Financial Aid Bill Contains $280 Billion in Business Tax Breaks—Half the Aid Goes to Business, Only a Quarter to Families, & a Big Break for Wealthy Business Owners Like Trump

America’s unprecedented health and economic emergencies demand quick enactment of the coronavirus aid package passed by the U.S. Senate, but the flaws in that bill should be swiftly addressed by follow-up legislation. The Senate’s Coronavirus Aid, Relief, and Economic Security Act (‘‘CARES Act”) offers too many benefits to business—including wealthy real estate investors like President Trump—and too few to workers, their families and to those on the frontlines: state and local governments and healthcare providers.

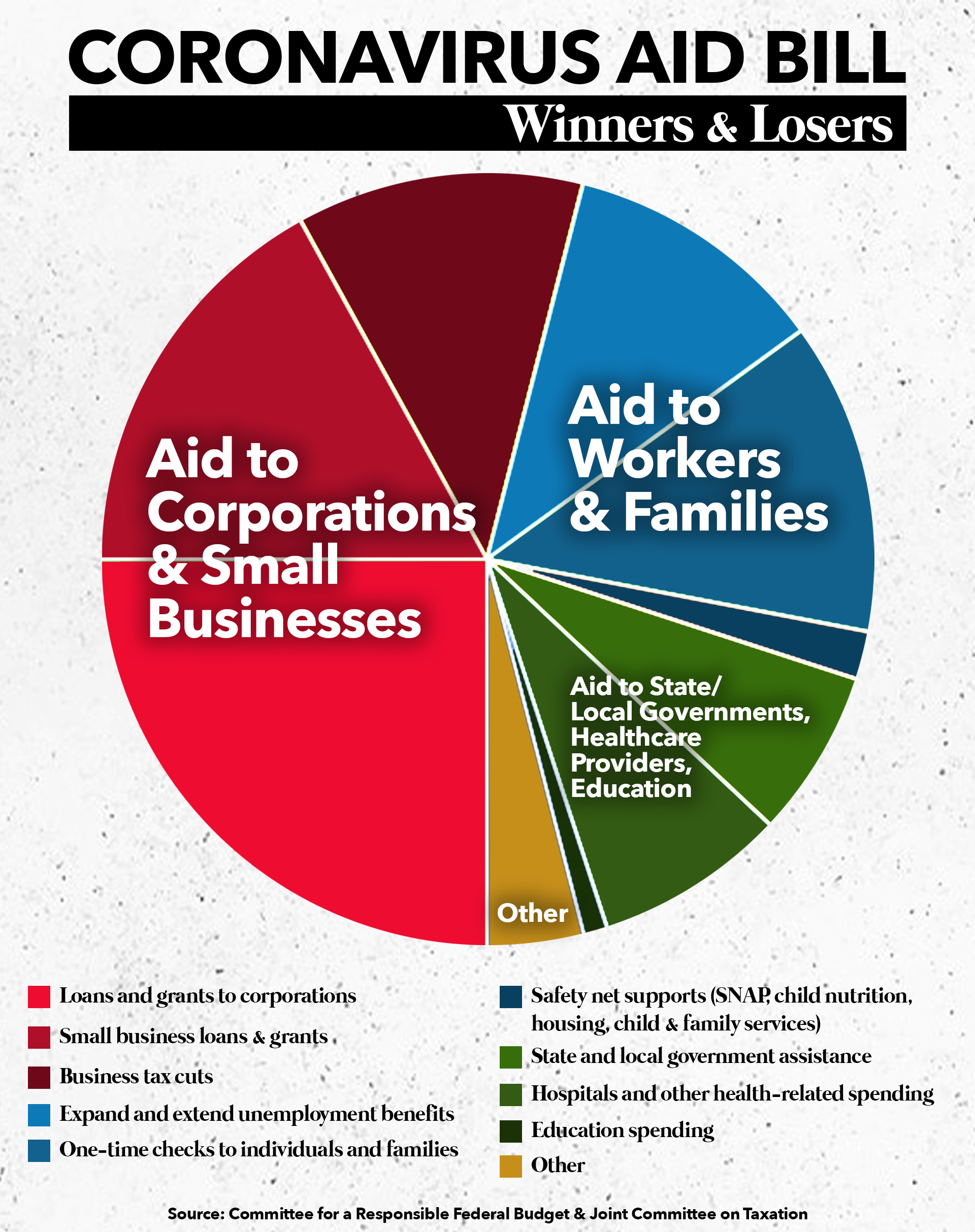

Americans for Tax Fairness has compiled the pie chart below and a table showing the distribution of the $2.3 trillion in financial assistance in the Senate bill. More than half (54%) goes to corporations and businesses, including 12% for tax cuts ($280 billion); only a quarter goes to workers and families ($594 billion); and just 16% ($372 billion) goes to state and local governments, hospitals and schools.

Perhaps the most outrageous provision in the bill—costing $170 billion over 10 years, according to the Joint Committee on Taxation—is the temporary restoration of a lucrative tax loophole for wealthy owners of pass-through businesses, which include real estate investors like President Trump. For instance, it would allow commercial property owners to use the theoretical wear and tear on those properties—“depreciation”—to offset unlimited amounts of real-world gains and thereby lower their taxes and even generate big refunds. Though the legislation forbids bailout money from going to the president or his family, this big tax break could be fully exploitable by the Trumps.

Another costly tax break for corporations and pass-through business is a loosening of rules for how companies can use losses to generate tax savings, known as net operating losses or NOLs. The 2017 Trump-GOP tax law had forbidden a tactic that uses current-day losses to wring out fat refunds from previous year tax filings. It was one of only a few money-raising reforms in a law that handed corporations over a trillion dollars in tax cuts.

The CARES Act not only temporarily repeals that reform but makes the original tax break even more generous. And corporations need not show their losses are related to the coronavirus crisis to exploit this lucrative tax break, which will cost $26 billion. Poorly managed companies will even be able to use losses they sustained during the boom years prior to the pandemic to secure retroactive tax refunds. The Senate bill also temporarily reverses restrictions on business interest deductions.

“Facing a dire economic crisis of unknown dimensions, the House of Representatives has no choice but to pass the Senate bill and send it along for the president’s immediate signature,” said Frank Clemente, executive director of Americans for Tax Fairness. “But the tilt towards business in this package must be rebalanced in new legislation soon. Protections for working family must be given priority over corporate bottom lines—people must come before profits.”