Authors: Zachary Tashman, senior research & policy associate; and William Rice, senior writer

Principal researcher: Zachary Tashman

EXECUTIVE SUMMARY

According to an analysis by American for Tax Fairness of new Federal Reserve data on household income and wealth, America’s billionaires and centi-millionaires (those with at least $100 million of wealth) collectively held at least $8.5 trillion of “unrealized capital gains” in 2022. These profits from unsold investments constitute the largest source of income for the super-rich. This staggering accumulation of “quiet” income may never be taxed unless special taxes on the ultra-wealthy now under consideration in Congress are enacted.

The data show that more than one in every six dollars (18%) of the nation’s unrealized gains is held by these roughly 64,000 ultra-wealthy households, who make up less than 0.05% of the population. That is nearly triple the share that billionaires and centi-millionaires held when the Federal Reserve started tracking unrealized gains in 1989. This tiny handful of the super-rich hold as much unrealized capital gains as the entire bottom 84% of American society (110 million households). Under current law, these gains in the value of stocks, bonds, businesses, real estate and other assets are not taxed unless the gain is “realized” through a sale.

But the ultra-wealthy don’t need to sell to benefit: they can live off low-cost loans secured against their growing fortunes. And once inherited, such gains disappear completely for tax purposes. President Biden and Senate Finance Committee Chairman Ron Wyden (D-OR) have each proposed reforms that would annually tax the unrealized gains of the nation’s wealthiest households. President Biden’s plan has been introduced in the House by Reps. Steve Cohen (D-TN) and Don Beyer (D-VA) with 60 cosponsors and Chairman Wyden’s plan has been introduced in the Senate with 15 cosponsors. Both plans would raise hundreds of billions of dollars in tax revenue exclusively from the nation’s very richest households, revenue that could be used to lower costs and improve services for the rest of America.

The Fed data comes from its Survey of Consumer Finances (SCF). Conducted every three years since 1983, the SCF is a unique study of Americans’ income and wealth, broken down by demographic and other characteristics. For 40 years policymakers and researchers have relied on the SCF for timely and detailed information on the economic status of American households.

The Different Economic World of the Ultra-Wealthy

New data from the Federal Reserve underlines how the economics of the ultra-rich are becoming increasingly disconnected from those of ordinary American workers. While most Americans predominantly live off the income they earn from a job–income that is taxed all year, every year–the very richest households live lavishly off capital gains that may never be taxed.

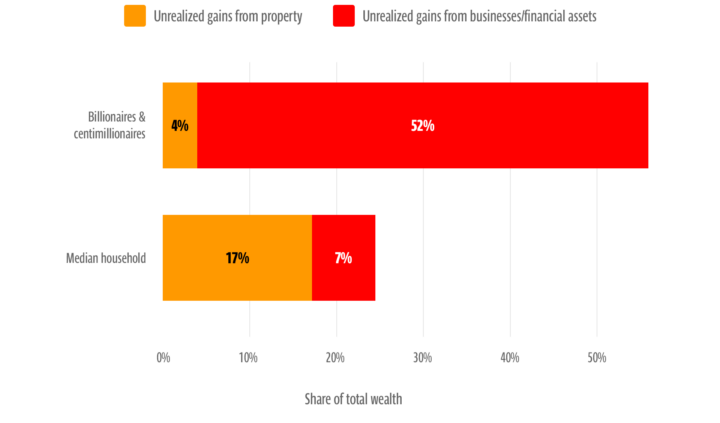

The Fed data also shows that the super-rich not only have unimaginably more of such earnings than the median American household, but the earnings represent over twice the share of their total wealth and come in a very different form. For billionaires and centi-millionaires, over half (56%) of their wealth is made up of untaxed gains, compared to less than a quarter (24%) for the average American household [Figure 4].

Comparing the distribution of unrealized capital gains of the ultra-rich to those of the bottom 90% of American households reveals wide disparities in how wealth gains are being accumulated. While gains on real estate generally, and especially on primary residences, are distributed somewhat more equitably–though the tiny elite still hold a hugely disproportionate share–the concentration at the top of unrealized gains in financial assets is the most extreme.

We estimate that each member of the centi-millionaire elite holds an average of $132 million in unrealized capital gains. This is almost 3,000 times more than the $47,000 of unrealized capital gains held by the median American household. Equally important, the vast majority of that typical households’ unrealized gains—$33,000, or 70%—are in the appreciated value of the family’s primary residence. Family homes are subject to an annual wealth tax in the form of state and local property taxes that reflects the residences’ increased value.

