“Our framework ensures that the benefits of tax reform go to the middle class, not to the highest earners.” – President Trump, Oct. 11, 2017 [USA Today]

“The rich will not be gaining at all with this plan.” – President Trump, Sept. 13, 2017 [The Guardian]

Source: Institute on Taxation and Economic Policy (ITEP), “TCJA by the Numbers, 2020.” https://itep.org/tcja-2020/

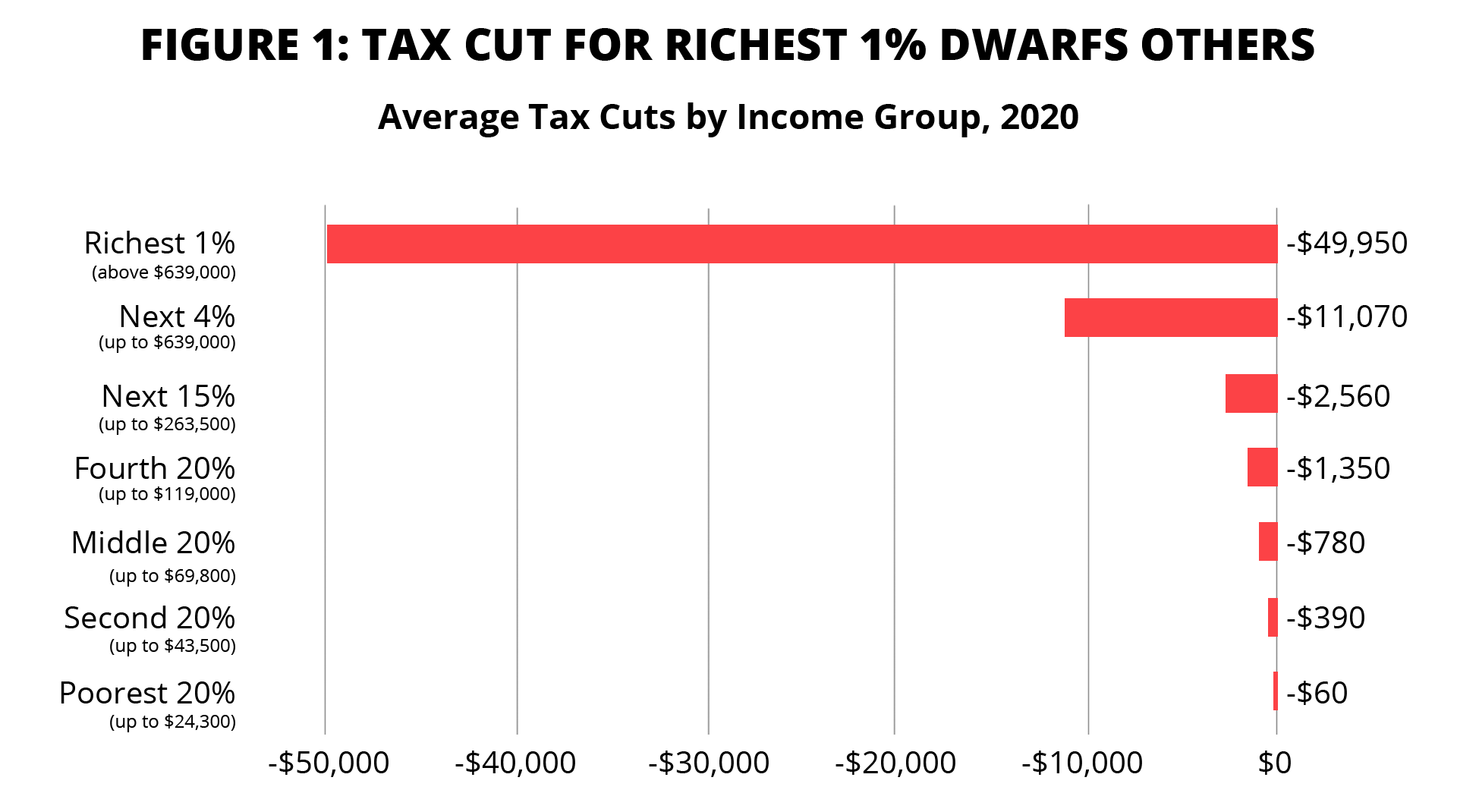

The richest 1% of taxpayers will get an average tax cut of $50,000 in 2020 from the Trump-GOP tax cuts. That’s over 75 times more than the tax cut for the bottom 80% of taxpayers, which will average $645.

