Billionaires’ Collective Fortune Grew $1.8 Trillion Over 17 Months, Enough to Pay for Over Half of Biden’s Proposed $3.5 Trillion Investment in Healthcare, Education & More

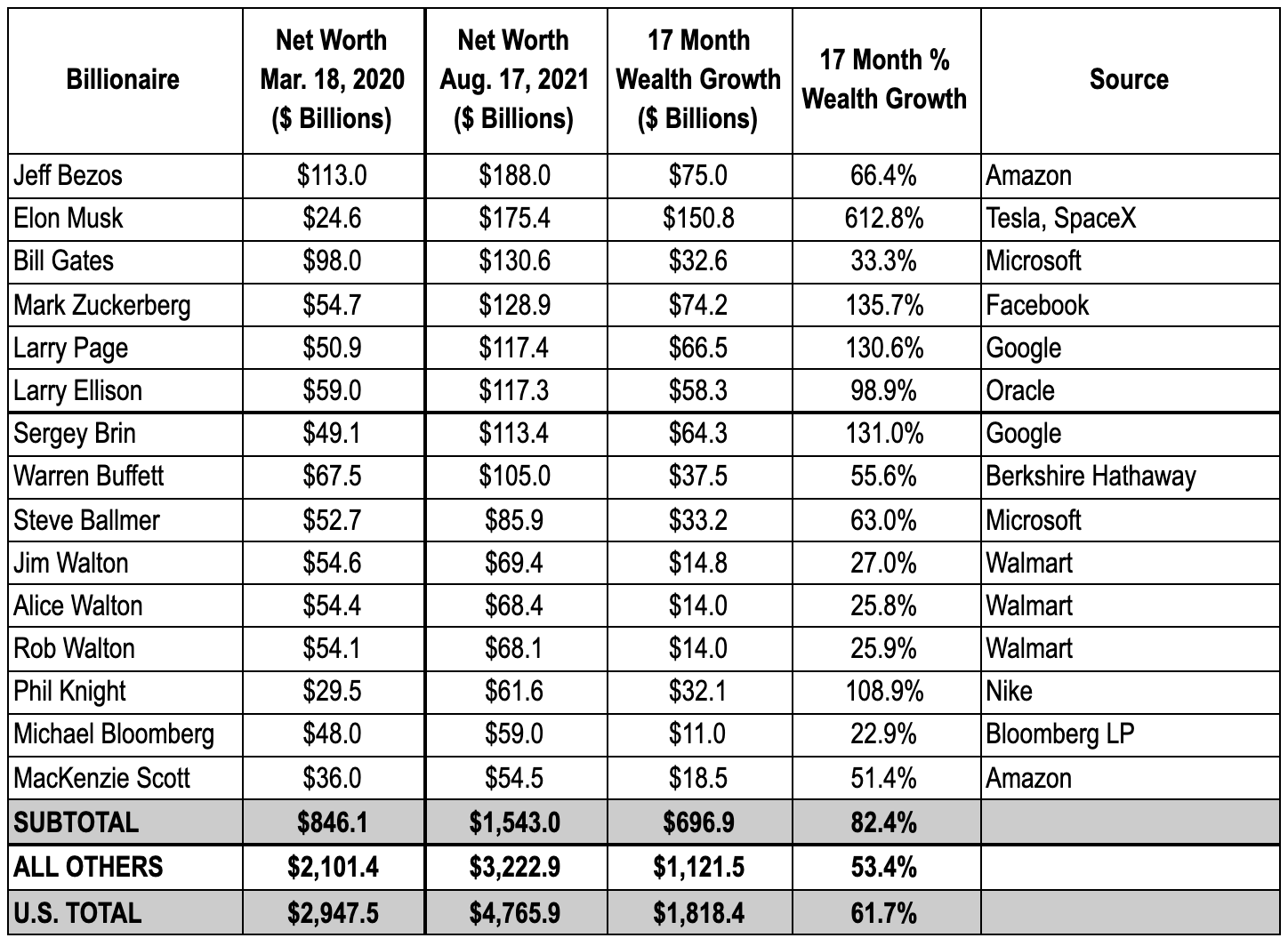

America’s billionaires have grown $1.8 trillion richer during the pandemic, their collective fortune skyrocketing by nearly two-thirds (62%) from just short of $3 trillion at the start of the COVID crisis on March 18, 2020, to $4.8 trillion on Aug. 17 of this year, according to a report from Americans for Tax Fairness (ATF) and the Institute for Policy Studies Program on Inequality (IPS). [A table of the top 15 billionaires is below and the full data set is here.]

America’s billionaire bonanza demonstrates the flaws in our current economic and tax systems President Biden and Democrats in Congress are trying to remedy by advancing a $3.5 trillion budget package, which has already passed the U.S. Senate and is being considered in the U.S. House today. If it becomes law through the budget reconciliation process this fall, it will aid communities and working families by making healthcare, eldercare, childcare, housing and education more affordable, investing in clean energy, expanding the Child Tax Credit and providing 12 weeks of paid family and medical leave. It will be paid for by making the wealthy and corporations pay their fair share of taxes, and it will not raise taxes on anyone making under $400,000 a year.

Not only did the wealth of billionaires grow, but so did their numbers: in March of last year, there were 614 Americans with 10-figure bank accounts; this August, there are 708. Their $1.8 trillion of increased wealth alone over 17 months, which will not be taxed unless they sell their assets, would pay for more than half of Biden’s 10-year $3.5 trillion investment package.