But for the ultrawealthy, the increase in value of the primary family home represents only a small fraction of their total gains. For them, only a relatively small $600 billion comes from property ownership in general, of which just $128 billion—less than 2% —is unrealized gains from their primary place of residence.

Of the $32.6 trillion in national unrealized capital gains in assets other than personal residences, $8.4 trillion—over 25%—was held just by the tiny handful of centi-millionaires and billionaires [Figure 5]. The largest source by far of unrealized capital gains for the centi-millionaire elite is derived from their ownership of businesses, stocks and mutual funds, accounting for $7.9 trillion (93%) of those untaxed gains.

National Gap in Wealth & Wealth Growth Outpaces That of Income

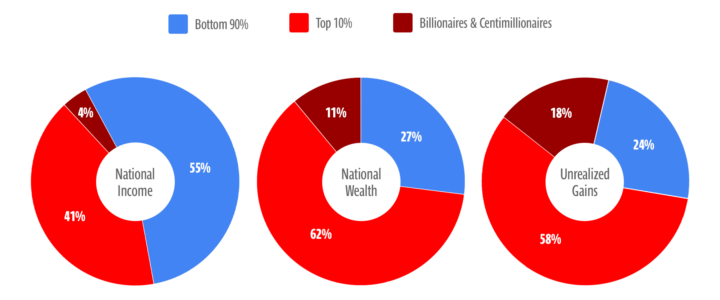

Of the $139 trillion in America’s national wealth, almost three-quarters (73%) is held by the richest 10% of households, over one-third (35%) by the richest 1%, and an astounding 11%—$15.2 trillion—is held by the handful of fortunate households that make up the billionaire and centi-millionaire class [Figure 1].

The bulk of that wealth is in the form of unrealized—and therefore untaxed—capital gains. This pool of $48 trillion of untaxed gains is even more heavily concentrated among the ultra wealthy. The wealthiest 1% of households hold 44% of national unrealized gains ($21.2 trillion), with billionaires and centi-millionaires alone controlling 18% ($8.5 trillion).

By contrast, national income as traditionally measured—made up of wages, interest, dividends, realized capital gains and other regularly taxed flows of money—is more evenly distributed. While still a lopsided distribution, billionaires and centi-millionaires take in a relatively modest 4% of such traditional income. This difference indicates tax reform intended to narrow the nation’s economic inequality should concentrate on wealth growth—untaxed capital gains—rather than on traditional forms of income.

Figure 1: WHILE INCOME IS MORE EVENLY DISTRIBUTED AMONG AMERICAN HOUSEHOLDS, WEALTH AND UNTAXED CAPITAL GAINS ARE MORE CONCENTRATED AMONG THE SUPER-RICH

Source: Americans for Tax Fairness

Without a Tax on Unrealized Gains, the Super-Rich Pay Little Tax At All

A leak of billionaire tax returns published by ProPublica revealed how little the ultra-rich pay in taxes. Twenty-six billionaires identified by ProPublica had collective income (as traditionally defined) of $132 billion between 2013 through 2018. On this income–which would include wages, dividends, interest and other forms of income that are regularly taxed– they paid an effective tax rate of just 18.2%. Because of loopholes and the discounted tax rate on most investment income, that percentage is already far below the top marginal rate during most of that time of 39.6%. But when their $500 billion of collective “wealth-growth income” (the increase in value of assets they don’t sell) over that period is included, their effective tax rate drops to just 4.8%—what ProPublica termed their “true tax rate.” A similar study from the White House estimated that the nation’s wealthiest 400 families paid an average effective tax rate of only 8.2% between 2010 through 2018 when the increased value of their stock holdings is counted as income. The average American family paid a tax rate of 13.6% in 2020.

Taxing income that hasn’t yet been translated into cash may seem unfair or even illogical to hard-working Americans who derive all or almost all their income from a paycheck. After all, it’s the money from wages that workers live on–wouldn’t investors also need their income in the form of cash to pay everyday expenses? But that’s one of those places where the economic realities of the super-rich and those of everyone else diverge. The ultra-wealthy can live off loaned money they borrow very cheaply because they are already so rich and are getting even richer.