These figures are comparable to estimates from the Tax Policy Center for 2018, which found the average tax cut for the richest 1% to be $51,000 and the average tax cut for the bottom 80% to be about $800. [Table 1, “All Provisions”]

Source: ITEP, “TCJA by the Numbers, 2020.” https://itep.org/tcja-2020/

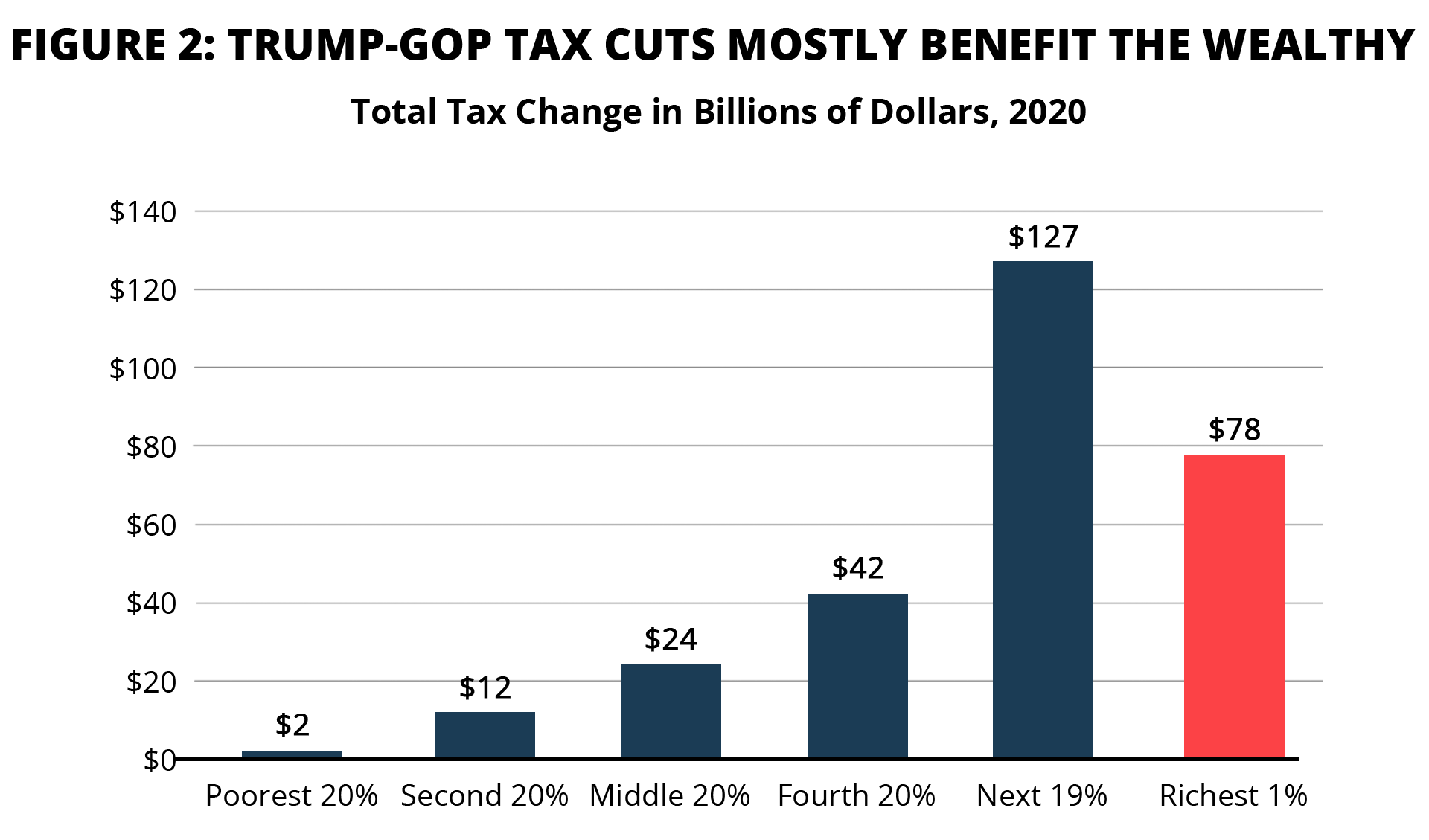

In 2020, the richest 1% will receive a total of $78 billion in tax cuts from the Trump-GOP tax law—more than a quarter of the total. That’s about the same amount as the bottom 80% of taxpayers will get.

