TAX CUTS AND JOBS ACT

- RealClear Politics 2019 Polling Average (Feb. 20, 2019): By a five-point margin, 46% to 41%, voters disapprove of the Trump-GOP tax cut law based on 2019 polls.

- National Association of Business Economics (Dec. 17, 2018 – Jan. 9, 2019) (Survey of 106 NABE members): The vast majority—84%—of respondents said that one year after its passage the 2017 TCJA has not caused their firms to change hiring or investment plans. This is similar to the view of 81% in the previous survey.

- Gallup (September 24-30, 2018) (1,462 adults, MOE +/- 3 percentage points): 46% opposed the tax cut law, while 39% approved.

- Public Policy Polling (June 8-10, 2018) (679 registered voters, MOE +/- 3.8 percentage points): 51% say they believe the tax cut law mostly helps the rich, with only 30% saying it helps the middle class and just 7% saying it helps the poor.

- Associated Press-NORC Center for Public Affairs Research (March 14-19, 2018) (1,122 adults, MOE +/- 4.2 percentage points): Of people familiar with the new tax cut law, 77% believe it helps large corporations and 73% say it benefits the wealthy, while 42% say it helps middle-income families.

- NBC-WSJ/Hart Research (April 8-11, 2018) (900 adults, MOE +/- 3.27 percentage points): 53% viewed the Trump-GOP tax bill negatively because it will increase the federal deficit and mostly benefit the wealthy and big corporations; 39% viewed it positively.

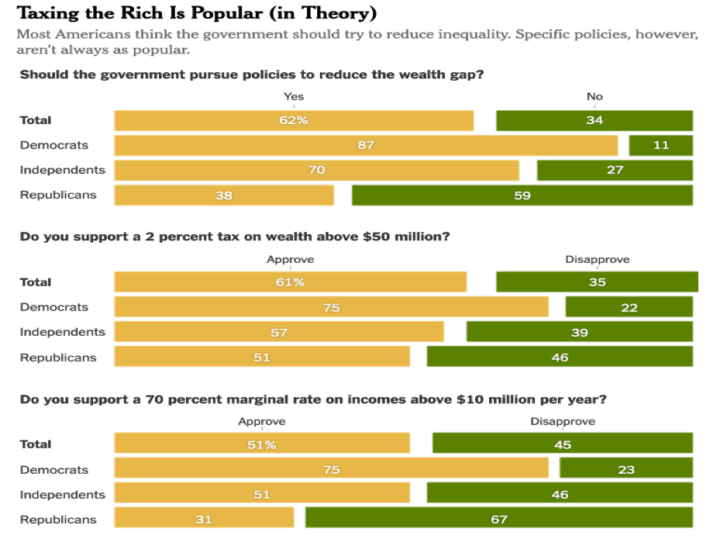

TAXING THE WEALTHY — GENERAL

- Fox News (Jan. 20-29, 2019) (1,008 registered voters, MOE +/- 3 percentage points): 65% of registered voters support increasing taxes on families earning over $1 million a year. 70% of registered voters support increasing tax rates on families earning above $10 million a year, including 54% of Republicans.

- RNC (September 2018): By 61% to 30%, voters said the Trump-GOP tax cuts benefit “large corporations and rich Americans” over “middle class families, leaving the pollsters to note “Republicans lost the messaging battle on the [tax] issue.”

- Gallup (April 2018): 62% say “upper income people” are paying too little in federal taxes and 10% are paying too much, which is consistent with Gallup surveys going back more than 10 years. The margin for corporations was 66% paying too little and 7% paying too much.

- Reuters/Ipsos (Sept. 29 to Oct. 5, 2017): 53% of adults “strongly agree” that the wealthiest Americans should pay higher tax rates. An additional 23% “somewhat agree” the wealthiest should pay higher tax rates, according to the poll of 1,504 people.

- Axios/Survey Monkey (Jan. 16-18) (2,277 adults): 58% of adults say that “unfairness in the economic system that favors the wealthy” is a bigger problem than the standard GOP message that “over-regulation of the free market… interferes with growth and prosperity” (39%).