These ultra-wealthy individuals can even use their untaxed gains to make big corporate purchases, such as when Elon Musk financed his acquisition of Twitter in large part through loans taken out against the rising value of his Tesla stock. The interest they pay on these loans is a fraction of what they would pay in taxes on the same amount of income. There’s even a clever name for this tax-dodging strategy: “Buy, Borrow, Die”.

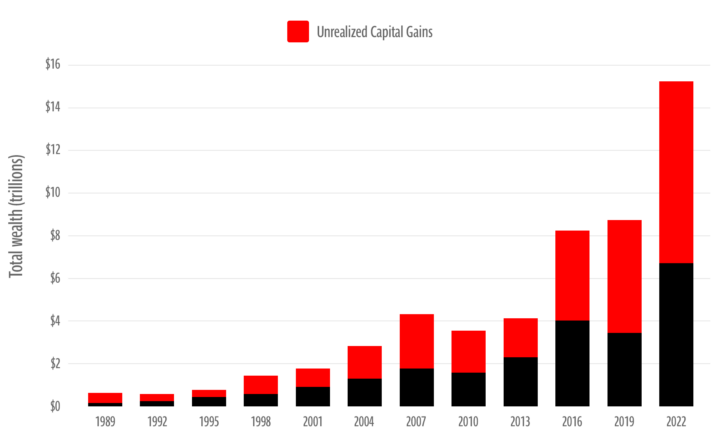

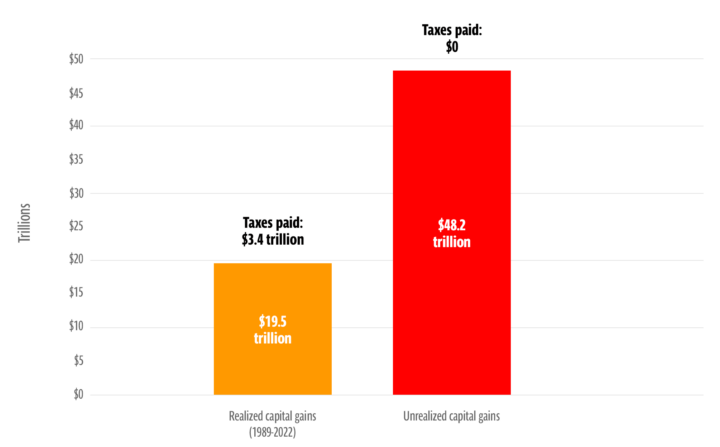

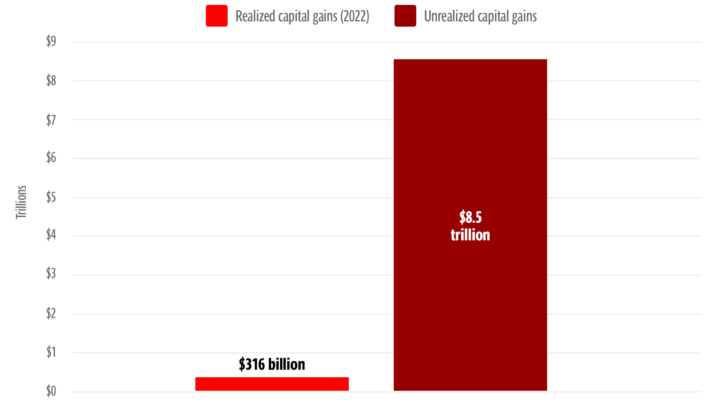

Because of this alternate method of tapping the economic benefit of increasing asset values, the great bulk of capital gains is never realized. Between 1989 (when the Fed began collecting such data) and 2022, $19.5 trillion of capital gains were realized, yielding $3.4 trillion of federal tax revenue. That works out to an effective tax rate of 17.5%. (Another special break for the wealthy is that capital gains are taxed at lower rates than wage income.) Over that same period, $48 trillion of unrealized capital gains was also accumulated [Figure 6]. If the unrealized gains are added to the realized ones, the rate paid on all gains drops to just 5%. In 2022, billionaires and centi-millionaires only realized, and thus only paid taxes on, $316 billion of capital gains–which is less than 4% of their $8.5 trillion in unrealized capital gains [Figure 7].