Source: ITEP, “TCJA by the Numbers, 2020.” https://itep.org/tcja-2020/

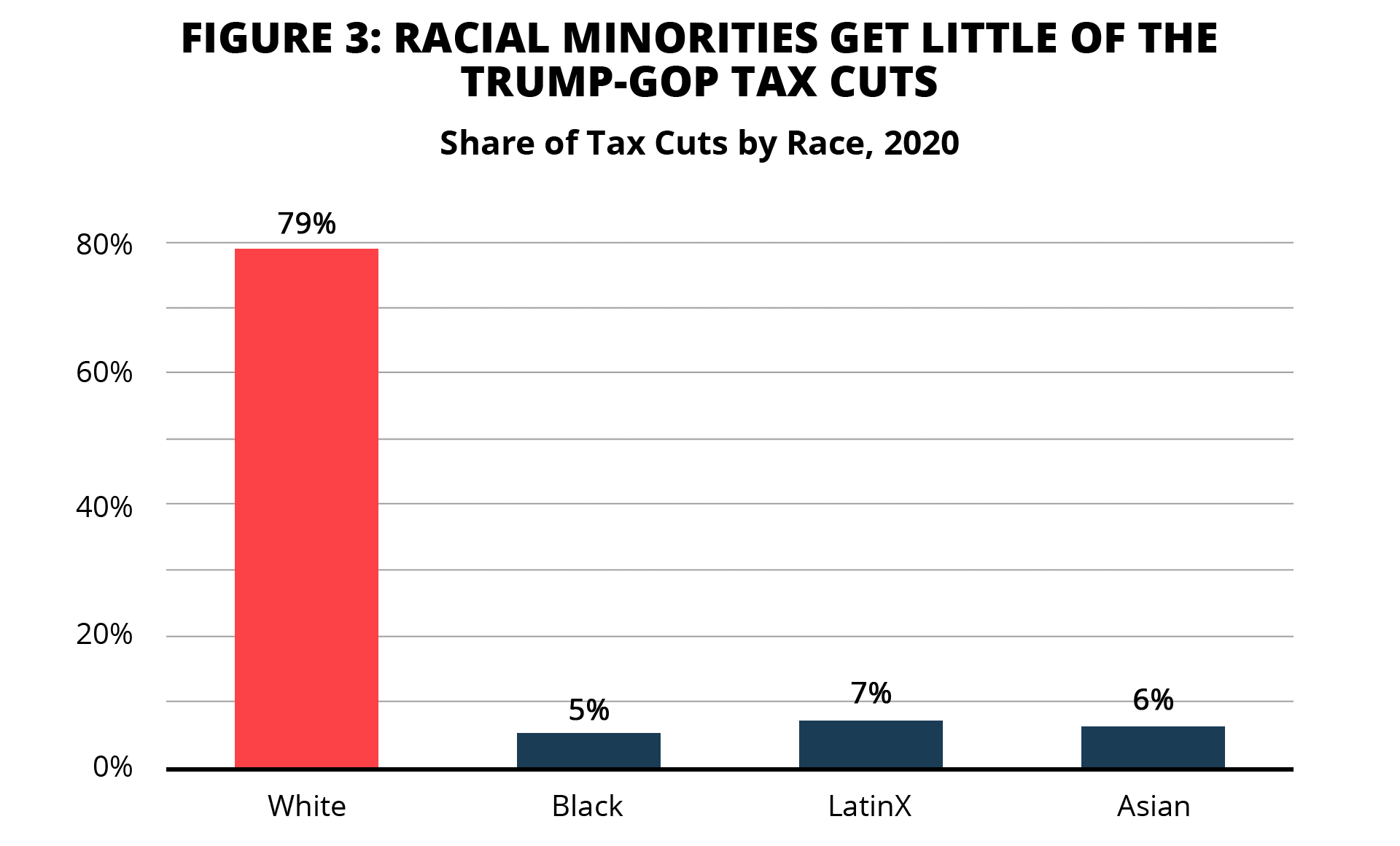

The Trump-GOP tax cuts disproportionately benefit white Americans at the expense of other racial groups. In 2020, whites will make up 67% of tax filers but will garner 79% of the tax cuts. On the other hand, African Americans will comprise 10% of all filers yet only receive 5% of the benefits. Latinx will be 12% of filers but get only 7% of the tax savings.

Source: ITEP, “Corporate Tax Avoidance in the First Year of the Trump Tax Law.” Dec. 2019. https://bit.ly/34t3HDq

The Trump-GOP tax cuts were focused first and foremost on cutting corporate income taxes. The law slashed the U.S. corporate tax rate on domestic profits from 35% to 21% and on foreign profits to about 10%. The law expanded the ability to write off equipment purchases, and granted corporations other big favors, but it did not close corporate tax loopholes. As a result, 91 profitable Fortune 500 corporations paid no U.S. corporate income taxes in 2018. Moreover, 379 profitable corporations paid an effective federal income tax rate of just 11.3% on their 2018 income, slightly more than half the 21% corporate tax rate—which already had been slashed down from 35% in 2017.

