative territory in the last quarter of 2019.

Sources: S&P Dow Jones Indices, p. 3. https://us.spindices.com/documents/index-news-and-announcements/20181218-sp-500-buybacks-q3-2018.pdf?force_download=true. For most recent quarters: https://us.spindices.com/documents/additional-material/sp-500-buyback.xlsx?force_download=true

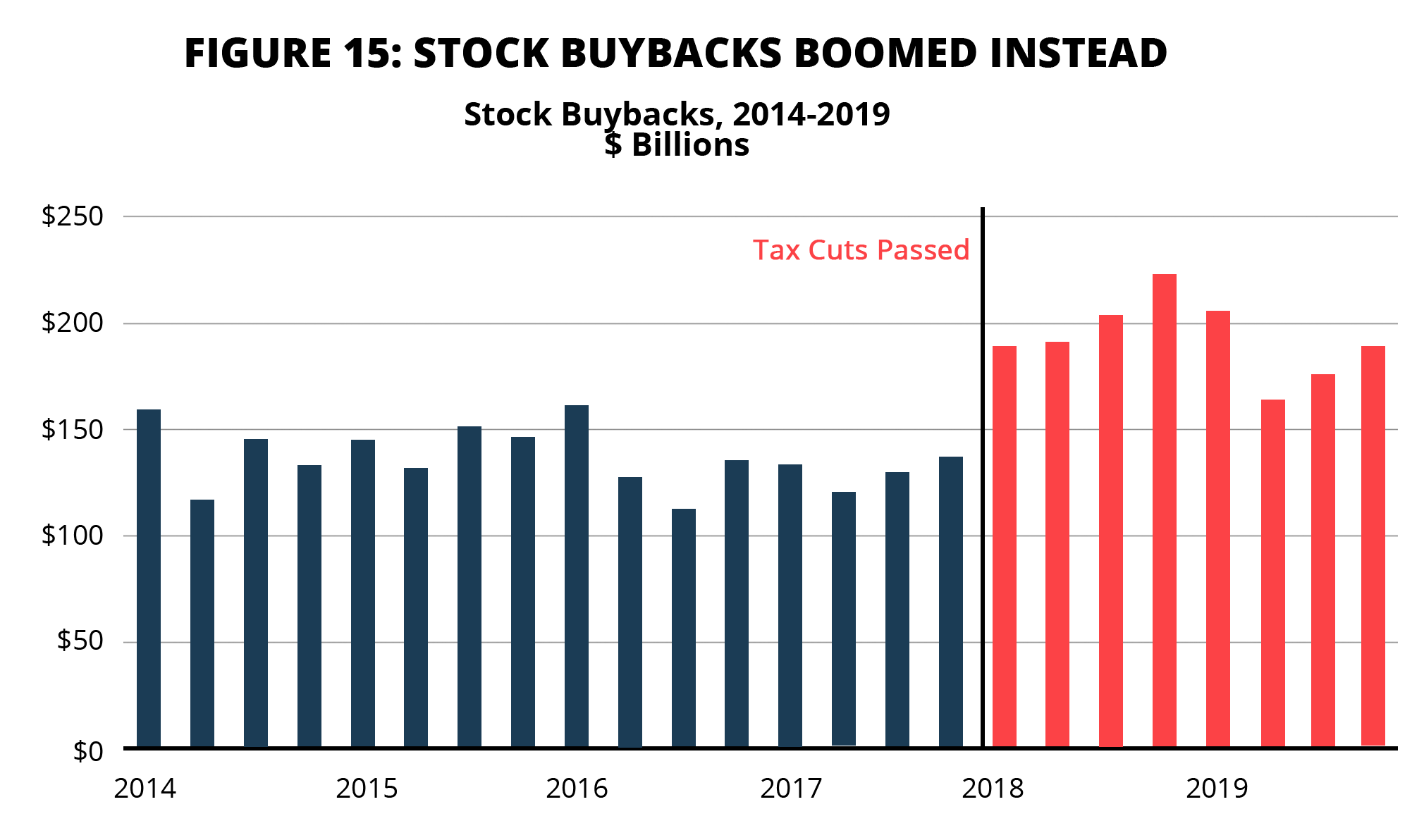

Corporate stock buybacks exploded in the year following enactment of the Trump-GOP tax law, as corporations showered their tax-cut savings on top executives and other wealthy shareholders. Corporations bought back a record $806 billion of their own shares in 2018. That represented an increase of nearly 60% over the $519 billion in stock buybacks in 2017. Stock buybacks hit $729 billion in 2019—still well above the pre-TCJA levels.