As the data shows, investors do occasionally sell an asset for a profit and trigger the tax. But the tax-free status of capital gains becomes final when they are inherited. The “die” part of the rich person’s three-step tax dodge relies on a loophole called “stepped-up basis”. Normally, an investor owes capital gains tax on the increase between the purchase price of an asset (what’s known as its “basis”) and its sale price. But when appreciated assets are inherited, the rules change. Then tax is only due on the increase in asset value from the time of inheritance. All the earlier gain, however huge, simply disappears for tax purposes.

Example: an investor buys $100 worth of XYZ stock and 30 years later those shares are worth $500. If they sell the shares themselves, they owe tax on a $400 gain ($500-$100). If they instead die before selling and pass the shares now worth $500 to their heir, and the heir immediately sells, that heir would owe nothing. The basis would have been “stepped up” to $500 and according to current tax rules, no gain had occurred.

President Biden has also proposed ending stepped-up basis for the wealthy. But if the unrealized gains of the super-rich were taxed annually, the amount of tax revenue lost to the stepped-up basis would be greatly diminished.

The Latest Numbers Continue A Trend

The cumulative $8.5 trillion of unrealized capital gains held by America’s billionaires and centi-millionaires in 2022 has jumped by more than half–or $3.2 trillion–just since the last Fed survey year of 2019. That increase continues a decades-long upward trend among the richest households in the United States [Figure 2].

Figure 2: UNTAXED, UNREALIZED GAINS INCREASINGLY MAKE UP THE BULK OF WEALTH FOR BILLIONAIRES AND CENTIMILLIONAIRES

(nominal dollars)

Source: Americans for Tax Fairness

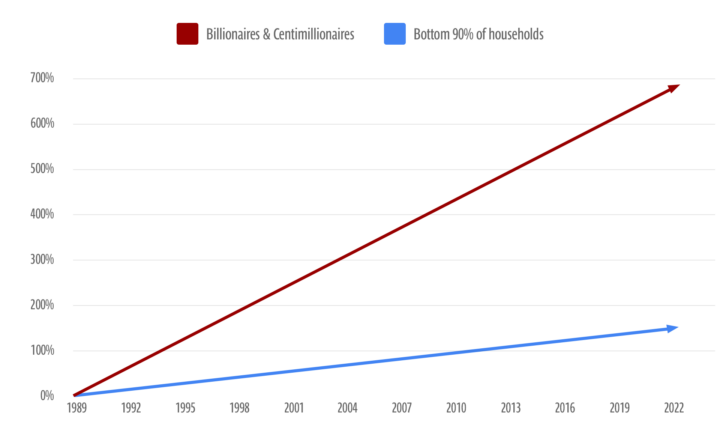

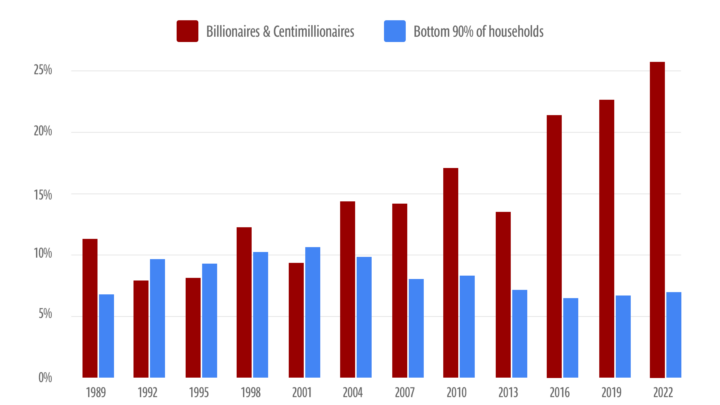

In 1989, households with wealth equivalent to the purchasing power of $100 million in 2022 ($43.4 million then) held about 6.7%—$472 billion—of the nation’s total unrealized capital gains. Over the past three decades that share has nearly tripled. America’s billionaires and centi-millionaires have seen a nearly 700% increase (inflation-adjusted) in unrealized capital gains over that span. The bottom 90% of households have seen their unrealized capital gains grow at one-fifth that rate [Figure 3].