RAISE TOP RATE TO 70% — REP. OCASIO-CORTEZ’S PROPOSAL

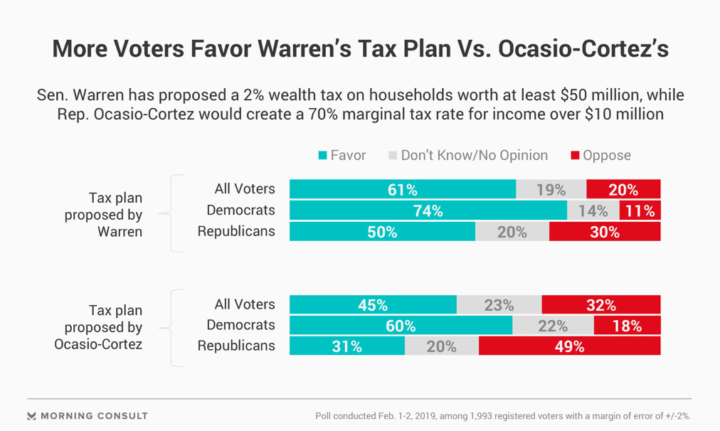

- NYTimes/Survey Monkey (Feb. 4-11, 2019) (9,974 adults, MOE +/- 1.5 percentage points): By a margin of 51% to 45% those surveyed supported a 70% marginal tax rate on incomes above $10 million per year.

- Navigator/Global Strategy Group (Jan 28-31, 2019) (1,126 registered voters): 48% support introducing a 70% marginal rate on income over $10 million, 28% oppose and 24% are unsure. After those who are unsure or opposed read more information about the meaning of “marginal tax rate,” support grows to 55% overall while opposition barely moves (29%). Just half of Republicans (50%) oppose the plan, 39% back it as does 47% of independents and 73% of Democrats.

- Hill/HarrisX (Jan. 12-13, 2019) (1,001 registered voters, MOE +/- 3.1 percentage points): 59% of registered voters support taxing incomes above $10 million at a 70% tax rate Q. Currently the top tax rate is 37%. Would you favor or oppose a tax proposal that would apply a 70% rate to the 10 millionth dollar and beyond for individuals making $10 million a year or more in reportable income? Favor: 59%; Oppose: 41%

TAX ON ENORMOUS WEALTH PROPOSED BY SENATOR WARREN

- NYTimes/Survey Monkey (Feb. 4-11, 2019) (9,974 adults, MOE +/- 1.5 percentage points): By a margin of 61% to 35% those surveyed supported a 2 percent tax on wealth above $50 million. The margin in favor was 51% to 46% among Republicans and 57% to 39% among independents.

- Hill-HarrisX (Feb. 1-2, 2019) (1,001 registered voters, MOE +/- 3.1 percentage points): 74% supported a Sen. Warren’s wealth tax proposal, which consists of a 2% tax on Americans with assets above $50 million and a 3% tax on people with more than $1 billion. Among Republicans 65% favored the wealth tax proposal; Democrats favored it by 86% and independents by 69%.

- You Gov/Data for Progress (Jan. 30, 2019) (1,282 registered voters): 61% supported Sen. Warren’s wealth tax proposal, with 46% “strongly” supporting it and 21% opposed. A plurality of Republicans supported it by a 44% to 37% margin while Democrats supported it 76% to 6%.

- Morning Consult/Politico (Feb. 1-2, 2019) (1,993 registered voters; MOE +/- 2 percentage points): 61% favored Sen. Warren’s “ultra-millionaire” plan, which is an annual tax of 2% on household wealth of more than $50 million and a 3% levy on wealth exceeding $1 billion. Ocasio-Cortez’s proposal for a new marginal tax rate of 70% on income over $10 million drew support from 45% of voters, opposition from 32% and 23% undecided.

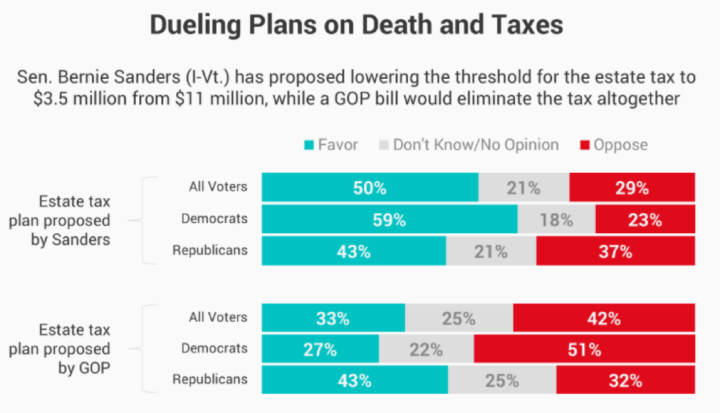

ESTATE TAX PROPOSED BY SEN. BERNIE SANDERS

- Morning Consult/Politico (Feb. 7-10, 2019) (1,991 registered voters, MOE +/- 2 percentage points): 50% said they favor a plan to lower the threshold for taxing estates from $11 million or more to $3.5 million, with 29% opposed. A Republican proposal to repeal the estate tax was supported by just 33% of voters with 42% opposed.

By The New York Times | Source: SurveyMonkey Feb. 4-11, 2019

Source: Morning Consult/Politico Feb. 7-10, 2019