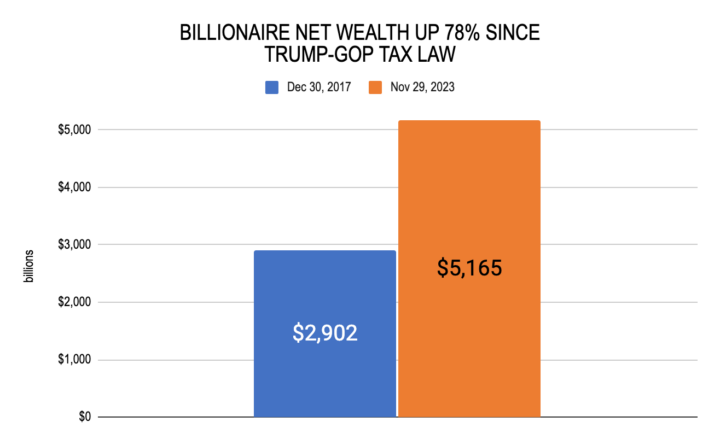

Their Wealth Has Grown 78% Since 2017 Trump-GOP Tax Cuts; Historic Support in Congress for Taxing Billionaire Wealth Growth as Senate and House Democrats Introduce Bills This Week

The collective fortune of America’s 741 billionaires has grown to $5.2 trillion at the end of November 2023, the highest amount ever recorded according to an analysis by Americans for Tax Fairness (ATF). This is up an astounding $2.3 trillion (78%) since enactment of the Trump-GOP tax law in 2017—a fiscally irresponsible measure heavily slanted towards the rich that undoubtedly contributed to billionaires’ wealth growth over the last six years.

This record-breaking billionaire wealth makes the case, once again, for why Congress must enact legislation taxing the super-wealthy’s largest source of income: growth in the value of their investments, whether they sell assets or simply borrow against them when they need cash.

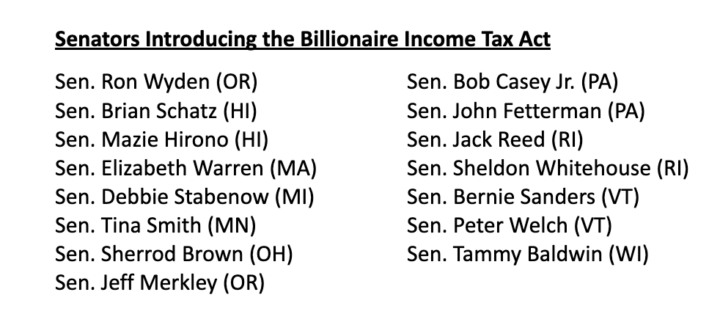

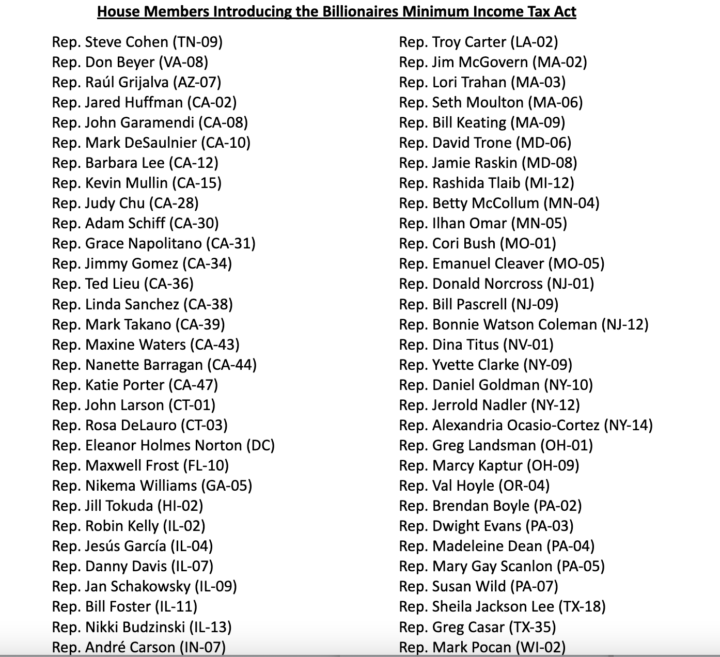

This week, Senate Finance Committee chair Ron Wyden (D-OR) will release his Billionaires Income Tax (BIT) and Reps. Steve Cohen (D-TN) and Don Beyer (D-VA) will introduce President Biden’s Billionaire Minimum Income Tax, with historic support in both chambers for the principle of taxing billionaires on all their capital gains, whether “realized” or not.

While tackling the problem of billionaire tax dodging in slightly different ways, Sen. Wyden and Rep. Cohen’s bills share the most important policy change: each would ensure that the ultra-wealthy pay their fair share by annually taxing the total income from their investments, including unrealized gains, just as American workers now pay taxes on all their wages all year, every year.

Current tax rules that exclude capital gains on assets not sold explains how billionaires and other members of the uber-rich can pay low and sometimes no federal income taxes despite their staggering fortunes.

In total, 77 members of Congress (15 senators and 62 representatives) representing the mainstream of the Democratic Caucus in each chamber—including 18 full committee chairmen and ranking members, as well as multiple members up for reelection next year in challenging races—are co-sponsors of one or the other of these important reform bills.