“The unconscionable growth in billionaire wealth through the misery of the pandemic is the clearest case I can imagine for the progressive tax reform working its way through Congress,” said Frank Clemente, ATF’s executive director. “We have a historic opportunity this year to begin unrigging the tax code and rebalancing the economy through fairer taxes on the wealthy and corporations, including taxing wealth more like work, raising the corporate tax rate, and curbing corporate offshore tax dodging. We can’t let the high-powered lobbyists for wealthy special interests stall this long-overdue reform.”

“Billionaires have reaped an unseemly windfall at a time when hundreds of thousands of people have lost their lives and livelihoods.” said Chuck Collins, of the Institute for Policy Studies, author of The Wealth Hoarders. “We should use this moment of extreme wealth inequality to fix a tax system tilted in favor of the wealthy and large corporations.”

Sources: March 18, 2020 data: Forbes, “Forbes Publishes 34th Annual List Of Global Billionaires” March 18, 2020

August 17, 2021 data: Forbes, “The World’s Real-Time Billionaires, Today’s Winners and Losers,” accessed August 17, 2021

The great good fortune of these billionaires over the past 17 months is all the more appalling when contrasted with the devastating impact of coronavirus on working people. Over 86 million Americans have lost jobs, almost 38 million have been sickened by the virus, and over 625,000 have died from it.

President Biden’s investment proposals contained in the Senate-passed budget resolution would significantly improve Americans health by making private insurance in the Affordable Care Act (ACA) exchanges more affordable; closing the Medicaid coverage gap in 12 states that refuse to expand coverage under the ACA; expanding Medicare to cover dental, vision and hearing benefits; increasing long-term care benefits to help people afford home and community-based services; and lowering the cost of prescription drugs by giving Medicare the authority to negotiate lower drug prices with drug corporations.

Biden’s proposed investments would reduce health insurance premiums for 9 million people, according to the White House, saving an average 60-year-old making $55,000 a year hundreds of dollars a month on their ACA insurance policy premium, according to the Kaiser Family Foundation. The cost of extending these subsidies is $163 billion over 10 years, per the Treasury Department. That means the $1.8 trillion increase in American billionaire wealth over the last 17 months could pay the entire 10-year cost of making healthcare more affordable for 9 million people more than 10 times over.

While these investments in healthcare would benefit millions of Americans and save money in the long run, the ballooning wealth of billionaires benefits no one but the super-rich. That’s because the current tax code is riddled with loopholes and special breaks that allow the super wealthy to avoid paying their fair share of taxes.

Due to one of the code’s biggest loopholes, increased wealth enjoyed by billionaires and other members of the richest 1%—for whom such wealth growth is the primary source of income—can go untaxed forever. The virtual tax-free status of billionaire wealth growth was highlighted recently by a report from ProPublica. It estimated that 25 top billionaires paid on average just 3.4% of their wealth-growth in federal income taxes and that several, including Jeff Bezos (worth $188 billion on Aug. 17) and Elon Musk (worth $175 billion), went multiple recent years paying zero federal income tax.

Even when taxed, the top tax rate on wealth-growth income is only about half that of wage income—20% vs. 37%. President Biden would end those special breaks on the wealth-growth income of millionaires and billionaires as part of his tax-reform package. Following are Biden’s tax reforms that are expected to be a part of budget reconciliation legislation to be voted on in the fall, many of which will ensure billionaires start paying closer to their fair share of taxes:

- Tax wealth like work. People with more than $1 million a year in income will have to pay a top tax rate on the sale of stock and other assets that is the same as the top rate workers pay on wages. Biden also will close a loophole that often allows the wealthy to avoid paying taxes on investment gains for their entire lives. These reforms will raise $325 billion.

- Restore the top individual tax rate to 39.6% and stop avoidance of taxes by wealthy business owners that are used to fund healthcare. These two reforms will together raise $370 billion.

- Crack down on tax evasion by the wealthy, which will raise $700 billion.

- Raise the corporate tax rate from 21% to 28%, leaving it still far below the 35% rate in 2017. Corporate taxes are largely paid by the owners of corporations, which means the stockholders. Billionaires are among the wealthiest 1% that own over half of all corporate stock. This reform will raise nearly $900 billion.

- Curb offshore corporate tax dodging by eliminating incentives to outsource jobs and shift profits to tax havens. This reform will raise more than $1 trillion.

A more direct way to tax billionaire wealth is to tax the wealth itself instead of just its growth. If the wealth tax proposed by Sen. Elizabeth Warren had been in effect in 2020, the nation’s billionaires alone would have paid $114 billion for that year—and would pay an estimated combined total of $1.4 trillion over 10 years.

Poll after poll shows that Americans of all political persuasions and by large majorities believe that the wealthy and big corporations need to start paying their fair share of taxes. A June poll by ALG Research and Hart Research shows 62% of voters support Biden’s proposed $4 trillion (at the time) investments in healthcare, childcare, education, clean energy and more—paid for by higher taxes on the rich and corporations.

March 18, 2020 is used as the unofficial beginning of the coronavirus crisis because by then most federal and state economic restrictions responding to the virus were in place. March 18 was also the date that Forbes picked to measure billionaire wealth for the 2020 edition of its annual billionaires’ report, which provided a baseline that ATF and HCAN compare periodically with real-time data from the Forbes website. PolitiFact has favorably reviewed this methodology.