Figure 3: GROWTH OF UNREALIZED, UNTAXED CAPITAL GAINS SINCE 1989

Source: Americans for Tax Fairness (inflation adjusted)

Figure 4: WHILE FOR TYPICAL HOUSEHOLDS, MOST UNREALIZED GAINS ARE IN REAL ESTATE, FOR THE SUPER-RICH MOST UNREALIZED GAINS ARE FINANCIAL

Source: Americans for Tax Fairness

Figure 5: THE SUPER-RICH’S SHARE OF THE NATION’S UNREALIZED GAINS IS REACHING NEW HEIGHTS

Source: Americans for Tax Fairness (excludes value of primary residence)

Figure 6: THE BULK OF NATIONAL CAPITAL GAINS ARE NEVER REALIZED, AND THUS NEVER TAXED

Source: Americans for Tax Fairness

Figure 7: AN EVEN BIGGER SHARE OF THE CAPITAL GAINS OF THE SUPER-RICH ARE NEVER REALIZED AND NEVER TAXED

Source: Americans for Tax Fairness

Untaxed Gains Are Mostly Held By Older White People

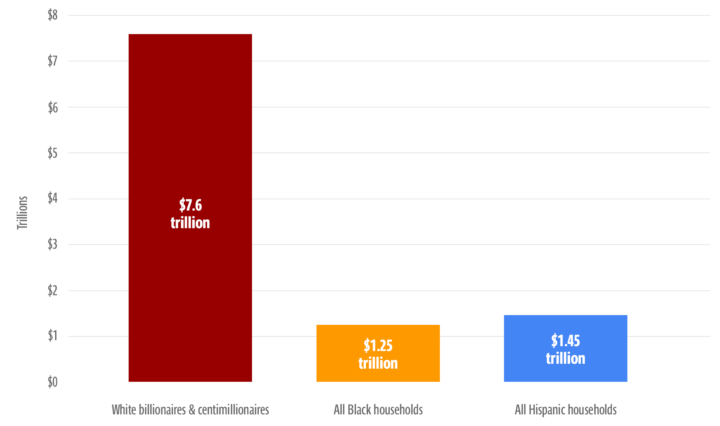

The bonanza of untaxed capital gains is overwhelmingly a white phenomenon. The average white household has $454,800 of unrealized capital gains compared to $73,300 for the average Black household, and $99,700 for the average Hispanic household. That’s a more than six-to-one advantage of white households over Black families and more than four-to-one over Hispanic families. All the nation’s Black families together have accumulated $1.25 trillion of unrealized capital gains; all the Hispanic families, $1.45 trillion. That total of $2.7 trillion represents just a little over a third of the $7.6 trillion of unrealized gains held by the tiny fraternity of white billionaires and centi-millionaires alone.

Figure 8: THE UNREALIZED CAPITAL GAINS OF WHITE SUPER-RICH HOUSEHOLDS DWARF THOSE OF ALL BLACK AND HISPANIC HOUSEHOLDS

Source: Americans for Tax Fairness

Half of all unrealized capital gains are held by Americans over the age of 63, despite making up just 28% of the population. Americans aged 18-39 also make up 28% of the population but hold just 7% of the unrealized capital gains. Billionaires and centi-millionaires alone hold more wealth than everyone 48 years old and younger.

CONCLUSION

America’s ultimate rich–the nation’s billionaires and centi-millionaires–inhabit a different economic world than the rest of us. They live off their money instead of their labor and their income does not have to be received in the traditional sense to be enjoyed. That difference is best encapsulated by the huge and growing unrealized capital gains of the uber-wealthy.

Under current law, those gains receive an ongoing exemption from taxation in life and a permanent exemption in death. Yet they are largely what funds the extravagant and intrusive lives of the ultra-rich: destabilizing our economy, weakening our society, and endangering our democracy.

Legislation has been introduced in both houses of Congress that would curb the economic and political power of the richest households by annually taxing their investment gains–whether realized or not–just as workers’ wages are taxed now, every year, all year round. Without this necessary reform to our system of taxation, the growth of untaxed income at the very top of our economy will continue to accelerate, to the benefit of a tiny few and the detriment of everyone else.

Footnote:

The Survey of Consumer Finances excludes the wealthiest 400 households listed by Forbes (pg 47) meaning that unrealized capital gains could be even more heavily concentrated than the SCF official projection. On September 30, 2022 Forbes reported the wealthiest 400 billionaires were collectively worth $3.89 trillion, which would translate into $2.18 trillion (56%) of unrealized capital gains, based on SCF estimates of other ultra-rich households. ATF has chosen just to use SCF data, but if this amount were to be included, it would bring unrealized capital gains for billionaires and centi-millionaires to $10.7 trillion—21% of the national total.