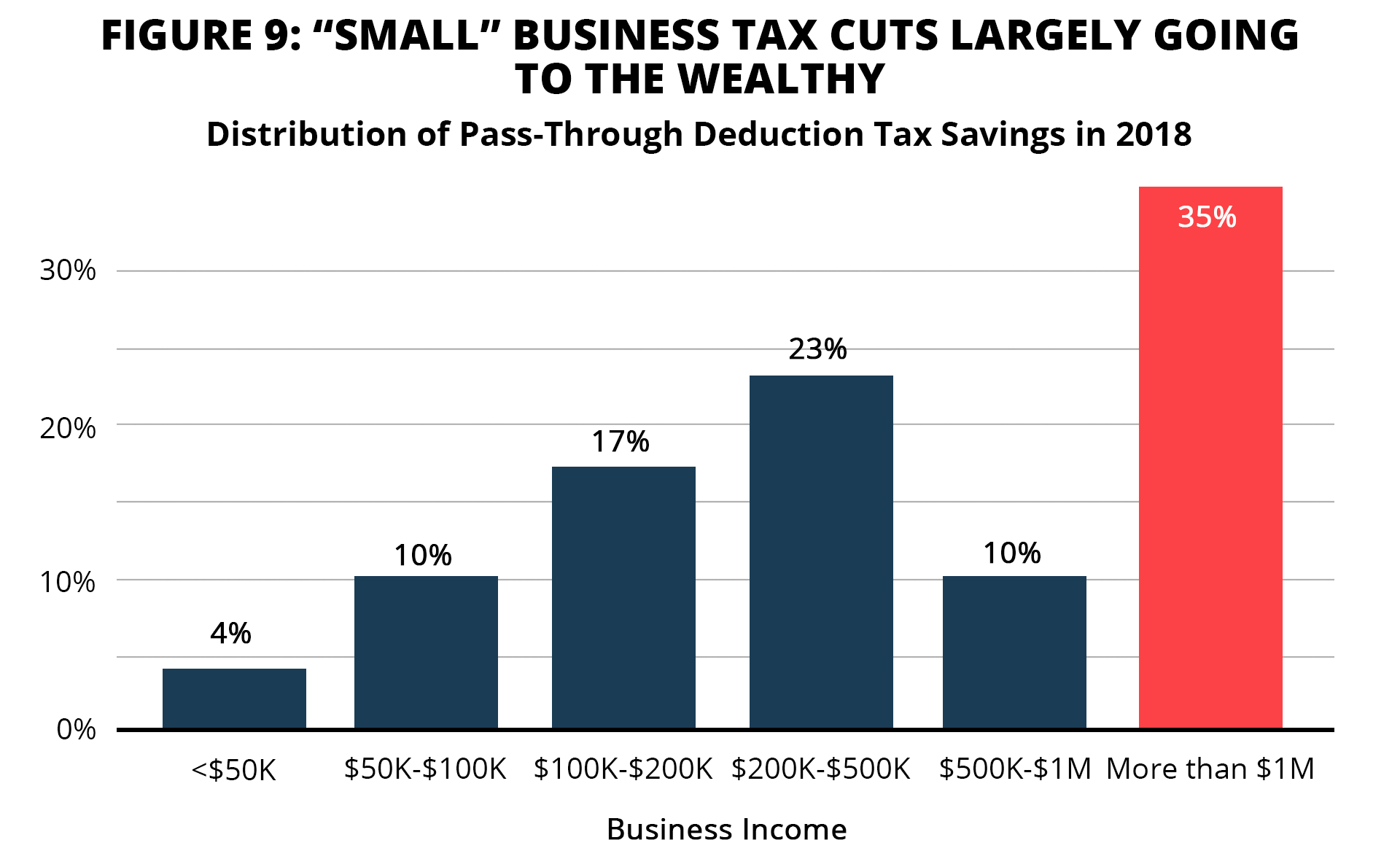

“The large number of pass-through returns, [98 percent], are all $500,000 or less. Those people will get substantial reductions — small and medium-size businesses.”

– Treasury Secretary Steven Mnuchin, Nov. 17, 2017 [CNBC]

Source: Internal Revenue Service, SOI Tax Stats 2018, “Qualified Business Income Deduction.” https://www.irs.gov/statistics/soi-tax-stats-individual-income-tax-returns-with-small-business-income-and-losses

More than one-third of this so-called “small” business tax cut went to the 1% of business owners with $1 million or more in annual income in 2018, according to IRS data. Just 14% of the “small” business tax cuts went to business owners making $100,000 or less a year. Yet, they comprise more than two-thirds (68%) of small businesses.

This tax break pertains to “pass-throughs,” which are unincorporated businesses ranging from corner groceries to big law firms. They do not pay corporate income taxes. Instead, profits pass through to the owners who pay any tax due on their personal returns at individual rates. The Trump-GOP tax law allows (with many complex exceptions) owners of pass-throughs to exclude 20% of their business income from taxation. Such a deduction is more valuable the higher the tax bracket: it in essence lowers the top tax rate from 37% to under 30%.