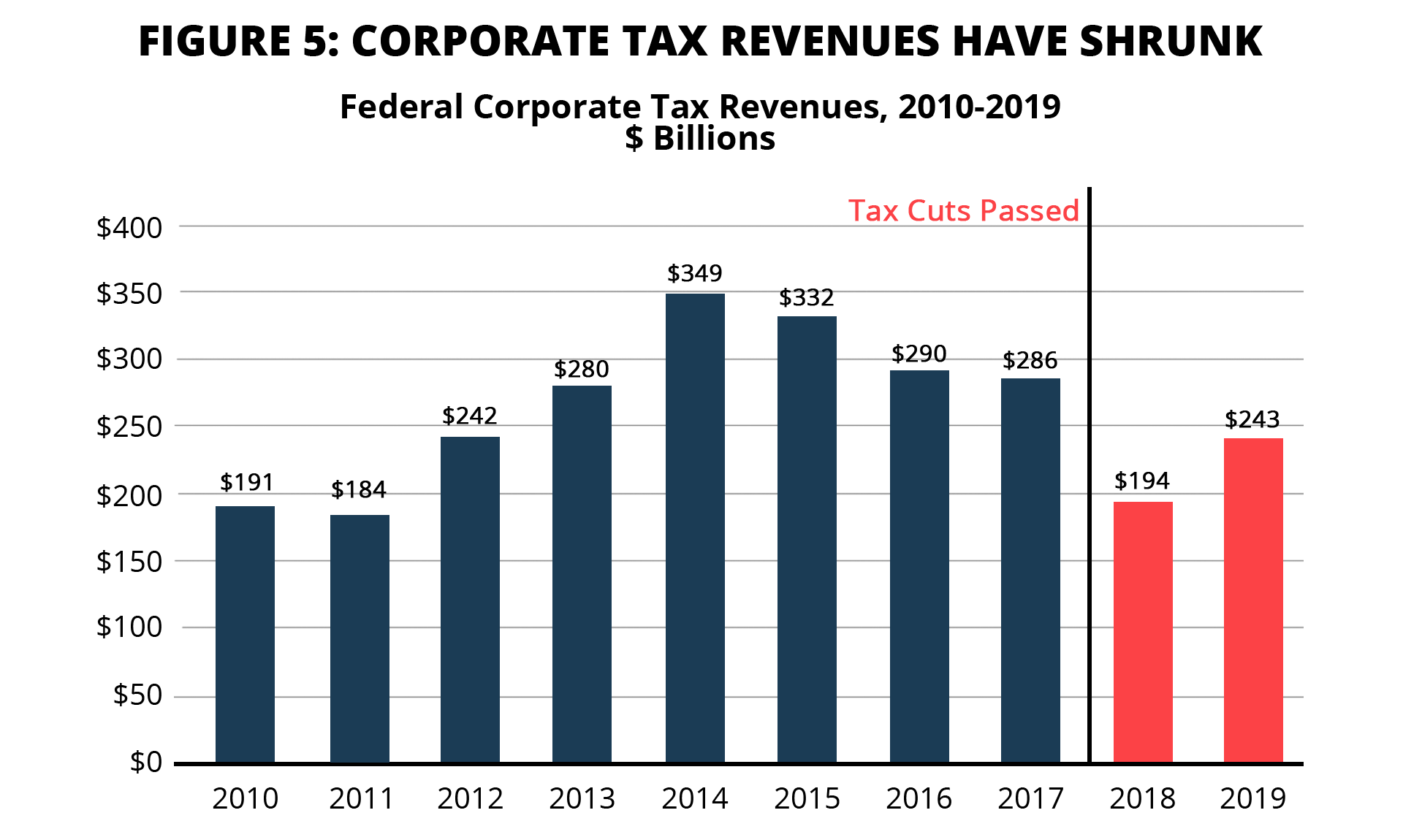

Source: Federal Tax Receipts from U.S. Treasury, Monthly Treasury Statements, Table 7. Fiscal year monthly data presented on a calendar basis. https://www.fiscal.treasury.gov/reports-statements/mts/previous.html

Corporate tax revenue has shrunk considerably due to the GOP tax cuts. It fell by nearly one-third, or $92 billion, the year after the tax law was enacted. It remained at a depressed level in 2019.